If you got your recent tax assessment, I am sure you have a little sticker shock. Not only are values going up but so are your property taxes. Fortunately, there could be some relief on the way. What is in the new ballot initiative 27 and how much will this save you in taxes?

How do property taxes in Colorado work today?

To calculate taxes, Actual Value is adjusted by the appropriate Assessment Rate to determine its Assessed Value. Commercial properties are multiplied by 29% (0.2900) and residential properties, including apartments, by 7.15% (0.0715).

The Assessed Value (less any exempted amount) is next multiplied by the applicable Tax Rate. In Colorado, tax rates are expressed as a decimal fraction of a dollar for every dollar of Assessed Value. Known as millage or mills, one mill is 1/1,000th of a dollar or $0.001 (1/10th of a penny). Millage greater than one mill is usually written as a whole number followed by three digits to the right of a decimal point.

In 2019, Denver’s combined general millage or Mill Rate including Denver Public Schools and Urban Drainage District is 72.116 mills or a tax rate of 0.072116 for every $1 of assessed value.

In 2019, the typical single family Denver home was valued at about $430,000. As a result, the property tax calculation for a typical residential owner was:

Actual Value x Assessment Rate x Mill Rate (Tax Rate) = Taxes

Typical Denver Residence

$430,000 x 0.0715 x 0.072116 = $2,217.21

How would the proposed ballot measure 27 impact Colorado property taxes?

Ballot initiative 27’s goal is to help slow the rate of property taxes due to the huge appreciation in assessments. Prior to initiative 27, the Gallagher amendment was the speedbump that prevented residential assessments from going to high. The Gallagher amendment was appealed in 2019 which allowed property tax assessments and in turn property taxes to rise substantially into perpetuity. The goal of 27 is to bring some balance back to the property tax equation. Here are the two primary changes that initiative 27 proposes.

- Commercial: lowers the assessment rate from 29% to 26.4%

- Residential: Lowers the assessment rate from 7.15% to 6.5%

Note, there is also a section (3) regarding homestead exemptions, that I am uncertain as to the impact of this section as it is not very clear. Here is the full initiative: https://www.sos.state.co.us/pubs/elections/Initiatives/titleBoard/filings/2021-2022/27Final.pdf

What impact will 27 have on property tax collections according to the state of Colorado?

For each initiative there must be an economic impact analysis. There is one for 27; see below for the synopsis:

Local government impact.

By lowering property tax assessment rates, the measure will decrease property tax revenue to local governments statewide by an estimated $1.03 billion, beginning in 2023. The impact will vary among local governments across the state, and the specific impact on each city, county, special district, or school district will depend on several factors, including mill levies and the composition of properties in each jurisdiction.

State expenditures.

The measure increases state expenditures to backfill lost property tax revenue to school districts. By lowering property tax assessment rates, the measure will decrease property tax revenue collected by school districts; as a result, the state share of school finance is estimated to increase by approximately $257.7 million in budget year 2022-23 and subsequent years. The measure will also increase workload for the Division of Property Taxation to update and review forms and training materials, as well as to respond to inquiries regarding assessment rate changes.

How much will 27 really save taxpayers and impact local governments?

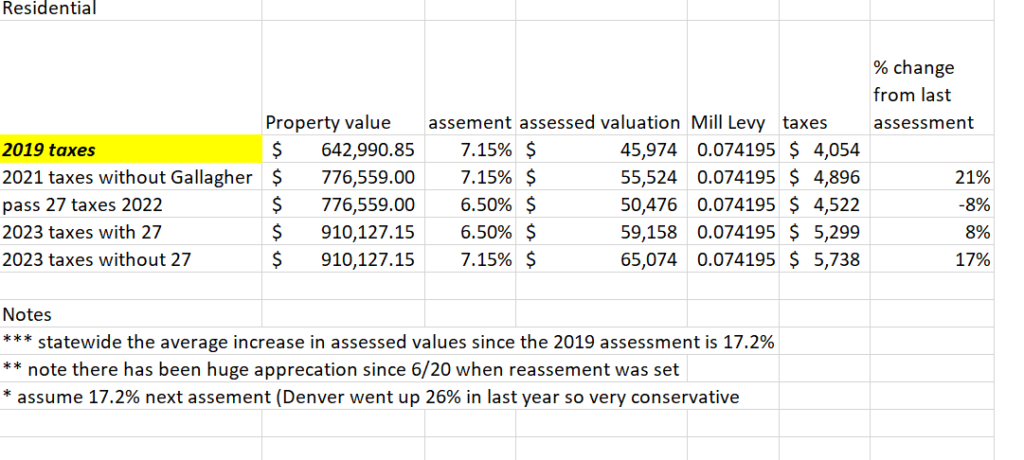

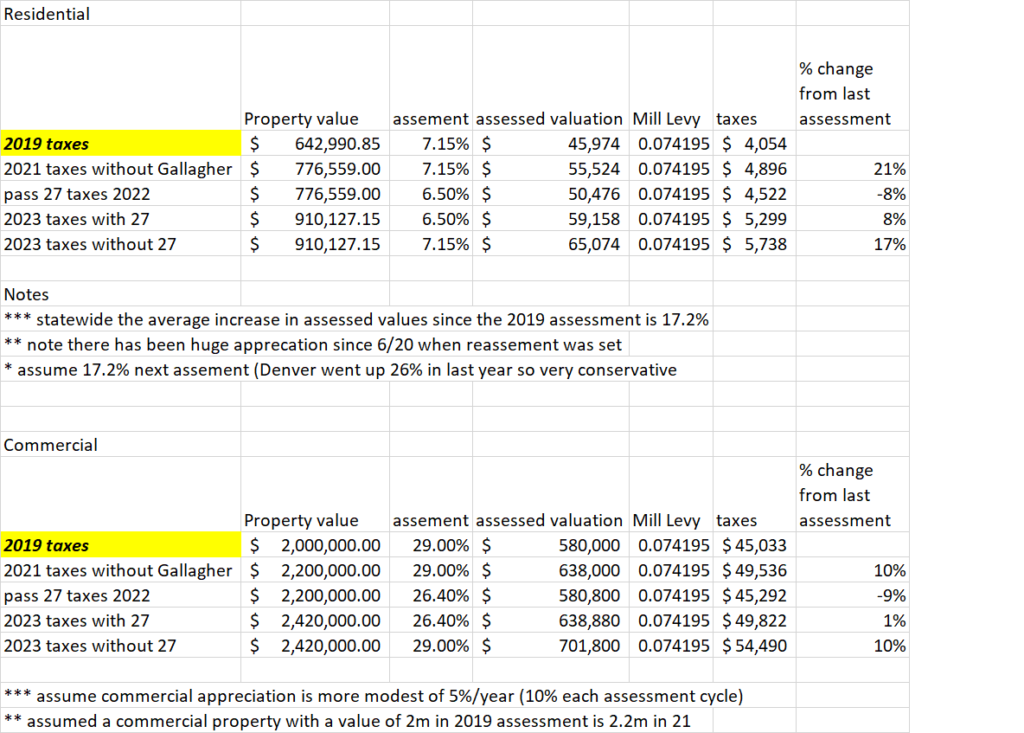

Like many governmental analyses, I am always a bit skeptical as unfortunately politics have crept into every governmental function and as a result unbiased opinions are hard to find. After reading the impact statement above it sounds like this initiative will be the death knell for local governments. Unfortunately, one factor was not accounted for in the analysis, property appreciation. I did an analysis on Denver county (see below); the economic impact statement above was a bit pessimistic. Initiative 27 in the future will merely keep your taxes from going up as quickly as they have been skyrocketing in the past unless you assume that properties will not appreciate in the future (a very unlikely assumption) .

Fortunately, numbers do not lie. Below I looked at residential properties in Denver county along with an imaginary 2-million-dollar commercial property also in Denver. There will be no apocalypse from initiative 27; there will be a blip in 2022 after a 21% gain in 21 and then taxes will continue to rise albeit at a lower rate.

Here is a link to my spreadsheet. There are three variables: property value, assessment rate, and mill levy. When you multiply the three together you get the tax amount. Please note Mill levies are specific to each county and city as voters can approve additional taxation. Typically, you can go to the county assessor’s website and look up your property to see the various mill levies for your property. In this spreadsheet, you can input various assumptions to see what the impact will be on your taxes. (note there are two tabs, one for the elimination of the Gallagher amendment and one determining the impact of proposed initiative 27).

Here is a link to my spreadsheet. There are three variables: property value, assessment rate, and mill levy. When you multiply the three together you get the tax amount. Please note Mill levies are specific to each county and city as voters can approve additional taxation. Typically, you can go to the county assessor’s website and look up your property to see the various mill levies for your property. In this spreadsheet, you can input various assumptions to see what the impact will be on your taxes. (note there are two tabs, one for the elimination of the Gallagher amendment and one determining the impact of proposed initiative 27).

Spreadsheet for 27 calculation

Summary

The elimination of the Gallagher amendment has allowed property taxes to rise considerably faster than salaries and inflation. As values continue their upward trajectory that was supercharged by COVID taxes will continue to rise even more. Initiative 27 merely puts a speed bump on the rising property taxes but is not a long-term solution. Hopefully, the legislature or another ballot initiative will come up with a longer-term solution where taxes cannot rise faster than some index like consumer price index. Until then initiative 27 will at least help with the out-of-control property tax situation we are now seeing throughout the state.

Additional Reading/Resources

- https://www.sos.state.co.us/pubs/elections/Initiatives/titleBoard/filings/2021-2022/27Final.pdf

- https://leg.colorado.gov/sites/default/files/initiatives/2021%252327FiscalSummary_00.pdf

- https://www.douglas.co.us/assessor/assessor-frequently-asked-questions/

- https://www.denvergov.org/content/denvergov/en/denver-department-of-finance/our-divisions/assessor/faqs.html

We are still lending as we fund in cash!

I need your help!

Don’t worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media. I would greatly appreciate it.

Written by Glen Weinberg, COO/ VP Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the state.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)