It has been a crazy election cycle in Colorado with multiple initiatives impacting everything from alcohol, nightly rentals, income taxes, school lunches, magic mushrooms, etc… Some taxes were reduced, others were increased. What were the big Colorado initiatives and how will they impact you, your wallet, your real estate, and your “recreational” options?

It has been a crazy election cycle in Colorado with multiple initiatives impacting everything from alcohol, nightly rentals, income taxes, school lunches, magic mushrooms, etc… Some taxes were reduced, others were increased. What were the big Colorado initiatives and how will they impact you, your wallet, your real estate, and your “recreational” options?

What were some of the big initiatives in Colorado this cycle?

Alcohol laws: I was very surprised that as of this writing only one of the 3 measures passed which will put liquor stores at a huge disadvantage. I would have thought that if voters wanted wine in grocery that they would allow liquor stores to have more than two licenses to at least have a chance of competing with big box retailers.

- [ Passing but looks like headed for a recount as it is close ] Proposition 125: Currently only liquor stores can sell wine, the new initiative will allow any licensed seller of beer to also allow wine sales starting 2023. This would cover grocery and convenience stores. (full text from the secretary of state)

- [ Failed ] Proposition 124: This would allow liquor stores to own more than two locations and phases in unlimited locations through 2037. For example in 2022 a liquor store could have up to 8 locations throughout the state Essentially this will allow corporate ownership of liquor stores and enable places like Costco to sell liquor throughout the state. (full text from the Secretary of state)

- [ Failed ] Proposition 126: Allow 3rd party delivery of alcohol to residential homes. I don’t think this initiative is a game changer one way or another, but could increase grocery share as when people order groceries online they can also get beer and wine delivered (full text from the Secretary of State)

Most liquor stores in Colorado will go under

There is a finite demand for beer, wine, spirits. As more consumers buy beer and wine from traditional grocery retailers it will be impossible for many liquor stores to stay in business. I was at a shopping center yesterday that had a grocery store, a liquor store, and a convenience store. The numbers don’t work to sustain all three businesses and the liquor store will be the one on the way out as beer and wine are incremental to convenience stores and grocery stores, so they don’t have to make much if any money on each sale. Furthermore, the margins will be higher for a grocery retailer as they can negotiate larger volumes than a smaller single store.

Grocery Anchored retail throughout Colorado will be under increasing pressure. With almost 1200 liquor stores likely closing over the next several years substantial grocery anchored retail space will be available. At the same time substantial inventory of new centers is coming online and natural attrition from e-commerce is also occurring. Who will fill all this vacant space that doesn’t already have a presence in these same centers? In Colorado, grocery anchored retail will be challenging with the increase in supply and limited new demand.

The national economy is already showing signs of cooling off; the increased closing of a substantial number of liquor stores will put downward pressure on retail rents and prices in grocery anchored centers throughout Colorado.

Colorado election: Income Taxes

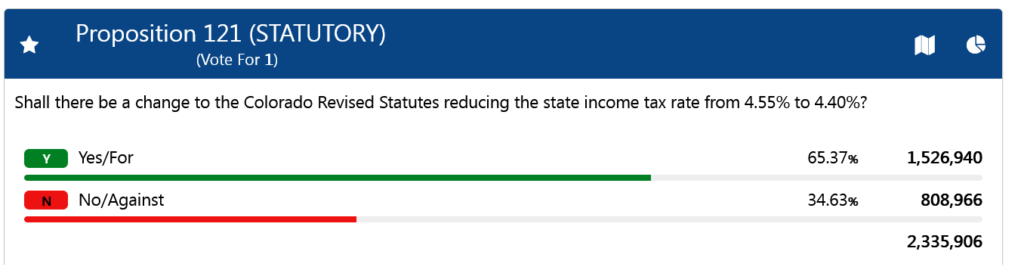

- [Passed] Proposition 121: Reduce state income tax rate from 4.55% to 4.4%

- [Passed] HB 1414: School lunches for free: Regardless of income the state of Colorado will provide free lunches for all students (HB 1414), this would be paid by decreasing the deductions for people making over 200k/year from 30k to 12k. This would be a tax increase as reducing deductions increases the tax liability

- [Passed] Initiative 108: Affordable housing: The measure diverts income tax revenue representing 0.1 percent of taxable income from the General Fund to the State Affordable Housing Fund. Diversions are estimated at $135 million in FY 2022-23 (half-year impact) and $270 million in FY 2023-24.The measure allows the state to retain and spend revenue diverted from the General Fund to the State Affordable Housing Fund as a voter-approved revenue change to its spending limit (“TABOR limit”).It therefore reduces refunds to taxpayers by an estimated $135 million for FY 2022-23 and $270 million for FY 2023-24.This initiative keeps money that should be refunded to taxpayers under the Taxpayers Bill of rights (TABOR). Do not be fooled this new proposal is a tax that will cost you whether they call it a diversion or a tax, you as a taxpayer will be on the hook for it.

In all, even with the reduction in income tax rate, your taxes are going up due to the new spending on Affordable housing and Free school lunches which will reduce any future tabor refunds. The other notable item is that when state revenues decline and there is not a tabor refund, 270 million will need to be taken out of the general budget for education, roads, etc.. in order to pay for housing. The initiative is basically a shell game moving the costs.

Colorado Election Proposition 122

- Proposition 122 would decriminalize the personal use and possession (for adults age 21 and older) of the following hallucinogenic/entheogenic plants and fungi, which are currently classified as Schedule I controlled substances under state law:[1]

- dimethyltryptamine (DMT);

- ibogaine;

- mescaline (excluding peyote);

- psilocybin; and

Colorado Election impact on Nightly rentals

There were so many nightly rental laws being voted on (14 as of my last count). I did a seperate post just focusing on the big changes to nightly rentals and their impact on real estate. Here is my prior rundown of the nightly rental taxes that were passed: https://coloradohardmoney.com/co-short-term-rental-elections-20-tax-rates-approved-what-are-the-results-and-what-does-this-mean-to-you-and-colorado-ski-real-estate/

Summary of Colorado Election 2022 results

This was a big election season in Colorado with huge prospective changes in liquor laws, income taxes, drug laws, and nightly rental taxes. I was very surprised that only one of the proposed changes to liquor laws passed, and also very surprised that proposition 122 (magic mushrooms) passed. Although it will still be more expensive in Colorado next year with higher taxes, at least people can legally use hallucinogenics to go to happier times with less taxes 😊.

Additional Reading/Resources:

- https://coloradohardmoney.com/wine-beer-in-colorado-grocery-stores-big-changes-to-co-liquor-laws-on-ballot-and-impact-on-real-estate/

- https://leg.colorado.gov/bills/hb22-1414

- https://coloradosun.com/2022/07/21/pit-count/

- https://leg.colorado.gov/sites/default/files/initiatives/2022%2523108FiscalSummary_00.pdf

- https://leg.colorado.gov/content/dedicated-state-income-tax-revenue-affordable-housing-programs

- https://www.coloradopolitics.com/denver/report-almost-half-a-billion-dollars-spent-on-homeless-services-in-denver-metro-region/article_c95eb736-f5fc-11eb-a3cd-1748639cd7d8.html

- https://www.wsj.com/articles/the-high-cost-of-free-money-harvard-exeter-study-stimulus-handout-low-income-well-being-health-personal-agency-poverty-covid-11658166372?st=upu64rqaz6h60x3&reflink=share_mobilewebshare

- https://results.enr.clarityelections.com/CO/115903/web.307039/#/summary

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender