The recent tourism data shows visitors spent over 28 billion dollars visiting Colorado. At the same time more business are packing up shop and heading for greener pastures. Why the diverging fates for tourism and businesses. Is the trend of increasing tourism and businesses leaving related? Is this just a random occurrence or is the state, cities, etc… encouraging this trend? What does this mean for real estate prices going forward?

What was in the data on Colorado Tourism?

The Colorado tourism industry is still on a tear. Since 2010 Colorado has hosted record numbers of visitors almost ever year (minus the Covid slump).

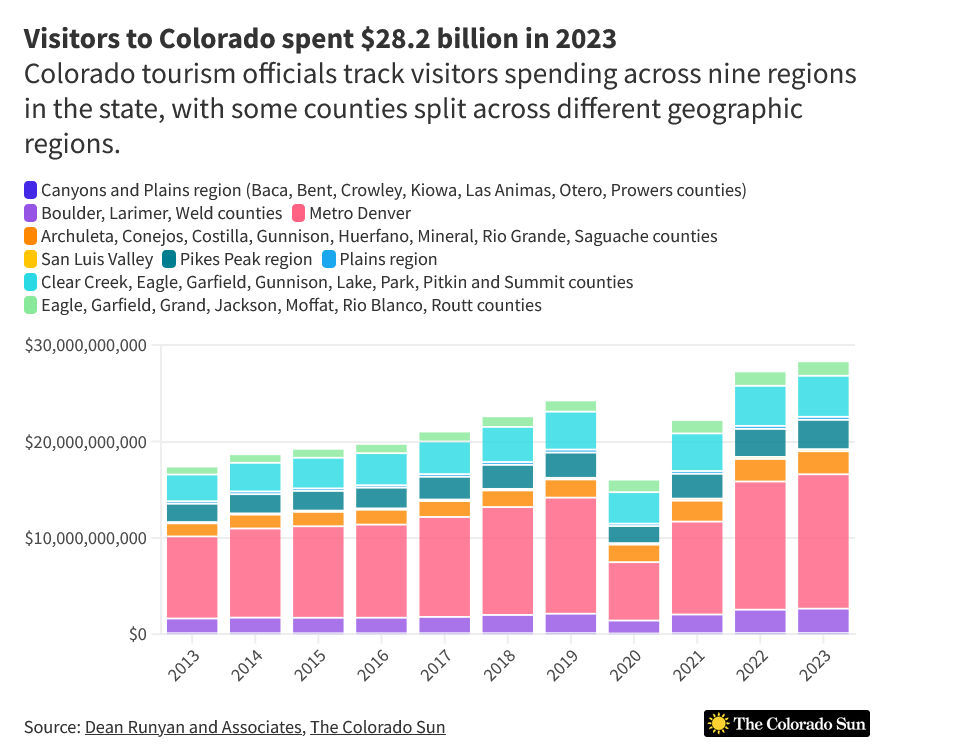

A total of 93.3 million travelers in Colorado spent $28.3 billion in 2023. Both those numbers are all-time highs. For reference, that compares with what was then a record in 2014, when 71.3 million visitors spent $18.6 billion in Colorado.

There are more travelers spending more in Colorado than ever before, according to Longwoods International, a visitor research firm that began tallying the impacts of U.S. tourism in the 1980s. Colorado was the first state to engage Longwoods to survey visitors in 1986. As you can see on the chart above every region has gotten on with the Denver metro and resort towns taking the lions share of the growth in tourism

Who is leaving Denver?

Tourism is thriving and yet more businesses are now leaving Colorado. TIAA, one of the nation’s largest financial firms, informed its employees Tuesday morning that it is closing its Denver operations center over the next two years, putting about 1,000 jobs at risk.

Denver became an important player in the money management and mutual fund industry decades ago, which helped it become a hub for financial service jobs, drawing in firms like TIAA, Charles Schwab & Co., Fidelity Investments and TransAmerica.

After years of steady growth, the number of financial service jobs statewide is at 2021 levels, according to the U.S. Bureau of Labor Statistics. TIAA’s relocation is especially painful for downtown, hard hit by the shift to remote work during the pandemic and struggling with an office vacancy rate above 30%.

State and local governments have picked tourism over businesses

It is not random that as tourism picks up businesses have decided to pick up and move. Colorado and many front range cities have favored tourism heavily over long term business investment.

