Our legislative branch and Governor have touted a new proposal to drastically reduce property taxes after they have skyrocketed due to increasing values and the elimination of the Gallagher amendment. Unfortunately the new bill will not help the overwhelming majority of property owners in the Colorado Mountains. Fortunately you can appeal and regardless of what you hear that everything is going up, the mountains present a unique opportunity to appeal and win.

What is in the proposed tax legislation to reduce property taxes in Colorado

The new proposal is just coming out as I am writing this article; below are the details I have seen so far:

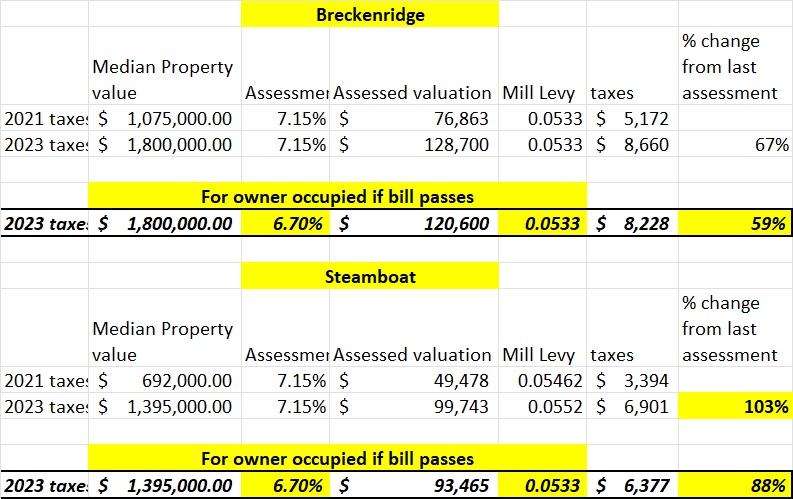

- Reduction in primary residence valuations by 40k

- Lowering of the residential assessment rate from 7.15% to 6.7% (note there was a prior bill that lowered assessments rates from 7.15% to 6.95% )

- The new proposal does nothing to cap future increases in assessed values

- Savings on property taxes will be taken from refunds due under the taxpayer bill of rights (TABOR) so you are still paying for the savings by forgoing refunds due to Tabor; depending on your income bracket your total taxes will likely still increase considerably

Why will the new tax legislation provide minimal if any help for Colorado Mountain towns

The new legislation does very little if anything for Colorado ski resort property owners:

- The reduction is only intended for primary homeowners, the overwhelming majority of Colorado resort properties are second homes and/or investment properties

- Values have increased so much in the mountains, the small reduction in the assessed rate coupled with a 40k reduction in assessed value will only save the median home owner 430 dollars in Breckenridge, note the taxes will still increase about 3100/year and in Steamboat taxes are set to basically double as well

When should you appeal your Colorado ski town taxes and how can you win?

I’ve read countless newsletters from various mountain realtors stating basically to not waste your time with an appeal of your property taxes as basically everything has gone up. This is a true statement, but the mountains are very unique which gives a big opening for appeals.

First, if you are in a uniform condo/townhome an appeal will be difficult as there is little if any variation in the units. Single family homes on the other hand create a unique environment for an appeal.

In any Colorado ski town, there are huge variations amongst single family homes. Many older homes have had gut remodels while others remain dated and languish. Furthermore, there can also be enormous differences in values based on very small changes in location or even orientation of a house. For example, does the house have mountain views or is it facing the airport? All these nuances create a perfect opportunity for an appeal.

I live and work in the mountains and my property reassessment basically doubled, but the value I calculated on 6/30/22 was about 30% less than the assessed value so I appealed with a strong case. Why such a huge variation in values?

- The comparables used by the assessor were superior due to their location. Even though they were mere feet from my house, they backed up to a golf course or a river, which are clearly worth more.

- Even a house next door could have wildly different views from yours, these views add considerable value (or subtraction in value)

- Other properties used had superior finishes (look on Zillow at the prior listings) to compare to your house

- The age of the house many times has very little to do with the condition/value of a property in mountain towns. Many are remodeled and the county doesn’t update the effective year which leads to inflated assessments.

Based on the information above, you have options to appeal as overall the assessments in the mountains might be correct, but they can be wildly off on individual properties. It is worth the time to appeal to the county as you likely have some ammunition to back up an assertion of a lower value. I have appealed on all my properties for the reasons above and I have a high probability of a substantial reduction which would save thousands a year.

Summary

Valuing a property in the Colorado Resort Communities is difficult due to the unique qualities in mountain towns. For single family homes, the value is very “squishy” and not as rigid as a townhome due to the myriad of variables in mountain towns. Property owners can use the uniqueness to effectively appeal their taxes saving thousands of dollars a year. Remember, the values determined this year are set for the next two years of taxes so the savings will be doubled.

Also, you only have until June 5 to get your appeal in. If you miss this window, you are out of luck. If you end up appealing in a Colorado ski town, I’d love to hear how it went. I’ll keep you posted on my appeals as well.

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender