After filing for divorce from Vail’s Epic pass last season, with much fanfare it was announced that Arapahoe basin was quickly back in the singles line looking to start a relationship with the Ikon pass Unfortunately, Arapahoe basin did not get married to Ikon, just agreed to some casual dating 😊 What resorts are left in Colorado that are not yet married? What does this mean for real estate?

A-basin joins Ikon

Although the headlines were catchy that Arapahoe Basin is now joining the Ikon pass, the real partnership is considerably less appealing. A-basin agreed to allow Ikon pass holders 7 days at their resorts, this is a far cry from the full Ikon pass that offers unlimited skiing at Copper, Steamboat, Snowmass, etc… The partnership with A-basin was more for marketing purposes as opposed to a true “marriage” between the resorts.

Who is left?

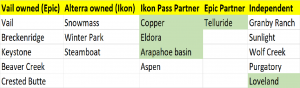

Most of the Colorado ski industry has already gotten married and/or is in a serious relationship with either Epic or Ikon. The chart (below) highlights how the marriages align now. This leads to the question of who is left to either partner or marry? I highlighted in green the remaining prospects that could change their current relationships.

The future partnerships/marriages

Although, in Colorado all the major resorts have already partnered up in some way, there will still be some significant changes in the partnerships and future “marriages”.

- Telluride: I was surprised that Telluride partnered with Vail, from a strategic prospective Telluride is a much better fit for Alterra that is focusing on the higher end market than Vail. Telluride is unique in that it is a world class destination where visitors spend big dollars on their trips. This could enable Telluride to continue to stay independent with a limited partnership with Vail or at some point Alterra. As capital demands increase it could push Telluride to “marry” one or the other. I think Alterra would be the choice if Telluride goes that route

- Copper/Eldora: Powdr Corp (the parent company that owns Copper and Eldora) is already in a full-blown partnership with Alterra. I think these two resorts are a prime candidate for acquisition for Alterra as both these resorts are heavily dependent on local/Denver traffic and are not huge “destination” resorts. Alterra would be the only option as Powdr corp lost its park city lease to Vail years ago so there is some bad blood amongst the two.

- Loveland/Arapahoe basin: Although both are independent resorts, they get ample traffic from Denver. I think they will both stay independent with some limited partnerships like A-basin and the Ikon pass.

- Other: I don’t see any big demand/partnerships with the remaining resorts. Each one has a niche and will likely stay independent. None of the remaining are “destination” resorts and therefore not likely acquisitions for Vail or Alterra Some of the remaining resorts (like Granby ranch) may ultimately fail as demand is concentrated with the Epic and Ikon passes.

Impact on Real estate

It is imperative to watch how these partnerships unfold. Alterra and Vail will dominate the ski industry going forward investing millions in each resort. It will be nearly impossible for any other conglomerate to match their scope as almost every major resort throughout the country is aligned with one of the two. Unfortunately, partnerships are not enough as we saw with Arapahoe basin, they can quickly change. This is especially true in Colorado as Alterra and Vail dominate the destination ski markets. As I’ve mentioned before, when investing in real estate for the long term, properties located in areas owned by either Alterra or Vail will outperform other areas. How do you think the “marriages” will align with the remaining ski areas? Do you agree with my predictions?

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games)