Although nobody knows how or when the next denver housing market recession will occur, we saw in the last cycle certain cities performed substantially better than others. Redfin recently ranked the top metro areas that will perform best (and worst) in the next real estate cycle. With mumblings of a recession all over the news, how will Denver fare when the economy changes?

The redfin model:

To identify the local housing markets most likely to feel adverse effects from the next recession, Redfin looked at the following factors and weighted each one to develop a “recession risk” score. The factors analyzed were:

- Median home sale price-to-household income ratio (weight: 1.5, higher is riskier)

- Average loan-to-value ratio of homes sold in 2018 (weight: 1.5, higher is riskier)

- Home price volatility, measured by the standard deviation of home prices year-to-year (weight: 1.5, higher is riskier)

- Share of home sales that are flips, i.e. sold twice within 12 months for a different price (weight: 1.5, higher is riskier since flipping can be volatile in a shaky economy)

- Diversity of local employment, measured as the probability that any two randomly selected workers are in the same field (weight: 1.0, higher probability is riskier)

- Share of the local economy dependent on exports (weight: 1.0, higher is riskier during a trade war)

- Share of local households headed by someone age 65 or older (weight: 0.5, higher is riskier)

What were the results?

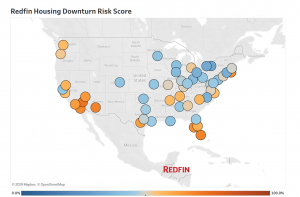

From the map you can see the Denver housing market is the top performer in the West and ranking in the top twelve in the nation (the higher the rank the better). According to the Redfin analysis, Denver will outperform all other Western markets and most markets throughout the country whenever the next recession hits.

One metric left out

Although, I think Denver will perform better than other markets, I’m not buying the accuracy of the redfin model. Cleveland and Buffalo will not outperform markets like Denver or Portland in the next recession. There was a major flaw in this study in that a primary driver of appreciation or depreciation in a market is supply. Nowhere in this study was the concept of supply captured.

Denver and many other Western cities are supply constrained. This lack of supply will put a floor under prices in a market transition like a recession. In the last recession we saw areas with ample supply struggle as demand tapered off substantially. In a market like Denver even as demand slows (as we are seeing now) there has not been much impact on prices

Why will certain cities perform drastically better than others?

To determine which cities will fare the best in the next recession supply has to be the driving factor in any analysis. The Denver housing market should be ranked higher in this study due to lack of supply and many of the leading cities like Cleveland and Buffalo should be much further down the list. The lack of supply will put a floor under a real estate market as there is less likelihood of panic selling. If there are a hundred new homes available, when a market turns the builders will look to fire sale the units. On the other hand if there are five units on the market, demands should pretty quickly absorb all the available units with minimal cost reductions.

Summary

Redfin’s model to try rank “most recession proof cities” was an interesting take to try to quantify how a city will perform in a downturn. Unfortunately, current and future supply was left out of the study. When incorporating this metric, the list would look drastically different. Regardless of redfin model, Denver will outperform the nation in the next recession due to lack of supply, a diverse and healthy economy, and ample demand.

Additional Reading/Resources:

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in the Colorado Real Estate Journal, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all they need is their simple one page application (no upfront fees or other games)