Almost every mountain town continues to appreciate or stay at historic highs, but two Colorado mountain towns are bucking the trend. What is happening in Silverthorne and Granby? Why are these two towns underperforming not only mountain towns but others throughout Colorado. Is this a trend or just a blip? What other mountain towns are next to decline?

What was in the data on falling prices in Colorado?

Zillow looked at home prices over the last 5 years to see the fastest and slowest appreciating markets in Colorado. I then parsed the data Further to show the Year over Year change in markets throughout Colorado to determine not only the best, but worst performing markets.

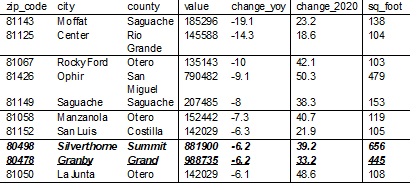

| zip_code | city | county | value | change_yoy | change_2020 | sq_foot |

| 81143 | Moffat | Saguache | 185296 | -19.1 | 23.2 | 138 |

| 81125 | Center | Rio Grande | 145588 | -14.3 | 18.6 | 104 |

| 81067 | Rocky Ford | Otero | 135143 | -10 | 42.1 | 103 |

| 81426 | Ophir | San Miguel | 790482 | -9.1 | 50.3 | 479 |

| 81149 | Saguache | Saguache | 207485 | -8 | 38.3 | 153 |

| 81058 | Manzanola | Otero | 152442 | -7.3 | 40.7 | 119 |

| 81152 | San Luis | Costilla | 142029 | -6.3 | 21.9 | 105 |

| 80498 | Silverthorne | Summit | 881900 | -6.2 | 39.2 | 656 |

| 80478 | Granby | Grand | 988735 | -6.2 | 33.2 | 445 |

| 81050 | La Junta | Otero | 142029 | -6.1 | 48.6 | 108 |

Granby and Silverthorne are radically different than the other falling markets

When I was looking at the data, I was a bit surprised. All of the falling markets are much smaller rural markets other than Granby and Silverthorne. The other markets are what I would expect as the work from home reverses people cannot live in the middle of nowhere and moved back closer to urban areas like what was prepandemic. Silverthorne and Granby are not like the other falling markets, they are definitely unique as other ski markets/areas continue to rise.

Why are Granby and Silverthorne real estate prices falling?

Granby and Silverthorne prices are resetting after historic run ups in price. Here are four reasons they are underperforming other markets.

- Huge appreciation unsustainable: Both Granby and Silverthorne were “affordable” prepandemic. Fast forward and the median prices are now almost 1m in Silverthorne and 850k in Granby. The affordable markets are no longer affordable

- Not core ski markets: Neither Granby or Silverthorne are core ski markets. For example with traffic it could still take over an hour to get to Breckenridge skiing from Silverthorne or Winter Park from Granby. If someone is looking for a ski property it is not worth it at this price point to be this far from skiing

- Nightly rental reset: In Silverthorne, the caps on nightly rentals definitely have had an impact as this was an affordable rental area and now this is capped on licenses and number of nights. Furthermore in Granby, there is a capacity issue as the number of nightly rentals in the area has grown so much rates and occupancy has decreased.

- Larger impact from mortgage rates: Granby and Silverthorne were “affordable” areas and much more likely to use a mortgage than a city like Breckenridge. As rates increased substantially, payments were no longer affordable for buyers.

What are the next towns that will fall?

Silverthorne and Granby are not the only ski town “suburbs” that eventually will be impacted by falling prices, here are some other cities that likely will see a reset.

- Oak Creek: about 3o minutes south of Steamboat, also an affordable area that has gotten a bit ahead of itself

- Kremmling: about 40 minutes north of Silverthorne, this area has come up in value substantially as a result of Summit county prices.

- Fairplay: South of Summit over Hoosier pass. There is nothing in Fairplay to justify the price other than it is a less expensive area close to Summit county.

- Idaho Springs: This area has also seen huge appreciation. The question is what is Idaho springs, an exurb of Denver, a quasi mountain town? It is too far for it to be considered a ski town.

Where should you still invest in Mountain real estate?

Ski real estate will still outperform most markets. But not all ski real estate is the same. The core ski towns will hold up the best. Aspen, Crested Butte, Steamboat, Vail, etc… in the actual towns not suburbs of these areas. Although prices are high in each of the ski towns, I don’t foresee the bottom dropping out.

Summary of ski real estate price resets

Although Silverthorne and Granby are located near ski towns, they are not core ski markets. Yet even though they are not core ski markets, their prices have increased substantially and gotten closer to other core ski markets. This price appreciation is not sustainable as buyers aren’t going to pay a huge premium to be 40 minutes from a ski resort (other than in Aspen where the median home price is over 5m, a good example is Basalt which should hold up okay).

Silverthorne and Granby are not alone as there are many “suburban” towns outside of ski resorts that will also see a larger reset in prices. The closer in core ski markets will do better than others and have considerably less risk.

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender