With the failure of proposition HH, the Colorado legislature is on the hunt for tax revenue and nightly rentals are in the cross hairs. Not surprisingly, the recent proposal to quadruple taxes on nightly rentals recently passed out of Colorado legislative committee with strong backing from Governor Polis. What is in the proposal? How will the market react if the bill becomes law?

What is in the proposal to tax nightly rentals as commercial properties.

The proposal would tax vacation homes like hotels and motels, which are subject to a higher assessment, on the days they are being rented and deliver the extra revenue to public schools, fire departments, libraries and other districts that rely on property taxes. State Sen. Chris Hansen, a Denver Democrat who sits on the powerful Joint Budget Committee and is leading the push for the legislation, said the idea is to boost revenue for local communities.

“There’s a really strong need for us to stabilize our property tax system and increase our local share,” said Hansen, referring to the rising education funding burden on the state budget. “If this is something we don’t get ahead of, it’s going to spiral out of control for the state”.

Here are some highlights of the bill as it is written today

- Properties rented nightly rental more than 90 days a year are subject to commercial property tax rates for the days they are rented.

- The commercial property tax rate is 29% while the residential rate is approximately 7%

The practical matter of the bill; some items need to be worked out

How the bill is currently rented will be challenging for assessors to track and calculate when a property is taxed at residential vs commercial. Assessors do not track nightly rentals as many are not licensed and not enforced. Take for example Jefferson county which has very few licensed nightly rental yet hundreds listed for rent on sites like Airbnb. Tracking and enforcing the nightly rental tax is going to be a nightmare for assessors.

One interesting part of the bill is that it looks to create a statewide registry of every single nightly rental. I’m not sure the practicality of this proposal as I haven’t seen it done in any other state and have no clue how they would monitor or enforce registration.

Will this legislation pass?

I’d handicap this bill at 70/30 with a 70% plus chance of passing. The bill is being pitched to help target the continuing funding issues of schools and local governments. There will be some intense lobbying by the realtor’s association and nightly rental companies.

Furthermore, I assume that some big changes will be made as this bill progresses especially regarding which properties are classified as nightly rentals and how assessors will enforce the new law to appropriately tax them.

How will the market react to the new legislation to tax nightly rentals as commercial

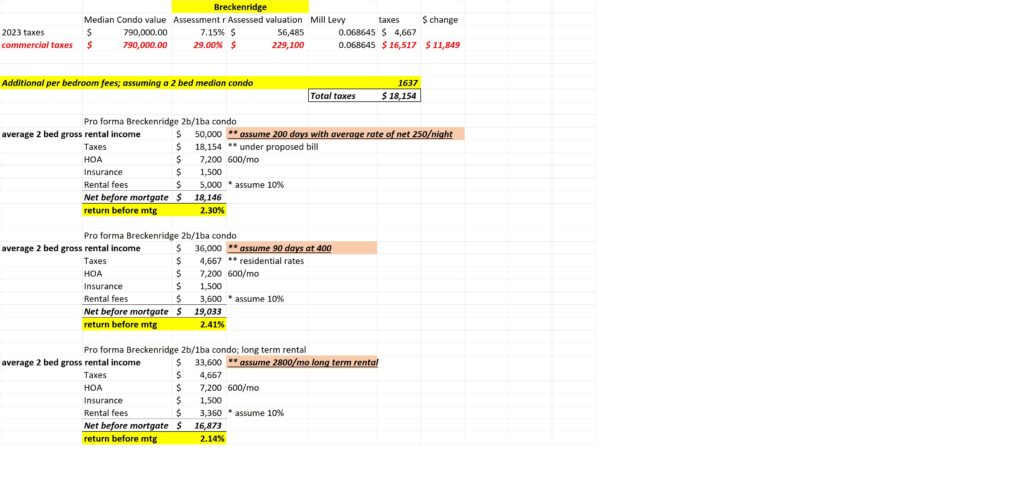

I did a pro forma for Breckenridge with two scenarios:

- Assume an owner rented the property for 200 nights a year with an average rate of 250/night which would put the property into the commercial classification per the proposed law. The average return would be around 2.3% before accounting for the mortgage.

