Vail, the largest owner of ski resorts not only throughout the world but also in Colorado, has dropped 22% while other hospitality stocks have been rising at double digit rates. Why is Vail stock dropping so much? What impact will this have on ski real estate throughout Colorado?

Why should you watch what happens to Vail resorts?

Vail resorts is the largest owner of ski resorts not only in the World, but within Colorado. Vail resort mountains include: Vail, Beaver Creek, Crested Butte, Breckenridge, and Keystone. What happens to Vail will impact the largest ski towns in Colorado.

What was in the recent Wall Street data on Vail resorts?

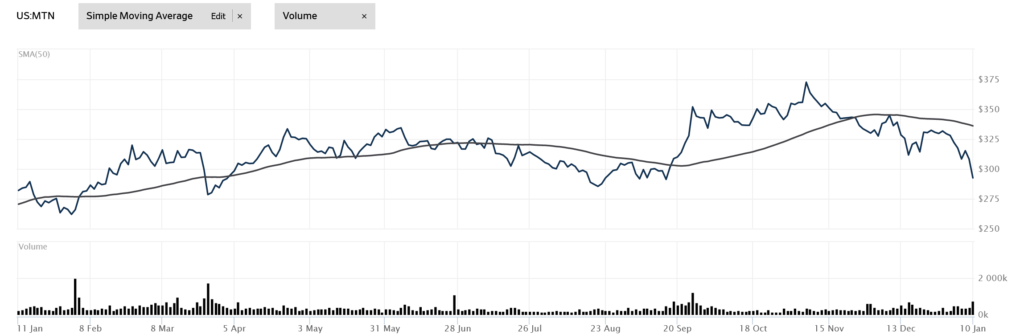

Since early November, Vail Resorts’ stock (MTN) has not been a great performer in the larger travel and leisure universe. While the general stock market made huge gains in 2021, Vail Resorts’ stock is down 15%, meaning the stock is underperforming by close to 25 percentage points.

The problem looks to be unique to Vail Resorts in the travel and leisure sector as other big travel stocks appear to be riding the reopening trade. Among the 12 analysts who cover Vail Resorts stock, two are saying buy and two are saying the stock is attractive, while the remaining eight are saying hold.

Wall Street Scathing report on Vail resorts

“We believe MTN (ticker symbol for Vail resorts) is experiencing severe labor issues that are negatively impacting the customer experience as evidenced by news stories in the media, our private industry contacts, and countless social media postings,” wrote C. Patrick Scholes, Alexander Barenklau and Gregory J. Miller with Truist. “Labor issues are impacting lift openings/staffing, snow grooming, and F&B and retail operations, all compounded by Epic pass sales up 76% from the 2019/2020 ski season.

On the other hand, labor-related issues are in general less of a major issue at competitors’ resorts, implying such severe issues may be more unique to MTN. In the past several days in response to this dissatisfaction, there have been letters sent out on social media by MTN’s COO (“this has been the most challenging holiday season I’ve ever experienced”) as well as general managers at several of MTN’s resorts publicly apologizing for the diminished customer experience.”

Below are some of the highlights from the report:

- Epic pass sales are up 76% vs. the 2019/2020 ski season, meaning the slopes would likely be more crowded to start with regardless of any labor issues.

- With resort living becoming increasingly more expensing, MTN’s wages are allegedly not keeping up in their local markets

- A pandemic-triggered escalation of real estate prices has reduced the number of homes available to local workers for rental

- H2-B and J-1 international work visas, which ski resorts have historically used to fill employment gaps, are in especially short supply leading to continued labor issues.

It doesn’t take a rocket scientist to figure out what was going to happen this season. Vail dropped the price of their passes by 20% to sell more and it worked. They sold 76% more passes but unfortunately they did not add any new capacity. This has led to a “diminished guest experience”. How could any rationale person not see that this would happen? The next question is what happens next?

What happens because of the 21/22 season for Vail resorts?

Vail will be forced to make some substantial changes after this ski season

- Wages will rise: as cost of living goes out the roof in mountain towns throughout the country, wages will have to rise in order to attract and maintain employees

- Pass sales will decline: There will many season pass buyers that get so fed up with the crowds and user experience that they will not buy a pass in the future

- Prices will rise even more: To bring back the user experience, Vail will have to raise prices to ease volume pressures. I could see them on the base possibly keeping prices the same but adding more blackout dates on not just holiday weekends.

What happens to Colorado ski real estate as Vail’s stock underperforms?

The resort communities throughout Colorado are going to be radically altered from the pandemic. In the past, there was a direct correlation between ski real estate and the actual ski resorts performance. Fortunately, this bond broke after the last recession with Colorado resort real estate not solely driven by the actual ski resort. The resort markets have become more “lifestyle” purchases where people might enjoy skiing, but more importantly they want everything else that comes along in a resort town like great restaurants, trails, hospitals, the arts, shopping, etc..

The Hamptons effect on Colorado real estate

Ironically the pandemic will likely hit the bottom line of Vail resorts heavily, but the real estate side should buck the trend. There was an interesting article in Bloomberg: Hampton houses are now luxury bunkers which shows the huge demand for luxury markets outside of large cities. The same trend is playing out in ski towns throughout Colorado as wealthy property owners flock to the various resort communities to ride out the pandemic. I am seeing this trend firsthand as many second homes have turned into primary residences as people would rather be in a ski town than a penthouse in NY or Chicago.

Summary

Although Vail’s stock is in for a rough road, the desirability of resort property will not only continue, but accelerate as more jobs become location neutral overnight. If someone could work anywhere, why would they choose a market like NY or San Diego when they could live year-round in a ski town with a small town feel with big city amenities along with easy access to an airport for when they need to physically go to the office. Even though Vail resorts will hit a financial speed bump from the pandemic, real estate in Colorado’s ski towns should buck the trend and remain good investments due to increased demand from location neutral employees and very little if any inventory.

Additional Reading/Resources:

https://www.steamboatpilot.com/news/wall-street-taking-notice-of-vail-resorts-issues/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)