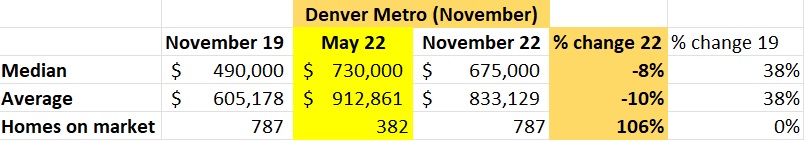

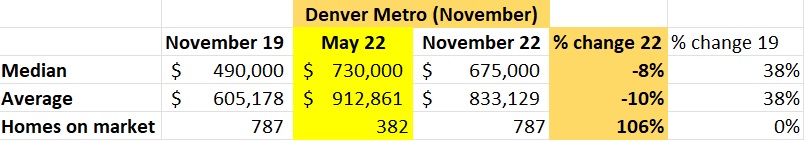

The prevailing theory is that this real estate cycle will be considerably better than others as so many people locked in rock bottom rates which will serve as “golden handcuffs” and prevent a meaningful increase in inventory. This in turn will keep prices high with little downside risk. (don’t always believe what you read). Is this true in Denver? What is the recent data showing us (hint; look at the chart above, May 22 is the peak). How will the golden handcuffs impact real estate inventory and in turn prices in Denver in 2023?

Will Golden Handcuffs hold back inventory? What does the data on Austin, TX show us?

Austin, one of the hottest pandemic markets, shows that the “lock-in effect” of golden handcuffs may not be the ironclad defense against home-price declines that some investors and homeowners think it is. As the thinking goes, homeowners aren’t supposed to willingly part with their below-3% 30-year mortgages when they would have to turn around and replace them with new home loans that carry interest rates above 7%.

In Austin, what appears to be happening is an effort to time the top of the market. Like stock traders, Austin homeowners and investors who bought their properties before the boom appear to be rushing to cash in their chips. “I suspect that people are nervous that home values are going to fall, so they’re trying to sell even if they have low interest rates,” said Jim Gaines, a research economist at the Texas Real Estate Research Center.

A similar story is playing out in Denver

Denver is replicating what is happening in Austin with median and average home prices plummeting and inventory rising sharply. Denver is a high cost market with the average home price of almost 1m. As a result large jumps in interest rates will have an outsize impact. These same trends are beginning to happen in covid “boomtowns” throughout the country.

| Denver Metro | |||||

| September 19 | May 22 | September 22 | % change 22 | % change 19 | |

| Median | $ 490,000 | $ 730,000 | $ 650,000 | -12% | 33% |

| Average | $ 601,573 | $ 912,861 | $ 814,861 | -12% | 35% |

| Homes on market | 1,105 | 382 | 970 | 154% | -12% |

How does 2022 Compare to 2019 in Denver

To make sure I am comparing apples to apples, I went back and looked at September of 19 as a baseline. Inventory in Denver has steadily risen coming in only about 12% lower than in 2019. I suspect that inventory will soon eclipse 2019 based on recent market trends of rising interest rates and less demand (absorption). I then looked at the same data set in November and 2022 is even with what the inventory was in November of 2019. I had to triple check the numbers as it is ironic that November is exactly the same in 2022 as in 2019. Basic economics shows that as supply increases and demand wanes prices in turn fall as we are already seeing in Denver.

“Golden Handcuffs” is a short term phenomenon especially in high cost areas like Denver

There has been a theory that the ultra low rates would prevent inventory from rising and furthermore we have a huge inventory shortage which will keep prices from falling. Unfortunately, this narrative is only partially true in the short term.

Depending on the economy if we have a very shallow recession and rates peak soon and then fall back shortly, the golden handcuffs scenario will likely hold up as property owners wait out the market.

The reality is that rates will likely remain higher for longer and the recession could also be deeper and longer. Higher rates for longer are the base case for most economists which means that inventory will ultimately increase for 3 reasons:

- Life Happens: Divorce, Marriage, kids, deaths, etc… In the short term if there is an economic hiccup most will hold on for a little while, but you can’t plan life around the economy and eventually life happens. From Marriage, Divorce, job changes, kids, empty nesters, deaths, etc… all these events will ultimately cause a sale or purchase of real estate which will cause real estate to turn. How extensive these events are will depend on how long the recession lasts and how high rates remain.

- Unemployment rate will increase: It is not possible to get inflation under control without addressing the wage pressures in the labor market. We are already seeing many high tech companies cut headcount from Google, Microsoft, Amazon, etc… As rates rise, the unemployment rate will also rise which will force people to give up the golden handcuffs. Although we have yet to see this occur in the labor market data, I can say with 100% certainty it will happen, it is just a matter of time.

- Migration back/out: As the unemployment rate rises, the bargaining power of employees will decline. You will see more companies requiring workers back in the office and/or adjusting pay to compensate for the location. Denver was recently ranked the second largest net “out migration” destination in a redfin study which will further crimp demand.

What happens to real estate prices in Denver in 2023

There are two primary scenarios that could play out depending on the depth of the next recession and how high the federal reserve must raise rates

- Golden Handcuffs buffer the market a little: Under this scenario rates peak early next year and quickly come down as inflation falls and we enter a mild scenario. This is the optimistic case which would lead to about a 10% decline in prices year over year. As the chart above shows, Denver is already down more than this which leads to the more likely option below.

- Base case of higher rates for longer prevails: If inflation doesn’t come down as quickly as the market is pricing in and the federal reserve is forced to raise rates higher for longer the odds of a deeper recession increase. Under this scenario, look for prices to fall around 20% in Denver metro.

Summary

Just like earlier in the year where everyone was stating that we were short millions of houses and yet inventory is now increasing substantially (not from new construction), there is a big question about how tight the “golden handcuffs” of low rates will be.

We are getting preliminary data from Denver that there are other factors driving people to sell thereby increasing inventory and leading to decreasing prices. How this scenario ultimately plays out will be determined by how high rates must rise to tame inflation and in turn how deep and long the next recession is.

My base case scenario is for a drop of around 10% in real estate prices, with a probable scenario of a drop as large as 20% (maybe 25%). My probable scenario of a 20% drop is looking more realistic as inventory jumps from the market peak in May to September by 154% and interest rates remain high. Look for a rocky road ahead in Denver real estate. Remember what happens in Denver typically spreads throughout the state of Colorado within about a year, so brace for a rocky 2023 in real estate throughout Colorado.

Additional Reading/Resources

- https://www.bloomberg.com/opinion/articles/2022-10-25/think-homeowners-will-stay-put-austin-texas-suggests-otherwise?

- https://car-co.stats.showingtime.com/docs/lmu/2019-09/x/DenverCounty?src=page

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender