Wow, the first half of 2023 has been relatively good in real estate throughout most markets. Volumes are down substantially, but there has been little movement in prices. Even with higher interest rates, most areas have stayed relatively flat, but the winds are definitely changing. Where does Colorado real estate go the later part of 2023? Will there be a sudden reversal in pricing?

Wow, the first half of 2023 has been relatively good in real estate throughout most markets. Volumes are down substantially, but there has been little movement in prices. Even with higher interest rates, most areas have stayed relatively flat, but the winds are definitely changing. Where does Colorado real estate go the later part of 2023? Will there be a sudden reversal in pricing?

Colorado Residential real estate 2023 predictions

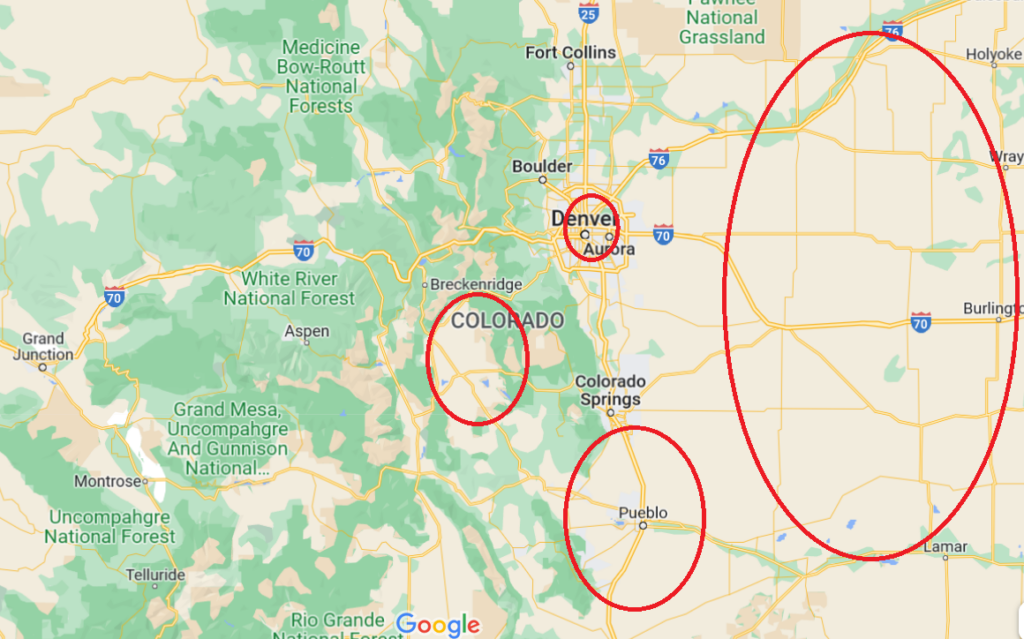

I categorized residential real estate into three buckets 1. Front Range/Denver 2. Ski towns 3. Rural I know these are large buckets, but wanted to highlight some important trends in each one

Front range/Denver 2023 real estate predictions

Denver in the past was always a top pick of places to relocate to but things have changed quickly. Now Denver is commonly on the list of best places to move out of. The number one driver is cost. Denver has gotten expensive, taxes have gone up, crime has skyrocketed and as rates have doubled it has gotten even more expensive. This change is evident in the recent sales data with Denver down substantially.

Due to the high prices in Denver, the market is in store for a reset very late 2023 or early 2024. Best case prices will be down around 10% year over year in early 2024, but this could be as high as 20% as rates remain strong. Keep in mind, even with a 20% decrease, Denver will still be up over 30% since the pandemic buying spree.

Note, the front range suburbs will perform better than Denver due to their lower price points along with lower tax bills. Look for this trend to continue/accelerate in the second half of the year. This likely will be a long term trend as buyers shift their focus out of the city core.

Ski towns (Steamboat, Breckenridge, Vail, Aspen, Winter Park, Telluride) 2023 real estate predictions

The ski towns will come off their highs. Look for drive up resorts like Breckenridge and Winter Park to come off around 10% as the Denver market softens. The farther out destination resorts (Steamboat, Telluride, Crested Butte, etc..) will fare better with prices staying flat to coming off around 5%.

The assumptions above could be drastically altered if the stock market corrects more than is predicted and the recession is deeper than anticipated. Furthermore, the recent bank failures could cause substantial pull back in credit availability. These changes will not be felt immediately in real estate and 2024 will get more interesting.

Other/rural/smaller markets in Colorado real estate predictions

I think the flight to the exurbs/rural areas will be a passing phenomenon in 2023 as people get back into the office and into old patterns. These are the highest risk areas as local income is not high enough to support the prices with the current interest rates. This will lead to a reset in the 10-20% range. Look for considerable inventory to come on in 2024 as the employment rate increases and employees lose their leverage on work from home.

2023 Colorado commercial real estate predictions

Overall Commercial real estate will have a tough run the second half of 2023 as interest rates remain elevated, many deals no longer make sense. Furthermore, there is a glut in certain property types like office and large industrial that will take some time to adjust.

Office: A space will struggle in 2023, B/C space will fall hard as the rents cannot keep pace with rising cap rates. I don’t think the bottom will fall out until 23 as the economy resets and companies start dumping old space as their leases renew.

Multifamily: This sector should do okay even as rent increases begin to slow. The big upside will be in lower priced B/C units where there is no new construction and tons of demand at the lower price points. Interest rates will continue to pressure prices as cap rates rise which could lead to some upside down properties.

Industrial: This sector will continue to outperform 23 even as warehousing/distribution slows down. There have been long term shifts in consumer buying preferences that will continue demand for industrial. Long term, Denver/Front range is well positioned as a hub for the intermountain west.

Retail: Class A retail will do okay, big box/lower tiered retail will struggle as consumers revert to traditional buying patterns and shift their spending to travel as opposed to goods. Furthermore, rising wages will make in person retail more expensive and force another pivot to selling online especially in the lower tier sections.

Summary:

2023 has started relatively calmly especially in residential, but choppy waters are ahead. We are already seeing initial signs of distress on the commercial side. I don’t foresee a cliff drop on the horizon, but there will be a reset very late 2023 into 2024 as rates remain high, cap rates increase, and the market comes to terms with the insatiable consumer spending that will inevitably slow.

Colorado real estate will not be immune from the macro economic forces and Denver will be impacted more than other markets due to the high price points and migration to less expensive locations. On the bright side, I don’t see a 2008 repeat, but it will still be painful for anyone that needs to sell late 2023 or early 2024 as prices reset lower.

Additional Reading/Resources

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender