Do you know where the next defaults will occur in Colorado? What cities and zip codes are most at risk during this recession? In every recession, there are two predictors of default/loss collateral and equity. What does the data tell us today about Colorado? What does this mean for real estate prices? Since 2008, there have been some major changes in financing, gone are the old days of subprime now replaced by government programs. Why is this change important?

What changed in financing?

Prior to 2008, the FHA market share was around 4% of the total mortgage market, fast forward to 2019, the share of FHA loans is now around 18% of the market. As the subprime mortgage market imploded in 2008 and 2009, these borrowers now are financed by FHA which has led to the explosive growth (source HUD).

Why are borrowers choosing FHA?

FHA rates are between ½ to ¾% of a percent higher than conventional loans. On a 400k house this adds up to around 3k/year. Why are borrowers choosing to go FHA versus your traditional conventional mortgage? It is easier! FHA allows down payments as low as 3.5%, credit scores down to 580, and higher debt to income ratios.

FHA loans are considerably riskier for defaults

According to 2019 data from Core logic, the default rate of an FHA loan is over 3 time more likely than a conventional mortgage. Why? FHA loans are riskier loans due to decreased equity and decreased credit and income requirements. FHA is a subsidized “subprime” lender sponsored by the federal government and tax payers.

Why track FHA loans?

With default rates on FHA loans substantially higher than traditional mortgages it is important to see where the majority of these loans are being made. The larger the amount of FHA loans in a particular area is a flag for increased defaults. 36% of all loans originated in 2001 ended up defaulting (Housing wire). If this occurred in a particular city/zip this would no doubt have an impact on surrounding properties.

What was in the data?

FHA publishes data on originations on purchases and refinances into FHA products. They also break down refinances on refi from an FHA loan to another FHA loan along with Conventional to FHA.

I found it interesting as to why would someone refinance from a conventional mortgage to an FHA mortgage? As mentioned above FHA rates are considerably higher so the only explanation is that the borrower cannot qualify for a conventional loan. This is a key indicator of financial duress as there is no other plausible reason to refinance into a higher rate.

What is the new data telling us today in Colorado?

To see areas more at risk for default, I focused on the amount of mortgages (dollar value) where borrowers were refinance from a conventional mortgage to an FHA mortgage as this is a leading indicator of possible financial duress. Below are the top ten cities

| City | Zip | Amount | Median Price | |

| 1 | Firestone | 80504 | 1523186 | 445,000 |

| 2 | Broomfield | 80020 | 1445867 | 445,000 |

| 3 | Highlands Ranch | 80126 | 1393615 | 490000 |

| 4 | Aurora | 80013 | 1311811 | 345,000 |

| 5 | Aurora | 80016 | 1238329 | 540,000 |

| 6 | Denver | 80219 | 1167691 | 360000 |

| 7 | Brighton | 80601 | 1020110 | 435,000 |

| 8 | Franktown | 80116 | 1012616 | 730,000 |

| 9 | larkspur | 80118 | 975782 | 615,000 |

| 10 | Loveland | 80538 | 898517 | 375,000 |

Do you want to know how your city/zip ranks, I created pivot tables based on the FHA data; if you click on FHA conv state you can filter by state, city, zip, etc..

What do these locations have in common?

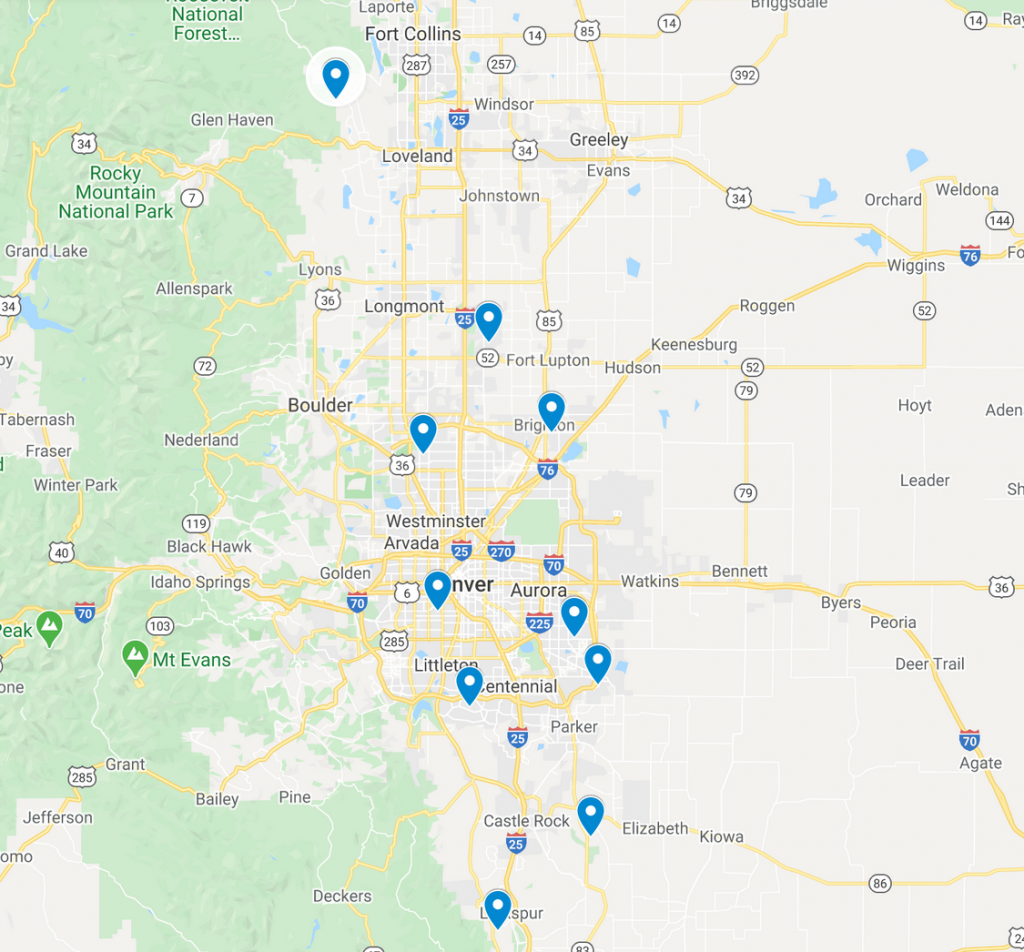

Below is a map of the top ten. All of them except one is a suburban or exurban location. The one intown location is a gentrifying area of Denver that is priced considerably less than the median home price.

What will happen in Colorado in the next cycle?

There will no doubt be more defaults in the locations highlighted above, but I don’t think the sky will fall like it did in 2008. The Denver front range is increasingly desirable to live in compared to other coastal cities so demand should stay constant and supply will continue to be constrained.

There are a couple of caveats. I am considerably more worried about many of the new construction neighborhoods as there is more inventory available which could lead to some downside pressure. Firestone and Brighton are good examples of this. Furthermore, Larkspur and Franktown (exurban locations) are at considerably greater risk for price declines than the metro locations. If you are in these areas now or invest in these areas, be a little more cautious on your values as they are “riskier” than other areas.

Summary

As Mark Twain famously said, history doesn’t repeat itself but rhymes. In our current crisis, I’m starting to see some very distinct rhymes from the last real estate crisis. Although it doesn’t appear that real estate will have nearly the fall that it did in 08, there will still be defaults and stress in the market. The locations highlighted by analyzing the conventional loans to FHA loan refinance are eerily similar to that last crisis that hit many suburban and exurban areas considerably harder than other areas.

Additional Reading/Resources:

- https://www.hud.gov/program_offices/housing/rmra/oe/rpts/sfsnap/sfsnap

- https://www.consumerfinance.gov/data-research/mortgage-performance-trends/download-the-data/

- https://www.huduser.gov/portal/ushmc/fi_FHAShareVol.html

- https://www.hud.gov/program_offices/housing/rmra/oe/rpts/fhamktsh/fhamktqtrly

- https://www.corelogic.com/blog/2019/01/mortgage-delinquency-rates-for-all-loan-types-continue-to-fall.aspx

We are still lending as we fund in cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)