- Assuming the new law passes, owners likely will stay below the cap and only rent the property on the most profitable 90 days. For the case of this analysis, I assume that the owners rented only in high demand periods which pushes the nightly rental rate up to 400/night for example the owner would only rent around Christmas, spring break, big weekends, etc… Under this scenario the owner could rent for only 90 days and make more than renting the whole year. I didn’t factor in wear/tear on the property, etc… so keeping under 90 days is more advantageous than leasing beyond the 90 day cap.

Huge changes to real estate in Colorado ski towns under the proposed legislation

As you can see above it is more profitable and considerably less risky to stay below the rental cap of 90 days. I foresee the overwhelming majority of owners will go this route to mitigate the risk of commercial property taxes. This will substantially reduce the number of nights that properties are rented and in turn rental rates throughout the year will now increase substantially as well.

Under the scenario above, I could see the average rental rate for the year increasing 10-20% due to the reduced supply.

Proposal will not raise considerable tax revenue

Even though this proposal is being pitched as raising substantial tax revenue for local schools, etc… the numbers do not add up. The proposed legislation will alter the market where most owners rent less than 90 days to stay below the cap.

Proposal will not substantially change the make up of long vs short term rentals

Although many think that the proposed legislation will help Colorado ski towns retain more long term rentals, unfortunately the numbers tell a radically different story. It is still more profitable to nightly rent on the most profitable days. Furthermore the owners can still use the properties and don’t have to worry about evictions, etc.. and other items with long term tenants.

Downside to Colorado mountain towns.

More traffic on I-70: If the legislation is passed there will be less overnight visitation to places like Breckenride, Copper, and Keystone as these resorts are still accessible via a day trip from Denver. This will push more people to come up for the day as nightly rental rates will be substantially higher throughout the season due to reduced inventory from the 90 day cap

Less sales tax revenue: If there are fewer overnight guests, there is less sales tax revenue for the towns that rely on this. Will the higher property taxes offset this loss? I’m doubtful based on the pro forma as most owners will not go beyond the 90 days.

Places like Steamboat have a bigger problem: Steamboat passed a nightly rental regulation of a 9% tax on nightly rentals to fund a new affordable housing development. Unfortunately the revenue from nightly rentals could be cut in half and in turn the nightly rental tax generation that has already been allocated will not be nearly as high as predicted.

Upside to legislation

I’ve mentioned a number of downsides to the proposed legislation, but there is also a big upside that the quality of the experience to visitors and local residents will be greatly increased due to a better balance of visitation. It is impossible to quantify “quality of life” improvements for full time residents, but I’m certain that many would be happy with a more balanced approach to tourism that this proposal could bring.

How will the taxes and caps on nightly rentals in Colorado impact real estate values?

If you were buying a property with the intent of renting it heavily, commercial property tax rates could throw a wrench in your plans. Furthermore, some owners that rely on nightly rental for their mortgage payments or retirement will feel these changes the most.

There will be substantial impacts on prices if the proposed legislation to tax nightly rentals as commercial properties becomes law. It is hard to predict exactly the impact, but I suspect you could see values in some ski towns drop 20% or so especially on condos as the rental numbers are substantially impacted. Places like Copper Mountain and Keystone that shot up in value recently as they were excluded from Summit Counties rental caps will be impacted considerably more than other areas.

Summary:

Long and short nightly rentals are in the cross hairs of Governor Polis and the proposed legislation has a good shot of passing due to the failure of proposition HH. If the bill passes there will be profound changes to the real estate market as most owners find it more profitable to only rent for less than the 90 day cap.

One wild card is that the legislation is still very fluid and there is a possibility that the cap is lowered from 90 days to something less which would alter the pro forma and assumptions I made. If this happens then look for an even greater impact on every ski town in Colorado especially in the condo market. This legislation is something that needs to be watched and factored in if you are looking to buy in the mountains with the intent to nightly rent.

Additional Reading/Resources:

- https://summitcountyco.gov/DocumentCenter/View/6/2021-Property-Tax-Table-pdf?bidId=

- https://leg.colorado.gov/sites/default/files/images/committees/bill_6_24-0388.pdf

- https://coloradosun.com/2021/10/14/short-term-rentals-tax-bill-colorado

- https://www.the-journal.com/articles/property-taxes-would-more-than-triple-for-colorado-short-term-rental-owners-under-proposal/

- https://coloradohardmoney.com/live-like-a-local-pay-hotel-property-taxes-on-nightly-rentals/

We are still lending as we fund in cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender