A federal judge had effectively frozen a legal battle over Summit County’s short-term rental regulations — at least temporarily — after county officials filed a motion to dismiss a lawsuit brought by area homeowners. One of the claims of homeowners is that the new laws violate various federal laws and that owners have a “fundamental right” to rent their properties. Who won the lawsuit and what does this mean for future nightly rental regulations?

What are in the new nightly rental regulations in Summit County?

The new rules limit the number of properties that can hold short-term rental licenses in the unincorporated county’s various basins, ranging from 5% to 18%. There is no limit in areas defined as “resort overlay zones,” such as Copper Mountain.

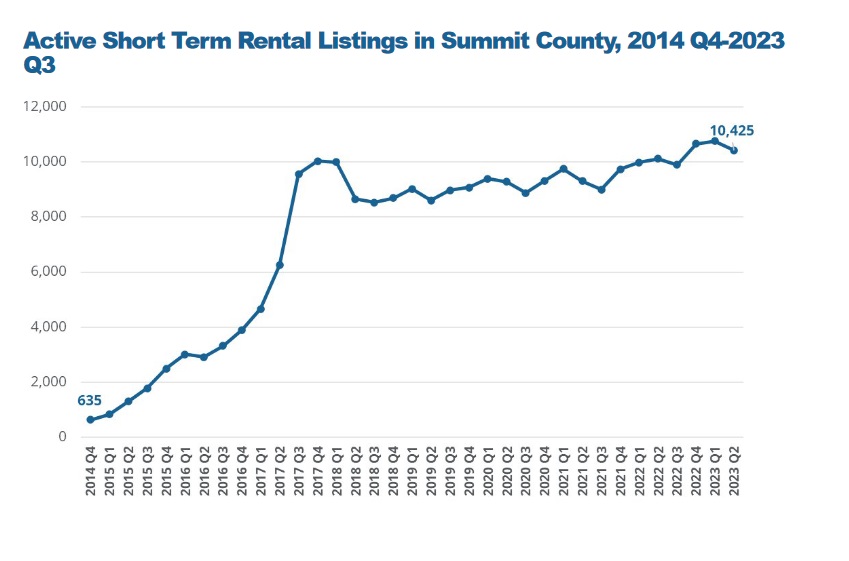

According to officials, resort zones account for roughly 63% of all short-term rental properties, while neighborhoods where caps will be in place account for 37%. In total, the caps are projected to decrease the number of short-term rentals from 1,659 short-term to 1,290 between 2025 and 2030.

The rules also limit the number of annual bookings for short-term rentals to 35.

Some exceptions exist, such as an exemption to the license cap for full-time county residents who work more than 30 hours per week in the county or who’ve retired and have a history of working in the county for at least 10 to 15 years. Licenses will also now be transferable between parents and children, spouses or domestic partners, siblings or grandparents and grandchildren.

What is in the lawsuit against Summit County?

Here is an excerpt from the lawsuit:

In short, many of the BOCC’s STR regulations, embodied in County Ordinances 20-B and

20-C, violate Plaintiff Todd Ruelle’s and members of Plaintiff Summit County Resort Homes

Inc.’s (“SCRH”) due process and equal protection rights, as well as their rights protected by the

Commerce Clause, under the United States Constitution. They also violate their statutory and

constitutional rights under Colorado state law. Thus, these STR regulations that treat County

homeowners differently, limit the STR bookings a homeowner can host, cap the STR licenses in

the County, and prohibit the transfer of STR licenses must be declared void and enjoined.

The court rules against homeowners.

I predicted when the suit was filed that it was a long shot as case law in Colorado is well established on city/county regulation of short term rentals. A federal judge has rejected a lawsuit from a group of homeowners in Summit County who questioned the constitutionality of new regulations. Here is the biggest piece of the lawsuit: “Plaintiffs have not established that the right to rent one’s property is a fundamental right”. The recent ruling is a big win for Summit county albeit not surprising.

How does this lawsuit impact Mountain Real estate?

This ruling is not a game changer. There is little if any immediate impact from this ruling. The ruling should not be a surprise based on what has happened in other Colorado ski towns. The real impact is that it basically gives a green light/template for other towns to basically copy Summit County regulations. As a result of this ruling, you will continue to see an increase in regulations on nightly rentals throughout Colorado and especially the various ski towns.

Summary

I’ve said for the last several years that mountain towns are changing and full-time residents/voters are pinning the blame rightly or wrongly on nightly rentals. The rules in Breckenridge and Summit County will continue to withstand the court challenges and likely be strengthened in the future due to the changing demographics of full time residents. Anyone investing in a nightly rental for the revenue needs to be extremely careful as regulations will continue changing.

Additional Reading/Resources

- https://www.summitdaily.com/news/legal-battle-over-summit-countys-short-term-rental-rules-is-on-hold-as-a-federal-judge-weighs-motions-filed-by-county-officials-homeowners/

- https://www.summitdaily.com/news/property-owners-sue-breckenridge-in-effort-to-invalidate-short-term-rental-regulations/

- https://www.summitdaily.com/news/summit-county-homeowners-sue-local-officials-over-short-term-rental-regulations/

- https://coloradohardmoney.com/did-breckenridge-implement-rent-control-did-summit-county-take-property-rights/

- https://www.lawweekcolorado.com/article/recent-suits-take-aim-at-city-short-term-rental-regulations/

- https://businessden.com/2024/06/28/judge-upholds-summit-county-restrictions-on-short-term-rentals/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender