I’m constantly asked: “what is the best place to buy ski real estate in Colorado”. What are the key drivers of “value” for ski real estate? I think most people would agree that we are somewhere near a peak in real estate for this cycle, so it is important to answer the question, what ski town is “less” immune to a correction in a market downturn?

I’m constantly asked: “what is the best place to buy ski real estate in Colorado”. What are the key drivers of “value” for ski real estate? I think most people would agree that we are somewhere near a peak in real estate for this cycle, so it is important to answer the question, what ski town is “less” immune to a correction in a market downturn?

What was in the data to identify the best Colorado ski town investment?

What comes up, must come down. Unfortunately, market cycles do not last forever. We are just now seeing the end to the bull market in real estate that has been going since 09 in some fashion. How can you rank the ski resorts on “risk” and future upside?

I sorted through statistics and data from various sources and two variables “jumped” out of the page as key indicators of ski real estate.

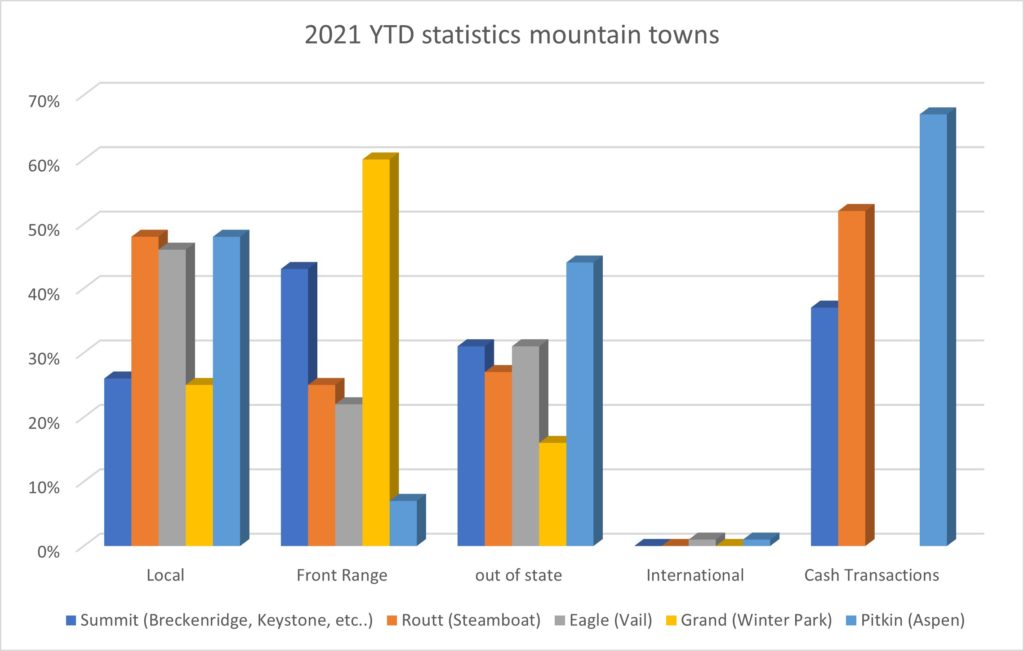

There are two main variables to watch in the mountain towns:

- Cash transactions: This is the most important factor and the higher the number of cash transactions the lower the risk in a correction. For example in Aspen almost 70% of all properties are bought in cash. This huge amount of cash transactions will limit any downside risk in a correction. If there is a mortgage there could be defaults/foreclosures, with 70% of all properties bought in cash the downside risk is substantially less.

- Percent of front range buyers (Denver metro): The more buyers from a market are from the Denver front range, the higher the correlation to the Denver market. For example, as Denver slows, the markets with a higher correlation will be impacted. Take Grand County (Winter Park) where 60% of the buyers are from the front range, as the Denver market slows the prospective buyers will be less inclined to buy in Winter Park. We saw this in the last cycle where as Denver slowed the markets with the highest correlation also slowed/corrected. The reason this is important is because the Denver real estate market is starting to slow which is an indication of where prices will head in certain resort markets.

Key findings from the data on Breckenridge, Aspen, Vail, Winter Park, Steamboat

I didn’t include all the ski areas as places like Telluride and Crested Butte are more difficult to access so the front range metric wouldn’t necessarily hold. I compared 2019 to 2021 to see what the Covid trends were in each market. Here are a couple of highlights from each market. Also reference the charts below

Breckenridge (Summit County)

- 37% of transactions are in cash, up from 33%

- Front range buyers constant around 43%

Aspen (Pitkin County)

- Cash transactions jumped from 42% in 2019 to 67% in 2021

- Front range buyers constant around 7%

Winter Park (Grand County)

- Front range buyers 60%

- No information on cash transactions

Vail (Eagle County)

- Front range buyers increased from 17-22%

- No information on cash transactions

Steamboat (Routt County)

- Front range buyers increased from 22 to 25%

- Cash transactions skyrocketed from 33% to 52%

What are the best Colorado ski town investments?

Based on the above, what are the best ski town investments in Colorado?

- Aspen (I’d include Telluride in first as well as it is very similar to Aspen)

- Steamboat (starting at a lower point than Vail so more upside)

- Vail/Eagle county (would put Crested Butte just above Summit)

- Summit

- Winter Park

Don’t get me wrong, none of the above are bad investments, the goal was to rank the top investments.

Where would I invest now?

- Vail: Although I couldn’t find the statistics of the cash transactions, areas like Beaver Creek are performing extremely well and will continue into the future as supply is non existent.

- Steamboat: The huge jump in cash transactions was eye opening. It shows that this market has been “discovered” by high-net-worth individuals and should remain a top pick

What happens to Colorado Ski real estate when the market slows?

We are either at the top or somewhere close to the top of this real estate cycle so it is critical to begin hedging for downside risk for when a market correction occurs.

- Aspen/Steamboat/Vail/Telluride will outperform other markets

- Breckenridge should be okay due to number of cash transactions, but riskier than Vail or Steamboat. Areas like Silverthorne or Dillon are riskier than Breckenridge or Keystone

- Grand county is biggest risk as it is most closely tied to Denver metro

Summary

I’m amazed at the recent appreciation in Colorado real estate. Unfortunately, it is not possible for the party to continue much longer. Whether you are looking at Colorado ski real estate or in other markets, it is imperative to not only look at which markets are the best investment now, but also which ones have the least amount of downside risk. Based on the cash transactions and percentage of out of state buyers, Telluride, Aspen, Steamboat, and Vail look to be the best buys as we head into the next cycle.

Additional Reading/Resources

- https://ltms.ltgc.com/resources/real-estate-stats-and-reports/

- https://www.coloradorealtors.com/market-trends/regional-and-statewide-statistics/

- https://coloradohardmoney.com/denver-prices-drop-5-listings-jump-11-closings-fall-13-what-is-happening-in-denver-real-estate/

- https://coloradohardmoney.com/commercial-property-taxes-for-nightly-rentals/

| 2021 YTD | |||||

| Resort town | Local | Front Range | out of state | International | Cash Transactions |

| Summit (Breckenridge, Keystone, etc..) | 26% | 43% | 31% | 0% | 37% |

| Routt (Steamboat) | 48% | 25% | 27% | 0% | 52% |

| Eagle (Vail) | 46% | 22% | 31% | 1% | |

| Grand (Winter Park) | 25% | 60% | 16% | 0% | |

| Pitkin (Aspen) | 48% | 7% | 44% | 1% | 67% |

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)