A new Ballot proposal, 108, will be voted on in November to “divert to” (aka give) the state of Colorado an additional 270 million dollars of taxpayer’s money for affordable housing. What is in the new proposal? How effective will a statewide fund be? What can we learn from Denver’s affordable housing program?

A new Ballot proposal, 108, will be voted on in November to “divert to” (aka give) the state of Colorado an additional 270 million dollars of taxpayer’s money for affordable housing. What is in the new proposal? How effective will a statewide fund be? What can we learn from Denver’s affordable housing program?

What is in Colorado Ballot proposal 108?

To create the state affordable housing fund (fund) in the state treasury; to deposit in the fund, commencing on January 1, 2023, all state revenue collected from one-tenth of one percent of federal taxable income of every individual, estate, trust, and corporation; and to specify that such revenue deposited in the fund is not subject to the limitation on fiscal year spending specified in section 20 of article X of the state constitution (TABOR).

In essence the state wants to get into the affordable housing business with every taxpayer in Colorado on the hook for the new initiative.

Ballot proposal 108 is a new tax

I always love how new taxes are pitched as a “diversion of revenue”.

The measure diverts income tax revenue representing 0.1 percent of taxable income from the General Fund to the State Affordable Housing Fund. Diversions are estimated at $135 million in FY 2022-23 (half-year impact) and $270 million in FY 2023-24.

The measure allows the state to retain and spend revenue diverted from the General Fund to the State

Affordable Housing Fund as a voter-approved revenue change to its spending limit (“TABOR limit”).

It therefore reduces refunds to taxpayers by an estimated $135 million for FY 2022-23 and $270 million

for FY 2023-24.

This Ballot Proposal keeps money that should be refunded to taxpayers under the Taxpayers Bill of rights (TABOR). Do not be fooled this new proposal is a tax that will cost you whether they call it a diversion or a tax, you as a taxpayer will be on the hook for it.

Denver a cautionary tale of how this Ballot proposal will work.

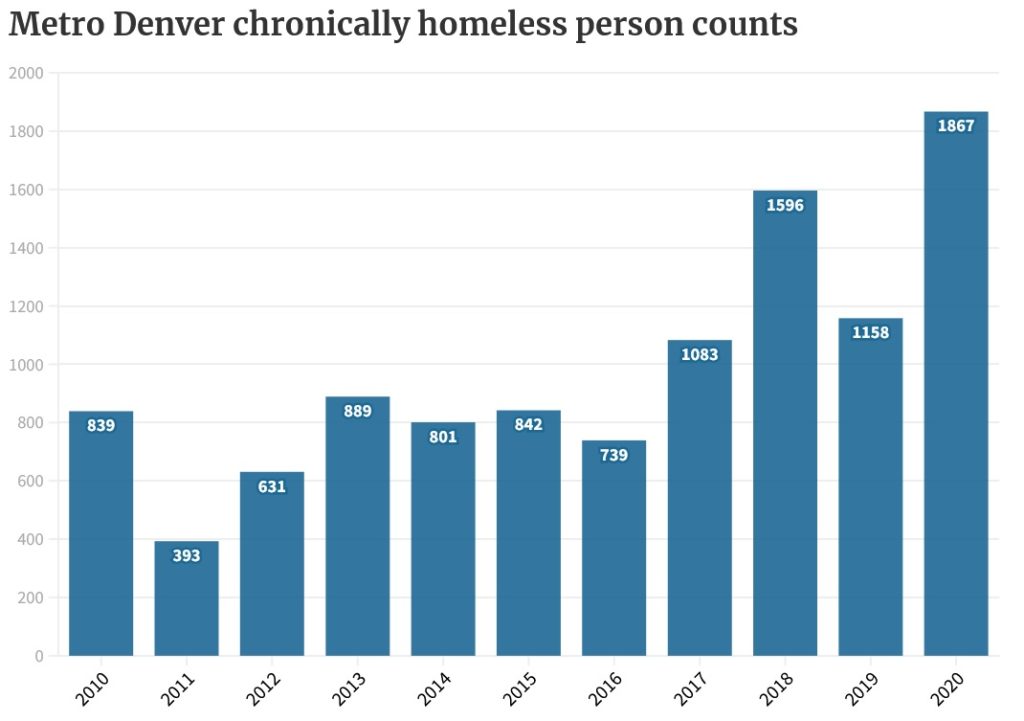

Denver is a prime example of how this initiative will work. The City of Denver and various organizations spend almost half a billion dollars annually to counter homelessness (481.2 million in the last year) yet at the same time the homeless population continues to increase. As spending increases, the homeless population continues to increase up almost 13% in the last count. Obviously, something is not working so the legislative solution is to throw more money at the issue and hope for a better outcome?

Cities throughout the state are already funding affordable housing

Cities from Denver to Steamboat and everywhere in between are already allocating substantial local dollars to affordable housing. For example, in Steamboat there is a new ballot proposal to raise the short term rental tax to 20% to fund affordable housing. This is on top of a recently passed mill levy that is also allocated to affordable housing. It strikes me as ironic that now the state is getting into affordable housing when it is already being addressed at a local level.

Summary

The new Ballot proposition 108 is not a “diversion” as stated in the fiscal summary. It is a tax increase for affordable housing. On the surface the initiative sounds noble, but cities throughout the state are already addressing affordable housing with local initiatives and taxes. To provide more money to enable the state to get into affordable housing is a bad idea.

As we have seen from Denver, increasing funding for affordable housing has done little to resolve the underlying issues as homelessness has continued to increase even with almost half a billion in funding annually. It is a terrible idea to take even more money from every Colorado taxpayer to continue with the same solutions that Denver has proven do not work.

Additional Reading/Resources

- https://coloradosun.com/2022/07/21/pit-count/

- https://leg.colorado.gov/sites/default/files/initiatives/2022%2523108FiscalSummary_00.pdf

- https://leg.colorado.gov/content/dedicated-state-income-tax-revenue-affordable-housing-programs

- https://www.coloradopolitics.com/denver/report-almost-half-a-billion-dollars-spent-on-homeless-services-in-denver-metro-region/article_c95eb736-f5fc-11eb-a3cd-1748639cd7d8.html

- https://www.wsj.com/articles/the-high-cost-of-free-money-harvard-exeter-study-stimulus-handout-low-income-well-being-health-personal-agency-poverty-covid-11658166372?st=upu64rqaz6h60x3&reflink=share_mobilewebshare

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender