If you look at Denver county, the number of properties sold is up 10% , in Routt County (Steamboat) sales of single family homes is up 30% over 2019. If there is no inventory/ little inventory available how are sales continuing to break records. Is there another metric we should be focusing on?

Should we be focusing on a metric other than inventory?

Historically one of the key metrics in real estate to focus on is available inventory. How can inventory remain at historic low levels and yet sales are still extremely high? There is something else going on in the markets. How quickly are homes moving from listing to sales?

What is Absorption rate:

The term absorption rate refers to a metric used in the real estate market to evaluate the rate at which available homes are sold in a specific market during a given time period It is calculated by dividing the number of homes sold in the allotted time by the total number of available homes. I like to refer to this as the “velocity” of the market. In other words, how quickly is the market moving.

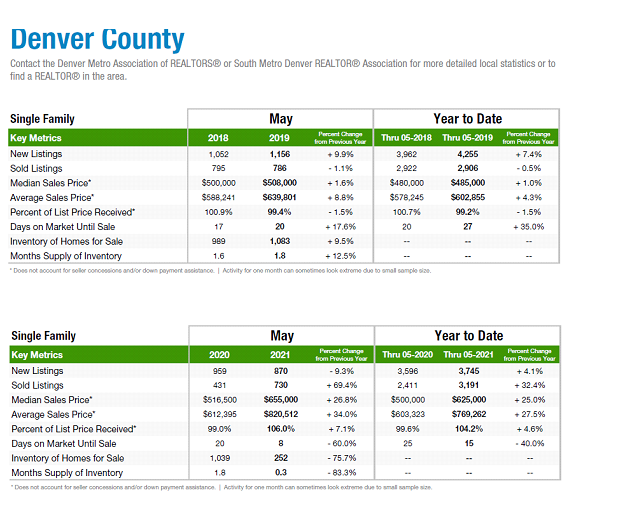

When I track Denver County not only has inventory dropped 17% since the same period in 2018 at the same time sold listings has stayed about constant leading to the frenzy we are seeing in the market. In a nutshell the absorption of properties has quickened leading to the “hot” real estate market.

What is in the data:

We are seeing throughout Colorado that real estate is “hot”. What does this really mean? What is the data saying? I looked at the last four years of sales in Denver County of single family homes and in Routt County (home to Steamboat) of single family and condos. The data is fascinating. In both Denver and the resort markets like Steamboat it is not just anecdotal that real estate is moving quickly.

In Denver, the absorption rate is now 84%, meaning 84% of all houses listed within a month are selling. Steamboat is around 77% up from a historical average of around 45%. The condo market is astounding with absorption up to 114% which means that all the inventory in a month plus whatever was lingering on the market was sold.

The pace of absorption is one of the biggest drivers of appreciation. It is showing that demand has stayed robust as properties are bought/sold quickly leading to considerably higher prices.

| * Based on Denver County with data from the CAR | |||||

| ** used May numbers to compare apples to apples | |||||

| *** Due to Covid, market really started picking up around June of 2020 | |||||

| May | New listings | Sold listings | Absorption | ||

| 2018 | 1052 | 795 | 76% | ||

| 2019 | 1156 | 786 | 68% | ||

| 2020 | 959 | 431 | 45% | *** | |

| 2021 | 870 | 730 | 84% | ||

| Routt County– Steamboat SFRs | |||||

| May | New listings | Sold listings | Absorption | ||

| 2018 | 93 | 42 | 45% | ||

| 2019 | 84 | 39 | 46% | ||

| 2020 | 67 | 16 | 24% | *** | |

| 2021 | 44 | 34 | 77% | ||

| Routt County– Steamboat condos | |||||

| May | New listings | Sold listings | Absorption | ||

| 2018 | 69 | 48 | 70% | ||

| 2019 | 87 | 50 | 57% | ||

| 2020 | 40 | 21 | 53% | ||

| 2021 | 51 | 58 | 114% | ||

Where do we go from here?

- Prices should start to slow the absorption rate: As prices continue to rise, more buyers are priced out which should begin to temper demand.

- More listings due to high prices: With prices reaching a peak in many markets, this has brought out a new group of sellers looking to cash in on the lofty valuations. This trend should continue and accelerate through the fall.

- Switch from goods to services: As the economy reopens there is a large shift from goods like houses to services like restaurants, travel, etc… We will see a huge reversal of spending pattern shifts over the next year which will put a damper on future sales.

- Interest rates: The Federal reserve hinted at a tightening coming down the pipe. The move in rates has yet to be factored into the markets expectations of interest rates. I anticipate a large jump in interest rates over the next 90-120 days which will drastically cool the market as houses are relatively more expensive.

- Labor Day: It is fascinating how many economists and people I have spoken with have a date of labor day in mind when the world “normalizes”. Labor Day is the date that schools should be back full time, businesses recall many of their workers, and a more “normal” pattern begins to emerge. If all these events occur on our around Labor day this will cool the real estate market and it too should behave a bit more normal.

Will prices fall?

I am doubtful we will see any major changes in Colorado on the pricing side. In 08 before the crash there was considerable overbuilding and lax underwriting. Neither of these conditions are occurring today. Furthermore, there is allot of wall street money getting into the single-family rental game which should help keep demand strong.

The one concern area is in the rural/non metro markets throughout the state along with the exurbs. As the economy continues to reopen there will be a large movement back to old patterns where people live closer to work.

What should Buyers and Sellers do in Colorado’s hot housing market?

- Seller: Now is the time to sell. With the absorption rate so high in many markets, now is the time to sell. It is likely the best time in the next 3-5 years.

- Buyer: Patience should allow more inventory to enter the market. Although I don’t see any large drop in prices in most metro and resort areas in Colorado, the feeding frenzy will slow down allowing buyers to take a measured approach to a purchase without the insane bidding wars and pressures of today’s market.

Summary:

It is not just anecdotal that Colorado real estate is hot. From Denver to the resort communities and everywhere in between absorption rates have increased leading to bidding wars and ultimately higher prices. The feeding frenzy in Colorado will not last much longer. I am already seeing signs of cooling as more properties come on the market due to the high prices. As interest rates rise and spending patterns normalize so will real estate. If you are a buyer, now is the time to sit tight. The opposite is true if you are a seller, now is the time to move as conditions are still extremely favorable. If the experts are correct, Labor day will be the tipping point for more “normalization” in the real estate market.

Additional Reading/Resources:

- Colorado Association of Realtors: https://www.coloradorealtors.com/market-trends/regional-and-statewide-statistics/

We are still lending as we fund in cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)