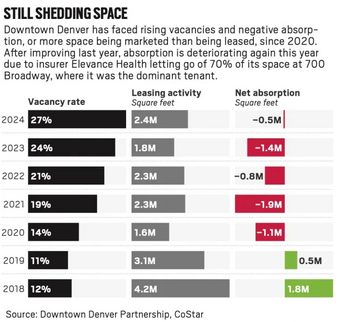

Denver has a 1.5 billion dollar plus problem as office values in a free fall. This puts Denver in one of the top three worst office markets in the entire country. Ready for a huge rise in your property taxes? Why is Denver suddenly moving from hot to not? What does this mean for real estate for the rest of the state? Will Denver have a quick rebound or are we just at the beginning, the chart above provides some clues.

Why are people leaving Denver?

It seems the dust is finally settling from the shake-up caused by the pandemic, and we’re beginning to see emerging moving patterns arise from economic and lifestyle factors rather than remote work or family obligations. The shine of the pandemic boom cities is wearing off, and many people are fleeing previously popular cities in favor of the next hot spot where the weather is mild, the cost of living is manageable, and the quality of life is satisfying.

Unfortunately Denver has quickly turned from the hot spot that was on the top of relocations to now one of the top contenders for people to leave.

Companies leaving Denver taking employment with them

The PODS study focused on actual moves, but many moves are driven by employers and unfortunately this is not helping Denver. Every day in the news I hear about more companies leaving Denver. Each relocation from Denver means that employees will also be leaving, and the trend becomes self-fulfilling

TIAA, one of the nation’s largest financial firms, informed its employees Tuesday morning that it is closing its Denver operations center over the next two years, putting about 1,000 jobs at risk.

Denver became an important player in the money management and mutual fund industry decades ago, which helped it become a hub for financial service jobs, drawing in firms like TIAA, Charles Schwab & Co., Fidelity Investments and TransAmerica.

After years of steady growth, the number of financial service jobs statewide is at 2021 levels, according to the U.S. Bureau of Labor Statistics. TIAA’s relocation is especially painful for downtown, hard hit by the shift to remote work during the pandemic and struggling with an office vacancy rate above 30%. TIAA is just the most recent in a string of large corporate relocations out of Denver.

What are the top 5 reasons for Denver relocations?

Although during the pandemic, the Denver metro area was hot, underlying all the pandemic high there were huge fundamental issues that got swept under the rug during the pandemic. Fast forward a few years and the items plaguing Denver have multiplied. Here are the top 4 reasons companies and individuals are choosing to move from Denver and/or not move to Denver in the first place.

- Crime

- Homelessness

- House prices: considerably higher than many other markets

- Taxes

- Legislative uncertainty: from labor laws, habitability bills, etc… the legislature has become anti-business pushing many companies to choose friendlier locals

Office market in Denver is in a freefall

Several of Downtown Denver’s largest towers sit half empty as the clock ticks on unsustainable debts that must be refinanced, repaid or renounced.

Unable to find enough tenants to support debt payments, about three in 10 commercial mortgages tied to office buildings in metro Denver are delinquent, the third-worst showing in the country out of 50 metros, according to a report from Trepp last summer.

Discounts of 80% to 90% or more below the prior purchase price, once unimaginable, have emerged in the past year on oil boom-era buildings. Colorado Plaza Tower I and Tower II, at 633 and 621 17th St., sold in April for a jaw-dropping 98% discount. Valued for $200 million as recently as 2019, the towers could only fetch $3.2 million

Just at the beginning of the pain in Denver real estate

Looking at the chart above, Denver is not near the bottom yet as companies are still shedding space leading to more vacancies. This trend is continuing in 25 as more companies vacate and the federal government also begins using less space. I don’t foresee an end in sight.

Self-Fulfilling prophecy of downward spiral

Unfortunately just as cities become hot and everyone wants to be there, the inverse is also true. Take Portland Oregon for example, it was one of the hottest office markets in the country for about 15 years and suddenly after Covid it is one of the worst in the country. Companies follow their peers in relocation so if everyone is now looking to Salt Lake City, more companies will follow that trend. The opposite is now occurring in Denver as nobody wants to be the last one standing around in a declining market.

As more businesses relocate and vacancy rates remain high, this creates a downward tornado with increasing crime due to less people in the area, less services from restaurants and ultimately less desire to be downtown. This also impacts other real estate in Denver from retail, restaurants, residential housing, etc… due to less demand in the area.

Tax revenue plummets in Denver

Denver is already facing a huge budget deficit even before the huge loss in downtown office value has been realized. Based on some of the larger offices in distress there is about 1.5 billion of distressed office in Denver. If I assume the ultimate price is around 30% when the assets are disposed, that means that the value of the buildings will be reduced for tax purposes by about 1.1 billion. On top of this the contagion effect will impact retail, housing, restaurants, etc… leading to a much larger hit. Unfortunately it is not possible to say exactly how large other than to know it will be a sizeable hit.

This will shoot a cannonball sized hole through Denver’s budget leading to even more drastic cuts or higher taxes. Either way, the higher taxes or huge budget cuts will make Denver even less desirable for businesses and in turn ancillary businesses. The crazy part is I have yet to see any mention of the impending fiscal disaster that is heading towards Denver.

What happens to real estate in the rest of the state?

In the short term you will continue to see a migration out of Denver into the Suburbs, but ultimately many markets throughout the state will be immensely impacted. For example, the primary driver of Breckenridge and Winter Park real estate has been from the Denver metro. Also if you look at the Western slope there was a huge surge in relocations from Denver where people had sold houses and would pay cash for a house in Montrose, Delta, etc.. This trade has dried up and you are now seeing softening in other parts of the state.

How does the real estate free fall in Denver ultimately end?

The million dollar question is what happens now? Unfortunately I don’t see anything on the horizon that will make the situation better in Denver as the 5 factors above seem to be accelerating in the wrong direction that will lead to even more negative absorption in the short term. This will lead to a negative cycle in Denver with even higher taxes and or reduced services which will ultimately lead to more vacancy. Unfortunately one of the key plans to increase downtown business is invest in a new sports stadium. Every economic study has shown that the costs of the stadium always outweigh any benefits.

At the end of the day Denver and the state of Colorado must attract businesses with consistent policies that enable and encourage businesses to thrive. Furthermore there must be a greater emphasis on crime/homelessness to attract businesses to the downtown core. At our current path we are taking the opposite steps looking a lot like Oregon which will lead to similar outcomes with a struggling downtown.

Additional Reading/Resources

- https://www.denverpost.com/2025/05/29/denver-office-buildings-foreclosure-real-estate-sales/

- https://www.pods.com/blog/moving-trends

- https://coloradohardmoney.com/you-should-not-buy-a-rental-property-in-denver/

- https://coloradohardmoney.com/colorado-insurance-crisis/

- https://www.bisnow.com/denver/news/capital-markets/metro-denver-among-cities-with-highest-concentration-of-cmbs-distress-125045

- https://coloradohardmoney.com/2025-best-colorado-ski-real-estate/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help as my goal in writing these articles is to provide the best information/insight on Colorado Real Estate that you cannot get anywhere else! Please like and share my articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, Hard Money Lender, Private lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender