by Glen Weinberg | Oct 23, 2023 | Colorado Hard Money, Colorado property tax appeal, Colorado property taxes, Colorado Proposition HH, Colorado real estate market trends, Colorado Realtor, Colorado residential property values

I wrote last week about proposition HH to eliminate Tabor under the guise of property tax relief. It is a bit ironic that it was just announced that there is a new property tax initiative that qualified for the 2024 ballot, initiative 50. The new initiative would...

by Glen Weinberg | May 10, 2021 | Uncategorized

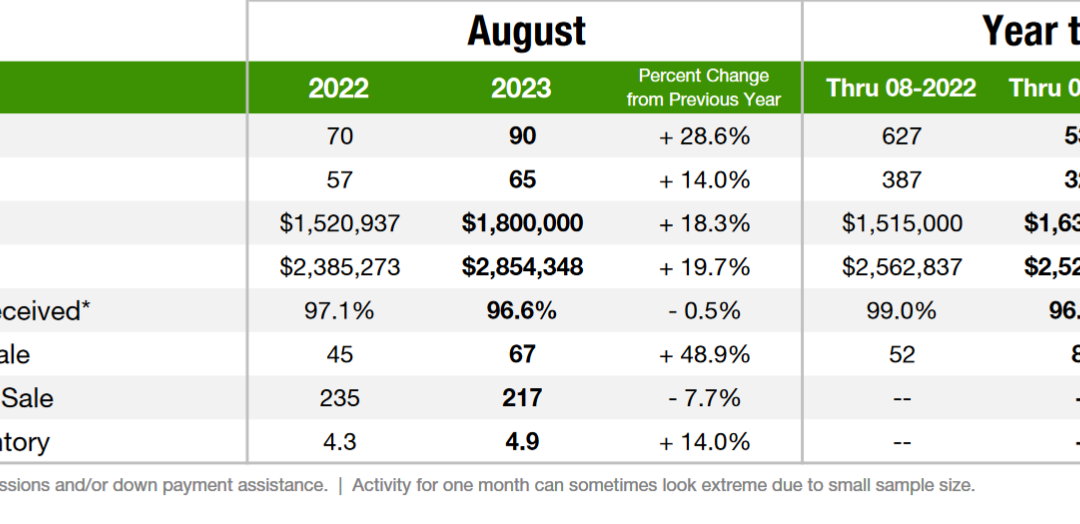

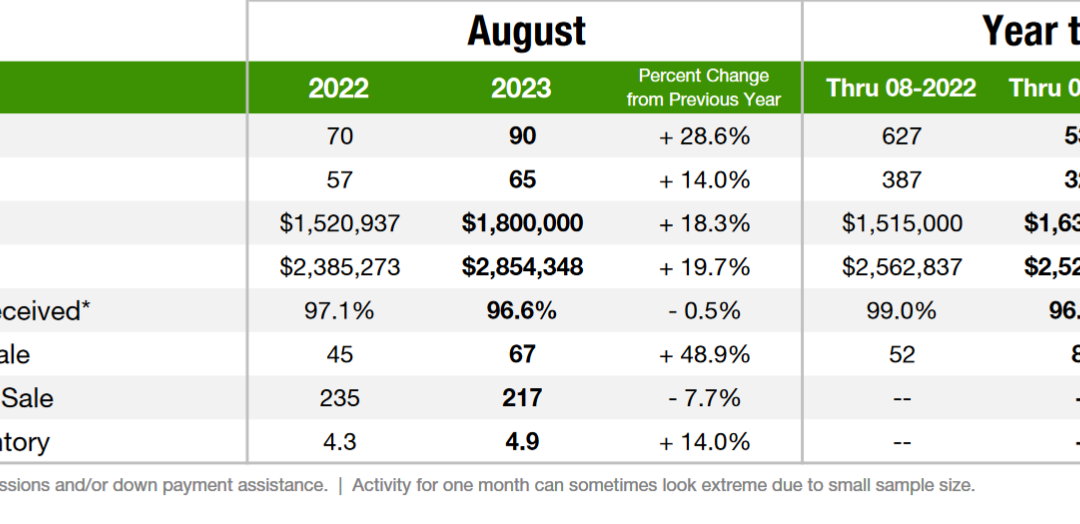

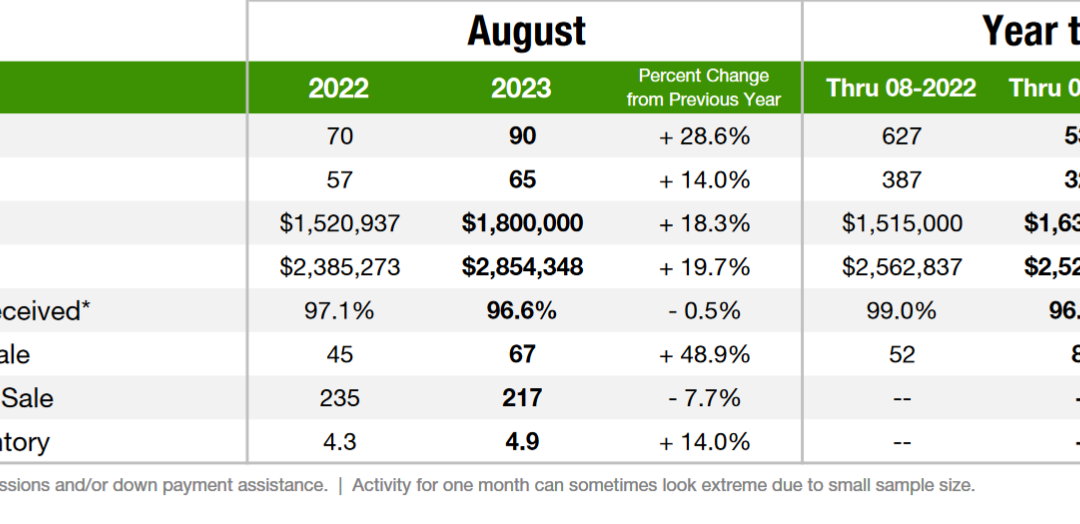

Did you get your envelope? Is the property tax assessor crazy? My assessed value went up 37%! Are you ready for your new tax bill? Real estate sales have jumped dramatically with covid and appreciation has been off the charts throughout Colorado. Check out my free...

by Glen Weinberg | Feb 11, 2021 | Colorado Living, Colorado Private Lending, Colorado property tax appeal, Colorado real estate market trends, Colorado Real Estate values

I have gotten many e-mails letting me know that they got their property tax bills and they didn’t go up nearly as much as I said they would. Do not worry, I’m not lying that your property taxes are going to skyrocket. When will you see the tax increases? How does...

by Glen Weinberg | Sep 21, 2018 | Colorado Commercial Property Valuation, Colorado Hard Money, Colorado Private Lending, Colorado Real Estate values, Colorado Ski real estate, Colorado Ski towns, Condo Lending, Denver real estate values, Ski lending/ investing

The state legislature is considering a bill that would tax residential nightly rentals (any rentals less than 30 days) as commercial properties. This would change the tax assessment on a statewide level. On the surface it doesn’t seem like a big deal, but commercial...

by Glen Weinberg | Nov 8, 2017 | Colorado Living

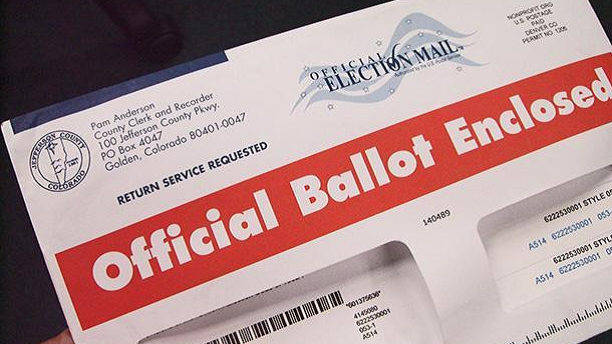

There were many local initiatives/bond issues not just in the front range but throughout the state. I was surprised by the rate of passage of these ballot questions. What city enacted a tax of 18.4%? What major items passed throughout the state? In a nutshell, taxes...