- Laws outlawing businesses: Look no further than Denver with their recent ballot proposal to ban meat packaging facilities along with a new city council resolution that will make it almost impossible to build gas stations in Denver County going forward. These laws epitomize the unfriendly business climate in Denver and throughout much of the state.

- Sharp spike in both property and sales taxes. Colorado is an expensive state with property taxes up almost 34% in the last several years. Furthermore many counties/cities continue to drastically increase sales taxes to fund just about anything which is further driving up the costs.

- Increase in initiatives that make buildings more expensive, green building, all electric, impact fees, etc…: the initiatives at the state and local level has made building in Colorado extremely expensive and also the cost to maintain buildings increasingly expensive. Take for example Boulder’s requirement that all new residential construction be net zero, this had thousands to the construction of any new properties. All of these costs are pushing businesses to look elsewhere like Houston, Atlanta, Salt Lake city, etc…

How is Tourism influencing business decisions to relocate

It is not just governmental costs driving business to relocate. Tourism is also having a large impact on business decisions. Businesses are quickly figuring out that just because a place is nice to visit, does not equate to a great place to do business.

Tourism is like a sugar high where state and local governments can get substantial revenue through sales taxes, hotel taxes, etc… quickly and easily without huge investments. For example it is much quicker to increase visitation to Colorado than spend months/years courting a major company to relocate to the area. Unfortunately taking the easy road of tourism is having unintended consequences that we are seeing today in both the Front range and every resort town.

- Housing prices increase: As more people visit, there is greater demand in the area for second homes, rentals, etc… this increases prices and since these areas are desirable prices rise even further.

- Cost of living increases: With high housing prices, business are forced to pay workers more from fast food all the way up to corporate positions. Workers require more wages in order to be able to afford to live/work in the area. This creates a price spiral where for example McDonalds must raise their prices due to higher wages. This is multiplied throughout the economy exponentially increasing the cost of living.

- Creates a mismatch between wages and costs: Although wages are increasing, they cannot increase enough to overcome the increases in housing and cost of living. Home prices in Denver are not over $700k, the overwhelming majority of workers in the hospitality industry cannot afford to live in the area which exacerbates the affordable housing crisis and ultimately leads to what we are seeing in Denver with homelessness, crime, etc.. and becomes a downward spiral.

What does the mismatch in wages and cost of living mean for real estate?

Denver and the resort towns are going to react differently due to radically different market dynamics.

Denver: Ultimately Denver will see a decline in prices as more businesses choose to leave the city due to the unfriendly business climate and rising costs of building, housing, taxes, etc… We aren’t seeing the impacts yet, but we will shortly. This will create a “doom loop” in parts of the city while other parts like Cherry Creek continue to perform well.

Ski towns: The ski towns will not see any meaningful reset in prices as demand far outstrips supply. The housing crisis will continue in every ski town as wages in the tourism industry don’t come even close to what is needed to afford a house. The last I checked the cheapest single family home listed in Steamboat was 1.2m, a restaurant worker or countless others can never afford that price. Look for ancillary towns within about an hour or so of the ski resorts to continue to increase in price due to the demand for workers in the area.

Summary

Colorado has created a Golden Goose in the tourism economy, but the goose is now no longer Golden. Colorado has reached a tipping point and businesses throughout the front range are feeling the impact and packing up shop and leaving. This has been exacerbated by local and state governments unfriendly business practices from legislation, taxes, etc… and the tourism economy has increased costs on businesses that aren’t even in the tourism industry to make Colorado unaffordable. The state of Colorado and local governments need to take concrete steps to make Colorado more competitive for businesses or else we will see the doom loop emerge in Denver and other locations.

At the end of the day, real estate will be impacted with parts of Denver seeing big resets in prices while the mountain towns continue to create unsolvable housing crisis as wages will never keep up with costs of living in these areas. Colorado is at a crossroads as the current path is not sustainable. The million-dollar question is what will state and local governments do or will they do nothing at all?

Additional Reading/Resources

https://coloradosun.com/2024/08/05/colorado-sets-tourism-records-in-2023/

https://www.denverpost.com/2024/08/06/tiaa-denver-closing-job-cuts-texas/

https://coloradohardmoney.com/denver-will-vote-to-ban-one-business-in-the-city/

https://coloradohardmoney.com/colorado-property-taxes-increase-35/

https://bouldercounty.gov/property-and-land/land-use/building/buildsmart/zero-net-energy/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender