As I predicted, we are starting to see some big changes in Colorado ski real estate. Even as prices in many markets throughout the country are staying flat, some Colorado ski real estate is still increasing while others are starting to correct. What is causing the huge changes in the fortunes of Colorado ski towns. What does this mean for future real estate prices? How does this data impact the best Colorado ski investments?

What was in the data on Colorado ski real estate?

To make sure I’m comparing apples to apples amongst the various ski towns, I look at the data from the Colorado Association of Realtors at the county level. Here is a quick key for the counties to ski resorts:

- Grand County: Winter Park

- Routt: Steamboat Springs

- Summit: Breckenridge, Keystone, Copper Mountain

- Eagle: Vail, Beaver Creek

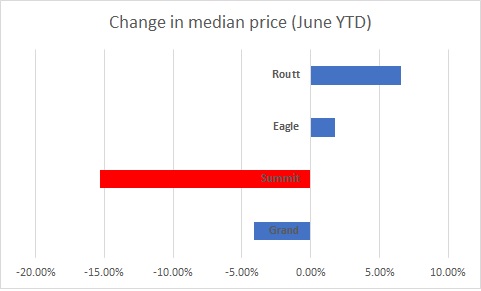

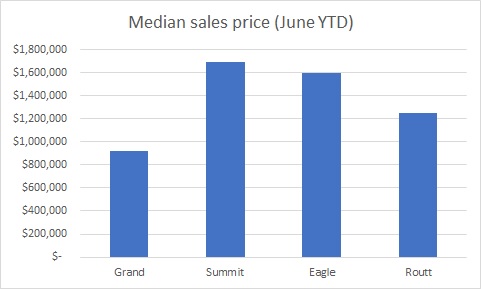

From the data it is easy to see that Grand county and Summit county are underperforming Routt and Eagle county on median home sales prices. Summit is down substantially more than the other 3 ski counties.

Why didn’t I include Telluride, Crested Butte, or Aspen

These markets are really hard to analyze as there can be huge outliers that radically skews the data and furthermore there are not a lot of transactions which can lead to further noise in the data. I would say Crested Butte is similar to Steamboat and Aspen/Telluride are in a league of their own. Aspen and Telluride are both still great real estate investments, but due to the factors above for this analysis I did not include them.

Why are Summit and Grand under performing?

Both Summit (Breckenridge) and Grand (Winter Park) have a very high correlation to Denver due to their proximity to the metro area. As prices soften in Denver, this impacts second home purchases in places like Breckenridge and Winter Park more than markets like Steamboat or Vail as they are “drive up” markets.

Summit County: Summit County has had an amazing run basically doubling since 2019. The market has definitely changed; gone are the days of 40% appreciation to declines in median home prices. Median home prices have declined about 15% year over year on single family homes. This is not due to the nightly rental regulations as the statistics I am using are single family homes to factor the noise out from the condo/townhome market. There is no doubt that after an unbelievable runup in prices that Summit county is cooling quickly. Historically, Summit County has a higher correlation to Denver so as Denver cools so does Summit County. It appears these historical trends are holding true in this cycle. Look for more downward pressure on prices the remainder of this year into next.

Grand County: Winter Park is also softening, but not as much as Summit County with median home prices down around 4% year to date. But the general direction of downward price pressures is accurate as Winter Park has a high correlation to Denver due to its proximity and price points. I expect Grand County to continue cooling as rates begin to bite and Denver continues to soften.

Why are Steamboat and Vail outperforming others?

Both Steamboat and Vail have a much lower correlation to the Denver metro area and draw buyers from throughout the country. Furthermore, Vail has a large international buying pool. Having a much larger pool of buyers helps smooth out the ups and downs in the market. I think this trend will continue and that Steamboat and Vail will outperform other markets due to the broader buying pool.

It is also important to note that historically Steamboat and Vail lagged changes that occurred in Denver and in turn Summit and Grand counties. This lag could be 6-12 months so Vail and Steamboat will likely still soften a little starting early next year.

What is the best place for Colorado ski real estate investing

In December of last year predicted the best Colorado ski investments. Here is what I said:

Both Summit (Breckenridge) and Grand (Winter Park) have a very high correlation to Denver due to their proximity to the metro area. As prices soften in Denver, this impacts second home purchases in places like Breckenridge and Winter Park more than markets like Steamboat or Vail as they are “drive up” markets.

My predictions were spot on last year and I’m going to continue to stick with my predictions as the data is showing exactly what I had previously predicted. I would also note that Aspen and Telluride are still my two top predictions for long term investing.

Both Telluride and Aspen have a lot in common. Both are land constrained, build costs are high, there are very few, if any, available lots, and most importantly they are seen as a hedge to inflation. In a high inflation environment, high net worth buyers are scrambling to “protect” their assets. In a typical market as the stock market fell, you could hedge with treasuries or international exposure, but in the current environment everything is falling so hard assets like real estate are one of the few “safe havens”. Furthermore, neither market has a high correlation with another market. For example, what happens in Denver doesn’t have much if any impact on either market as the buyers come from all over the country and world. Both Telluride and Aspen meet these characteristics.

Summary

There aren’t any “bad” ski towns in Colorado. Every Colorado ski town is basically land locked and building costs are high which will limit new inventory coming online. But if I had to rank them in order based on today’s economic environment Telluride and Aspen would tie for the top place followed by Vail/Steamboat/Crested Butte. Long term all the Colorado ski areas will outperform most other real estate throughout the country so none of these markets would be a bad long-term investment but in the short term as we are seeing in the data above some will clearly outperform others.

Additional Reading/Resources

- https://coloradorealtors.com/market-trends/regional-and-statewide-statistics/

- https://coloradohardmoney.com/best-colorado-ski-real-estate/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender