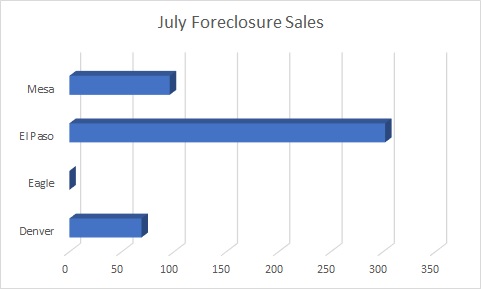

Many counties in Colorado are now using an online auction program for foreclosure sales which provides an interesting comparison of where distressed real estate deals are occurring. Denver, the most populous county in Colorado, is not even close to the top of the number of foreclosures. What is causing the increase in foreclosures? What is the significance of the chart above? Why are there more foreclosures in certain counties as opposed to others? What does this tell us about investments/future values?

Where did the data on foreclosure filings in Colorado come from?

Many counties in Colorado are now using Real Auction to conduct foreclosure auctions. This allows me to look at each county by month to see the total number of foreclosures being advertised. I also took it one step further and looked at the details on many of the foreclosure filings in each county to see why they were being foreclosed and if there were trends. I use another lender tool to look at the type of loans that were put on each property to fill in the gaps.

What was in the data on Colorado foreclosure filings?

My initial guess would be that Denver County would have substantially more foreclosures than others throughout the state just based on size. Statistically the more properties there are some percentage would default and ultimately lead to foreclosures. Surprisingly, this is not what is occurring in real life.

What is the number one determinant of default?

We have seen from previous cycles that the number one variable to watch that trumps every other metric is equity. As long as there is substantially more equity than debt the borrower has an option to sell and resolve any default. As soon as the equity equation inverts where the debt on the property is closer to what the property is worth this is where borrowers run into problems. This is how the 2008 crisis unfolded with many homeowners quickly underwater on their values which led to a huge number of strategic defaults.

Why does Denver have less foreclosures than other Colorado counties?

Denver County has substantially less foreclosures than other counties that are considerably smaller. The primary driver is that Denver’s price point is substantially higher than counties like El Paso and Mesa counties which means that considerably more buyers are using more conventional financing and putting more down than and FHA or HUD loan. I did an analysis about 3 years ago showing Denver had less FHA loans than many others in the metro area.

Why are counties like El Paso and Mesa counties having more foreclosures than Denver?

El Paso is Colorado Springs, and Mesa is Grand Junction. Both areas had huge jumps during Covid as people rushed for smaller markets that were less expensive than places like Denver. The lower price points led to more buyers using FHA loans that required considerably smaller down payments.

When I dug into the data of actual foreclosure in El Paso and Mesa counties, a considerable number were FHA/HUD loans which is a huge red flag as FHA loans are considerably riskier for default.

According to 2019 data from Core logic, the default rate of an FHA loan is over 3 times more likely than a conventional mortgage. Why? FHA loans are riskier loans due to decreased equity and decreased credit and income requirements. FHA is a subsidized “subprime” lender sponsored by the federal government and taxpayers.

With default rates on FHA loans substantially higher than traditional mortgages. The larger the amount of FHA loans in a particular area is a flag for increased defaults. 36% of all loans originated in 2001 ended up defaulting (Housing wire). If this occurred in a particular city/zip this would no doubt have an impact on surrounding properties.

FHA loans are not the only driver of defaults. Many of these lower-priced markets are also starting to soften as the work from home returns to work from home only one or two days a week. Furthermore, for example in El Paso County, property prices are off a few percentage from their high.

Why no foreclosure sales in Summit and Eagle counties

I thought this was interesting that there are no foreclosure sales in two of the mountain counties. This is also true in Steamboat Springs as there haven’t been any foreclosure sales advertised in a while. The reason for no sales is that most property owners have tons of equity. Take Summit County, home to Breckenridge, where appreciation was 40-60% in a single year during Covid. It increased everyone’s equity position substantially so if someone was having issues paying their mortgage, they could sell and pocket a ton of cash and move to a less expensive market. Furthermore, in most Colorado resort markets well over half the purchases are made in cash, which further insulates prices and limits foreclosures.

How should this foreclosure data influence where you should invest in Colorado real estate?

The smaller metros like Grand Junction and Colorado Springs will ultimately soften a bit more than other areas as the work from home migration centers back on larger markets and the surrounding suburbs. Although I do not think the bottom will fall out on real estate prices, I would be cautious about investing in small/midsize markets at this point in the cycle.

Summary

The number of foreclosure filings in smaller counties compared to Denver was a big surprise. Although prices are still holding up well throughout Colorado, the foreclosure data is a warning that the market is starting to transition, and distress will ultimately return in real estate.

The last 10 years or so have been relatively simple to invest in real estate. As long as you bought a property, more than likely the value went up whether it was in Denver, Grand Junction, Steamboat Springs, or Colorado Springs. But the tides have now turned and not every location will be a winner.

Now is the time to be more careful in real estate investing. The increases in Foreclosures in counties throughout the state shows that the golden days of real estate investing have come to an end. The chart above should not be taken lightly. Certain markets will considerably outperform others and there will ultimately be losses in some markets.

Additional reading/resources

- https://www.realauction.com/clients/index

- https://coloradohardmoney.com/where-will-colorado-foreclosures-occur/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender