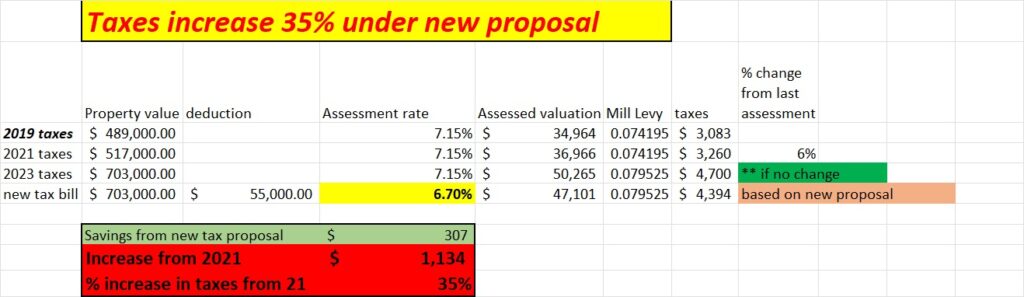

With little real progress on property tax relief by the legislature (above is the legislative fix), there is an initiative now on the November ballot to radically alter how property taxes work in Colorado. The new initiative would cap property taxes with a constitutional amendment. What is in the new initiative? How will this impact property owners?

Why is there another property tax initiative?

The legislature has failed to adequately address the stunning rise in property values. The root cause of these huge jumps is the elimination of the Gallagher amendment which balanced residential and commercial valuations so that we did not see huge jumps year over year.

When Gallagher was eliminated it also coincided with the pandemic jump in property values leading to huge tax increases. Since the elimination of Gallagher taxes have gone up 50%+ on average throughout most areas of Colorado with huge jumps in the last cycle. There has yet to be any real plan to stop huge future jumps in property taxes which led to this initiative

The new tax bill, initiative 50

AS a result of everything above, Colorado taxpayers are fed up with huge jump in property taxes and have put a new tax initiative on the 2024 ballot. Here is the summary of Colorado Initiative 50:

- IF THE TOTAL OF STATEWIDE PROPERTY TAX REVENUE IS PROJECTED TO GO UP MORE THAN 4% OVER THE PRECEDING YEAR, VOTER APPROVAL IS NEEDED FOR GOVERNMENT TO RETAIN THE ADDITIONAL REVENUE

- FOR VOTER APPROVAL OF A PROPERTY TAX REVENUE INCREASE , ANY REFERRED MEASURE MUST BE A STAND – ALONE SUBJECT . THE BALLOT TITLE SHALL READ : “SHALL PROPERTY TAX REVENUE BE INCREASED BY [ TOTAL PROJECTED INCREASE OVER THE PRECEDING YEAR] ALLOWING GOVERNMENT TO RETAIN AND SPEND PROPERTY TAX REVENUE ABOVE THE 4% ANNUAL LIMIT ON PROPERTY TAX INCREASES FOR [ DATES X TO X]?”

The new tax proposal raises some interesting questions:

After reading through the bill, there are some unanswered questions in my mind as to how this will actually work.

- Values continue being assessed as they are today which means that the only other variables to adjust would be mill levy or assessment rate. How does this work on a statewide basis? Which factors are actually adjusted in order to achieve the 4% cap.

- Assume two cities Aspen and Alamosa, Aspen increases values 20% and yet Alamaso declines hypothetically 5%, assume they cap the mill levy percentages, to 4%, this means Alamosa would lose substantial tax revenue while Aspen would bump up against the 4% cap based on the new law.

- Issues based on implementation. I foresee we will create another issue that cropped up with Gallagher where lower appreciating markets begin losing tax revenue as this is done on a statewide basis.

How should initiative 50 be fixed?

Unfortunately nobody asked my opinion prior to getting the initiative on the ballot, but if anyone is reading this and it becomes law a couple changes need to be made:

- Cap indexed for inflation: if we end up in an inflationary environment we need to make sure the cap adjusts for these factors or we are going to get into a huge funding issue for schools, etc…

- Tax revenue capped at the county level: Having a statewide cap sounds great, but it should be implemented on the county level and assessors adjust the mill levies at a local level to ensure they do not exceed the 4% cap. As it is written now, we are going to see huge issues for rural areas that are not appreciating as fast as others.

Initiative 50 will have huge impacts to the state budget

Not only will initiative 50 cap local property tax revenues, but the loss in revenue to schools will have to be backfilled by the state budget to the tune of 2 billion dollars. Since the elimination of Gallagher, the state of Colorado has received a windfall of revenue as they no longer needed to backfill many cities/counties due to revenue shortfalls in the education budgets that are now paid by increasing property tax values. This has allowed a massive expansion in state government spending which will be substantially curtailed if initiative 50 passes.

Will initiative 50 pass?

A lot can happen between now and election day, but I don’t see any fundamental changes that would alter our current tax policy. Assuming initiative 50 is on the ballot, I would put the odds at 80% that it passes as Coloradoan’s are not happy about the continued hike in property taxes that is well above any measure of inflation. There is currently no other long-term solution to address the tax issue and the recent proposal in the legislature does nothing to fundamentally alter the property tax crisis in Colorado.

Summary of new Colorado tax proposal

The legislature has created a mess by allowing property taxes to surge over the last four years with even bigger increases this last cycle. Local governments have not helped as they are keeping the windfall tax revenues (only one, Douglas county is making a minor adjustment to mill levies). Taxpayers are fed up with the tax and spend mentality which has led to the initiative 50 on the ballot next year.

Although initiative 50 is not perfect it does draw a line in the sand at 4%/year growth so that property taxes cannot continue to accelerate at a torrid pace. Unfortunately the legislature has not developed any solution that would limit revenue as that in turn would mean that spending would have to be limited which is a non starter for many in the legislature :< Initiative 50 will drastically alter the state of Colorado budget by limiting huge growths in future spending.

Additional Reading/Resources:

- https://coloradosos.gov/pubs/elections/Initiatives/titleBoard/filings/2023-2024/50Final.pdf

- https://www.denverpost.com/2023/10/10/initative-50-colorado-constitutional-amendment-property-taxes/

- https://ballotpedia.org/Colorado_Property_Tax_Revenue_Cap_Initiative_(2024)

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender