Almost 6% of all homeowners (8% of one type of loan) are “stuck” in some sort of forbearance. Unfortunately, the number of borrowers in forbearance has barely budged recently with no end in site. What does this mean for defaults? Why is one mortgage type considerably riskier than others? Where will these defaults occur in Colorado? Should you be worried?

Almost 6% of all homeowners (8% of one type of loan) are “stuck” in some sort of forbearance. Unfortunately, the number of borrowers in forbearance has barely budged recently with no end in site. What does this mean for defaults? Why is one mortgage type considerably riskier than others? Where will these defaults occur in Colorado? Should you be worried?

What was in the data?

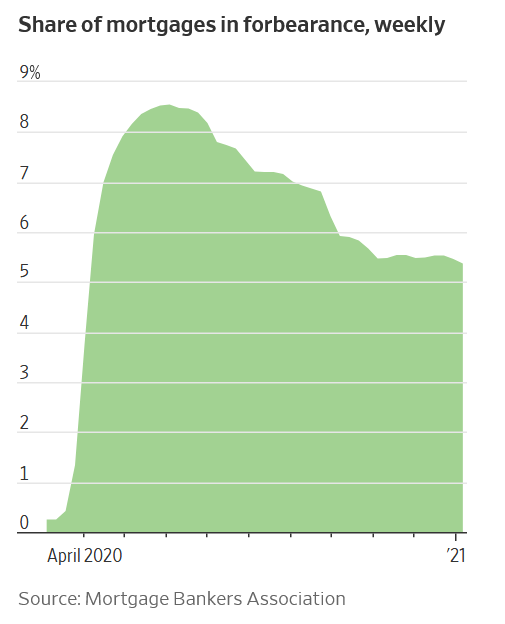

The proportion of homeowners postponing mortgage payments had been falling steadily from June to November, an indication that people were returning to work and the economy was beginning to recover. But the decrease has largely flattened since November, when the current wave of coronavirus cases surged in communities across the country.

For roughly the past two months, that group of homeowners has flatlined at about 5.5%, according to the Mortgage Bankers Association. Though that is down from a peak of 8.55% in June, some economists are concerned about the stalling forbearance rate—and worry that it could even start climbing as the economy sheds jobs. The roughly 5.5% of borrowers in forbearance represent about 2.7 million homeowners, according to the MBA.

Homeowners with Federal Housing Administration loans are more likely to be in forbearance than those with mortgages backed by Freddie Mac or Fannie Mae, according to MBA data. Just 3.13% of Fannie and Freddie mortgages were in forbearance in early January, compared with 7.67% of FHA loans. As these homeowners continue to struggle, the debt continues to accrue. The probability of default increases for the vast majority of these loans.

Why focus on FHA loans

FHA loans are considerably riskier for default. According to 2019 data from Core logic, the default rate of an FHA loan is over 3 time more likely than a conventional mortgage. Why? FHA loans are riskier loans due to decreased equity and decreased credit and income requirements. FHA is a subsidized “subprime” lender sponsored by the federal government and tax payers.

With default rates on FHA loans substantially higher than traditional mortgages it is important to see where the majority of these loans are being made. The larger the amount of FHA loans in a particular area is a flag for increased defaults. 36% of all loans originated in 2001 ended up defaulting (Housing wire). If this occurred in a particular city/zip this would no doubt have an impact on surrounding properties.

Where will the defaults be in Colorado?

FHA publishes data on originations on purchases and refinances into FHA products. They also break down refinances on refi from an FHA loan to another FHA loan along with Conventional to FHA.

I found it interesting as to why would someone refinance from a conventional mortgage to an FHA mortgage? As mentioned above FHA rates are considerably higher so the only explanation is that the borrower cannot qualify for a conventional loan. This is a key indicator of financial duress as there is no other plausible reason to refinance into a higher rate.

What is the new data telling us today in Colorado?

To see areas more at risk for default, I focused on the amount of mortgages (dollar value) where borrowers were refinance from a conventional mortgage to an FHA mortgage as this is a leading indicator of possible financial duress. Below are the top ten cities

| City | Zip | Amount | Median Price | |

| 1 | Firestone | 80504 | 1523186 | 445,000 |

| 2 | Broomfield | 80020 | 1445867 | 445,000 |

| 3 | Highlands Ranch | 80126 | 1393615 | 490000 |

| 4 | Aurora | 80013 | 1311811 | 345,000 |

| 5 | Aurora | 80016 | 1238329 | 540,000 |

| 6 | Denver | 80219 | 1167691 | 360000 |

| 7 | Brighton | 80601 | 1020110 | 435,000 |

| 8 | Franktown | 80116 | 1012616 | 730,000 |

| 9 | larkspur | 80118 | 975782 | 615,000 |

| 10 | Loveland | 80538 | 898517 | 375,000 |

What do these locations have in common?

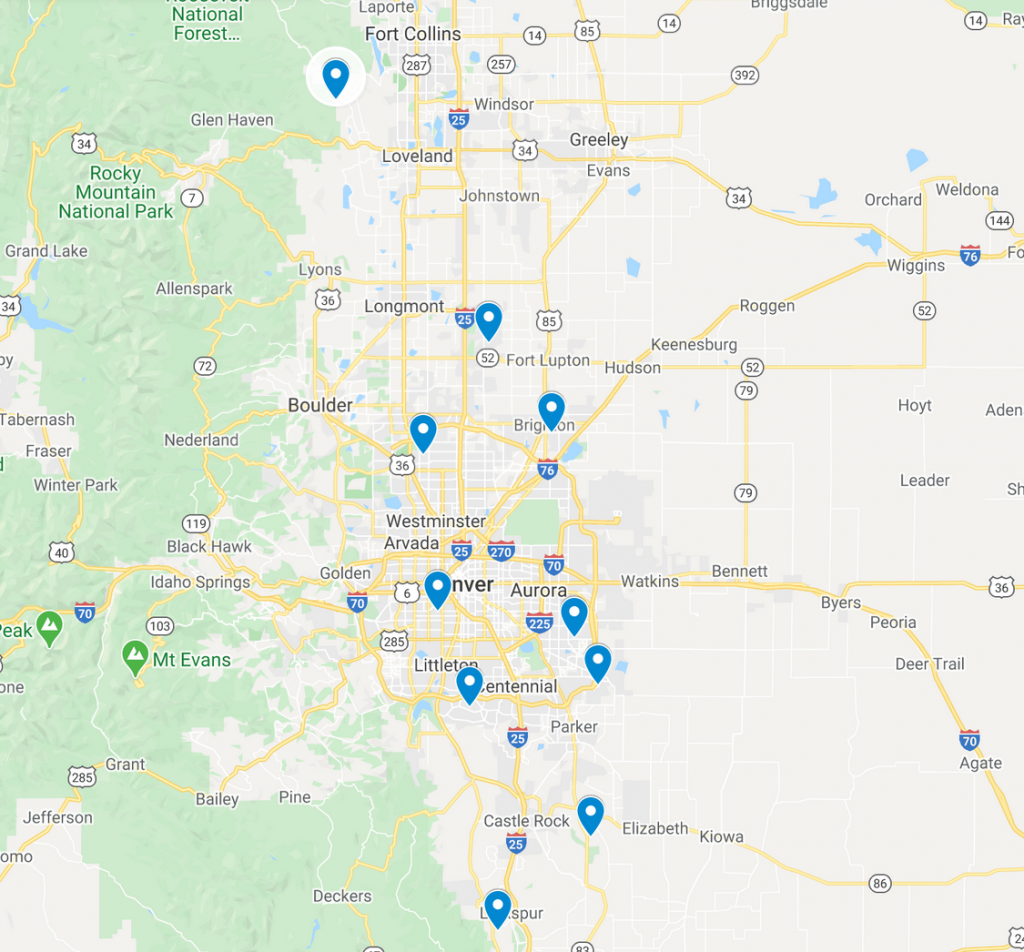

Below is a map of the top ten. All of them except one is a suburban or exurban location. The one intown location is a gentrifying area of Denver that is priced considerably less than the median home price.

How big is the problem across the country?

Based on historical data, FHA loans default at considerably higher rates than conventional mortgages. This leads us to the next question, how big on an issue is this. If I assume the last two years are most at risk due to the amount of negative equity, the defaults will start adding up quickly. Below is a quick analysis, based on actual loan volumes originated by the FHA in 2019 and 2020 (assume Q3/4 2020 follows 19 patterns on originations)

| Dollar Volume | ||||

| 2019 Q1 | 39 | |||

| 2019 Q2 | 59 | |||

| 2019 Q3 | 72 | |||

| 2019 Q4 | 75 | |||

| 2020 Q1 | 66 | |||

| 2020 Q2 | 69 | |||

| 2020 Q3 | 39 | * assumed same volume as 19 | ||

| 2020 Q4 | 59 | * assumed same volume as 20 | ||

| Total | 478 | billion | ||

| Default rates | ||||

| 7% | 33.46 | billion | ||

| 10% | 47.8 | billion | ||

| 15% | 71.7 | billion | ||

Summary

Between 200 and 500k loans will likely go into foreclosure starting in March of 2021 (or later depending on the foreclosure moratoriums). Based on current default projections and the lack of equity in the last two years in many of these properties, I would expect that rate to be around 50 billion dollars in properties that would go into foreclosure and ultimately have to be sold.

The million-dollar question is how well will the markets absorb thousands of new distressed properties. In places like Denver, Colorado with very low inventory and continued demand, the market will likely not hiccup much. But, in places like Detroit, the absorption will be much more difficult and lead to substantial market declines. Regardless of the location, 50 billion dollars of foreclosures is a large number that will have to be dealt with by the federal government.

Unfortunately, I have yet to see any government officials (regardless of political party) release a back of the napkin calculation of the problem coming in March nor are there any prospective solutions other than to try to kick the can down the road and hope for the best.

Mid 2021 is going to be a reckoning for the economy and real estate as eventually the piper must be paid. Look for the foreclosures to start ticking up especially in the 10 cities highlighted above.

Additional Reading/Resources

- https://coloradohardmoney.com/where-will-the-next-wave-of-foreclosures-defaults-be-in-colorado/

- https://www.wsj.com/articles/covids-financial-toll-mounts-as-homeowners-keep-postponing-mortgage-payments-11611493201?mod=mhp

- https://www.hud.gov/program_offices/housing/rmra/oe/rpts/sfsnap/sfsnap

- https://www.consumerfinance.gov/data-research/mortgage-performance-trends/download-the-data/

- https://www.huduser.gov/portal/ushmc/fi_FHAShareVol.html

- https://www.hud.gov/program_offices/housing/rmra/oe/rpts/fhamktsh/fhamktqtrly

- https://www.corelogic.com/blog/2019/01/mortgage-delinquency-rates-for-all-loan-types-continue-to-fall.aspx

We are still lending as we fund in cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)