The good times continue to roll on. Inventory is down and prices are stabilizing and still increasing in some markets. When will there be a reset in Colorado real estate prices. What happens when this cycle ends? Are there opportunities currently? Where will new opportunities arise?

More downside than upside risk in Colorado Real Estate

Unfortunately, there is considerably more downside risk to the economy than upside risk. With ultra-low rates lasting considerably longer than they should, the Federal Reserve has painted itself into a corner. Rates will continue to remain higher for far longer than the market has predicted.

The higher rates will ultimately lead to a downturn in the economy as businesses pull back on investment and prices of assets reset based on higher interest rates. The next cycle has not begun yet and looks to be in the offing in 2024.

When will there be a reset in Colorado real estate prices?

This is always a challenging question. When will the reset in Colorado real estate prices occur. If you had asked me at the beginning of the year, my prediction would be later this year. But with all the recent economic news the recession date has been pushed out. The labor market remains tight, and inflation seems to be coming down as planned, but there is still a lot of risk in the market with higher interest rates at some point hitting demand of businesses and household budgets.

The real indicator to watch is going to be the unemployment rate. Even if we have a recession, if unemployment does not increase materially, the impacts on real estate prices will be pretty minor. The reason it is important to watch unemployment numbers in Colorado is because the Golden handcuffs of low rates will not loosen up inventory until there is some distress due to an event like a job loss.

What does a downturn mean for real estate prices?

There will be two primary impacts when the downturn hits.

- Inventory Increases: As interest rates continue to rise over the next six months, we will see large jumps in inventory in real estate throughout Colorado. The days of 12 offers on a house are already in the rear-view mirror. This trend will happen throughout the state. I’m already seeing more inventory in Denver and even the mountains as sellers try to take advantage of the high prices before the cycle ends.

- Prices soften: Ironically as I was writing this article, I got two alerts about price drops on homes. I don’t see a plunge in prices like we saw in 2008, but prices will come off their highs as inventory increases and real estate prices far outpace any increase in wages.

Where are the current real estate opportunities in Colorado?

With every cycle there are opportunities, and the beginning of this cycle is no exception. With so much economic uncertainty there will be more situations where borrowers must sell. It is not going to be as crazy as 2008, but there will be the ability to pick up properties below market. I’m already starting to see some signs of market duress with more houses entering default/late.

Here are some of the property types/areas I like:

- Small industrial around metro: light industrial has always been one of my favorite property types. Regardless of the cycle there are typically renters looking for small industrial space especially close to a metro area like Denver.

- Single family and multifamily suburban: The suburban market is in high demand with the work from home trends. Single family and multifamily close in suburban markets have upside potential. We should have another 12 months or so of rent growth as rents catch up to prices which will be a hedge on inflation

- Small suburban retail: As Covid fades, there is an increasing demand for in person retail/dining especially in suburban locations. These properties should perform okay even in a down cycle as people migrate back to in person experiences.

What areas have more downside risk?

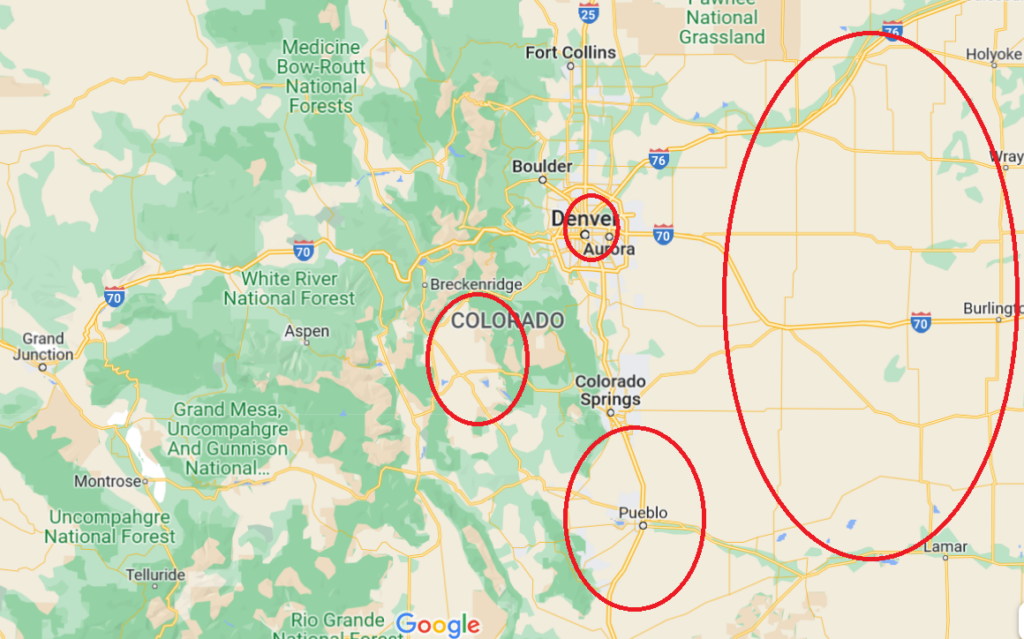

The map above shows some of the more at-risk markets, I highlighted rural markets and markets like Pueblo that do not have the employment of other areas. Furthermore, the Denver core is riskier than the suburban markets due to increased taxes, crime, and not having to necessarily commute into the office each day.

Will Colorado real estate crash?

I see a pullback in prices, but I don’t see a crash in Colorado real estate. This recession is going to be different than 2008 primarily because we do not have the “liar loans” as we had leading up to the last recession. The credit quality of borrowers is substantially higher with higher down payments which will limit the scope of the fall in this recession. Furthermore, we haven’t seen a huge increase in inventory in most markets.

Although the bottom should not fall out, there will be pain in the market. I see a pullback in prices of 10-15% with a greater pullback in smaller rural areas. Remember to put this in context. Many markets went up 20-30% just last year with many of the mountain communities up 40%+, this is on top of multiple years of double-digit growth. A pullback in the 10-20% range although it sounds big on paper is not a huge decline based on how far up the market has come.

Where will there be real estate opportunities in the future?

There will be opportunities as the real estate market resets. Although we are unlikely to experience a 2008 rehash, there will still be opportunities as the market changes. I expect to see more buying opportunities sometime in 2024 as the federal reserve interest rate moves push the economy into a downturn and unemployment pushes up inventory. I’m still not buying the soft-landing theory with interest rates staying so high for long. Eventually something must break as it has in every single cycle.

Summary

Although the economy is still humming along, higher interest rates will eventually bite with unemployment increasing. This will create opportunities for buyers as prices drop off their highs. The key areas will be close in suburban areas and the key property types will be investment single family/multifamily along with light industrial. Now is the time to keep your eyes peeled for buying opportunities that should only improve in 2024 but you will need to temper your expectations as a 2008 rerun is not in the cards at this point.

Additional Reading/Resources:

- https://www.bloomberg.com/news/articles/2022-05-13/us-consumer-sentiment-falls-to-fresh-decade-low-on-inflation

- https://www.bloomberg.com/news/articles/2022-05-13/age-of-inflation-in-us-will-last-much-longer-than-pandemic-spike?srnd=premium

- https://www.cnbc.com/2022/05/12/powell-says-he-cant-guarantee-a-soft-landing-as-the-fed-looks-to-control-inflation.html

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender