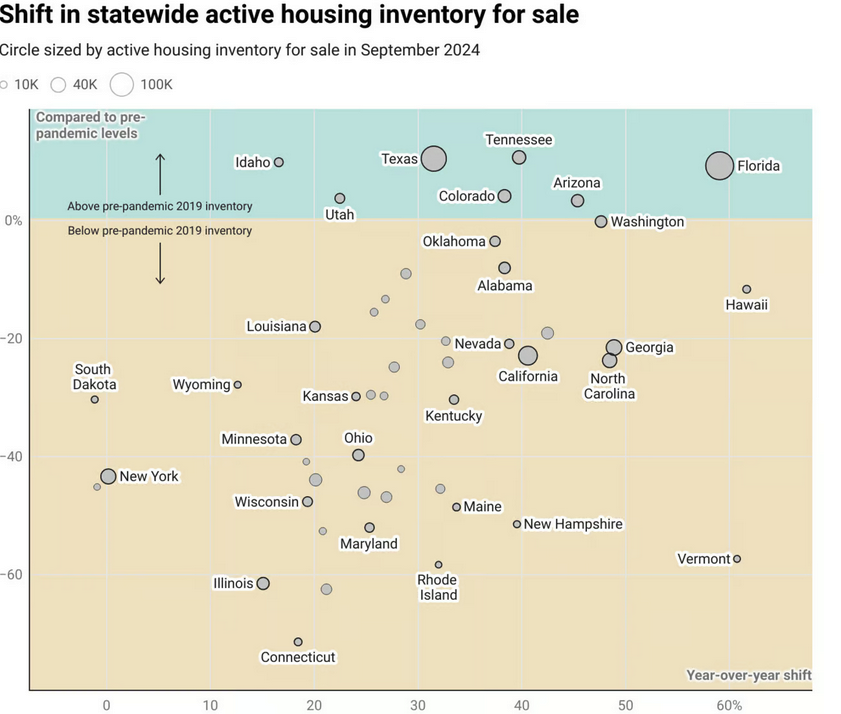

I continue to hear that Colorado has a huge shortage of housing, at the same time Colorado just reached a milestone where current inventory handily surpassed prepandemic levels. What do the 6 states have in common with the biggest increases in inventory? What does this mean for Colorado real estate prices?

First, the picture above and chart below are not surprising, every realtor I’ve talked to in the Front Ranges says that the real estate market has basically stopped on a dime. I’ve been hearing this for months and the trend continues to accelerate in most markets throughout Colorado

Sales slowing leading to rising inventory

Sales of existing homes in the U.S. are on track for the worst year since 1995—for the second year in a row. Persistently high home prices and elevated mortgage rates are keeping potential home buyers on the sidelines. Sales of previously owned homes in the first nine months of the year were lower than the same period last year, the National Association of Realtors said Wednesday.

Existing-home sales in September fell 1% from the prior month to a seasonally adjusted annual rate of 3.84 million, NAR said, the lowest monthly rate since October 2010. Economists surveyed by The Wall Street Journal had estimated a monthly decrease of 0.5%.

September sales fell 3.5% from a year earlier. The sluggish sales are leading to huge increases in inventory in Colorado and many other markets.

What is driving the increase in Colorado real estate inventory?

There are three primary factors driving the recent uptick in inventory.

- Lower absorption: If sales slow that means more inventory is piling up so there are more listings while the existing listings linger as well which further increases inventory.

- Rising rates/ high rates: As rates rise, properties become relatively more expensive therefore limiting demand. Interest rates have jumped from a low of around 2.75% to over 6.5% and salaries can’t keep up with the higher mortgage payments due to rising rates and high prices.

- Inflation: As car payments are higher, food is higher, insurance taxes and other items are higher due to inflation which means less is available for house payments.

Note, the rise in inventory is not the market returning to a new normal as during the October to December time frame inventory usually declines substantially as sellers take homes off the markets and plan to relist in the spring.

What do the 6 markets with rising inventory have in common?

The commonality of the 6 markets is that each of them were pandemic darlings with double digit price increases year over year. Now the tides have radically turned with the once hot states now suddenly cooling off ironically because of their high prices.

Will the trend of rising inventory reverse soon?

We are just at the beginning of the reset in real estate inventory. Interest rates have increased since the federal reserve cut rates and will likely trade in a similar range for the next several years. High rates coupled with high prices will lead to rising inventories as buyers can’t afford the payments to purchase a house. Furthermore, with housing prices so high, people are leaving for less expensive markets like Atlanta or Kansas City.

Will we see a drop in housing prices due to increased inventory?

I’ve read hundreds of articles all professing that this cycle is different and that prices will continue rising as there is still a shortage of housing. Regardless of all the theories, eventually gravity and basic economics prevail. As supply increases and demand stays flat/declines, the only outcome is declining prices.

We are seeing this scenario play out today. Even with interest rates dropping and supply increasing, the number of closed sales is also decreasing which means eventually prices will come down. If we look at the Colorado data, we can already see how this transitions through the market, huge jumps in the supply of condos have led to a drop of 13% in the median sale price in markets like Steamboat.

Colorado’s rising inventory will ultimately lead to price resets

The last couple years of 20% plus appreciation has come to an end. The recent increase in inventory over the summer and now fall are an indicator of more to come. As inventory increases, prices will no doubt moderately fall. Although the sky is not falling, as rates remain high or increase even further Colorado’s inventory will continue to increase, days on the market will increase, and ultimately prices will reset further. My guess is that we will finally see a reset in prices in 2025 to the tune of 10-20% in markets throughout Colorado. The ski towns will be closer to the 10% while the front range and cities like CO Springs will be in the 15-20% range. Although this will hurt recent buyers to put it in perspective real estate has doubled in many markets over the last 7 years or so the drop should not be as bad as 08.

Additional Reading/Resources

- https://coloradohardmoney.com/big-changes-in-colorado-real-estate-every-major-market-impacted/

- https://www.wsj.com/economy/housing/home-sales-on-track-for-worst-year-since-1995-9a2029ae?mod=middle-east_whatsnews_pos1

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender