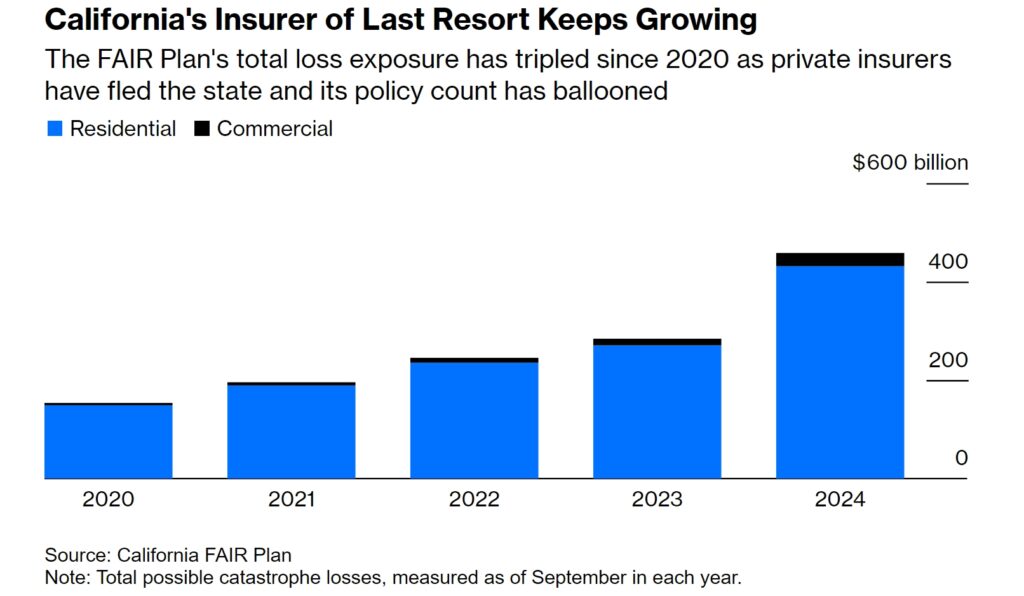

In the last several weeks, I’ve had two deals fall through due to insurance. One was on a rural property that they could not find reasonable insurance on, and the other was on a condo in Denver that was under insured due to the huge jumps in insurance costs for the association. What 4 factors are driving Colorado insurance rates much higher than the national average? Will the new Colorado Fair plan help homeowners with their insurance costs or will it increase costs on all property owners? Look at the chart above, is it the insurer of last resort or the only choice? What happened in California after the LA wildfires? Has Colorado learned anything from California or are we making the same exact mistakes?

Why the huge jumps in insurance costs throughout the country?

“People just aren’t aware that these natural disaster risks are occurring everywhere. It’s not just where the headline news points you to in terms of where natural disasters are occurring.” The report said the US was seeing an increase in the number and severity of natural disasters, including hurricanes, tornadoes, and wildfires which had “greatly increased the short and long-term risk for insurers and led to increases in insurance costs and reductions in coverage for property owners”.

Why are Colorado’s insurance rates increasing faster than the national average?

There are four primary drivers of increased insurance costs in Colorado that are pushing premiums through the roof.

- New Risks of Fire: Look no further than the Marshall fire in metro Denver that burned suburban areas and the losses are now pegged at 2 billion dollars. Before the Marshall fire, the risk was deemed low in many metro suburban locations, the Marshall fire changed that equation and forced insurance companies to reprice their risk throughout the state.

- Increase in Hail claims: There have already been several major hailstorms in Denver this year, as costs increase from Hail and other hazards, these are passed on to homeowners

- Skyrocketing rebuild costs: Rebuild costs continue to climb from higher labor to material costs, to increase building requirements. For example, to install a new hail resistant roof is now 50% more than a conventional roof, but the impact resistant roof is now the code minimum in many areas.

- Increased building in higher risk areas: Along with increased losses, the amount of construction in high risk foothill and mountain areas continues to increase which further increases the risk of losses to insurance companies.

Will insurance costs continue to increase in Colorado?

Yes! All of these risks look to only accelerate over the next several years which will unfortunately mean that insurance costs will continue to increase. At the end of the day, insurance companies have to be profitable or they will leave a market as we are seeing in California and Florida. This means that insurance companies must continue to increase their rates in order to remain profitable with the huge losses they are incurring in Colorado.

Will the Fair Plan help homeowners with their property insurance costs?

This year Colorado will start selling policies under the state run Fair Plan. The plan is only meant for property owners that cannot get coverage in the marketplace and can document 3 declinations from carriers. Essentially the fair plan is supposed to be an insurer of last resort with a maximum coverage of 750k for a home.

The Fair plan subsidizes property owners and does not address the root cause

Unfortunately the new state sponsored insurance agency will further subsidize property owners in high risk areas. A good example is the recent Marshall fire. A large cause of how quickly the flames spread were wood fences that created a “ladder” to the structure and ultimately destroyed many houses. One would think that with this knowledge when properties were rebuilt the should not have wooden fences. Unfortunately the opposite is occurring whereby many of the houses that are being rebuilt have installed wood fences. In other words, nothing has changed and a state run insurance program would continue to subsidize bad decisions.

Furthermore a state run insurance program will enable continued building in high risk areas whose costs will be borne by taxpayers. A state-run insurance program is a redistribution from lower risk properties to higher risk properties with no change in behaviors.

How will the Fair Plan impact Colorado’s insurance market? A Cautionary tale from California

We can look no further than California for what happens with a state-run program. Last week, surprising no one, California’s FAIR Plan said it didn’t have enough money to cover claims from the recent Los Angeles wildfires. The plan, which insures people who can’t obtain coverage from private insurers, has doubled in size in the past four years to cover more than 450,000 homes. It faces possible exposure of $4 billion for the Palisades Fire and $775 million for the Eaton Fire but had just $700 million in cash when the fires began and a $900 million deductible on its $2.6 billion reinsurance policy. Running out of money was never a question of if for FAIR, but how quickly and by how much.Who pays for the fair plan and how much?

Anyone not in the state subsidized program will pay via higher rates and taxes/fees that will be needed in order to subsidize a high risk insurance pool. We have seen in California that costs have skyrocketed for insurance. Just last week State Farm asked for 22% emergency increase this is on top of the pass through costs from the fair plan baiout. The same will occur in Colorado as the fair plan is rolled out and insurers ditch high risk properties and focus on more profitable (aka lower risk) policies.

Summary

Colorado’s plan to get into the insurance business is a bad solution to a problem that is not real. The overwhelming majority of property owners can obtain insurance at a price. The real reason that the state is getting involved in the insurance business is because property owners do not like the price of the new coverage. Remember, the price reflects the risk that insurance companies have and also creates incentives and disincentives in the market.

Colorado is on a collision course with the insurance industry and we have seen how this has played out in California and Florida with mainstream carriers leaving the market which in turn has forced more into the state run program. The same will ultimately occur in Colorado leading to substantially higher rates for most property owners.

Colorado has done very little to actually address the root cause of the insurance crisis which is increased risk from hazards. For example the state could mandate that every new roof in the front range must only use hail resistant materials and furthermore only non combustible materials could be used on siding (like concrete stucco, hardiplank, etc…). Furthermore the state could drastically limit building in high risk areas by imposing fees that are given to local fire jurisdictions that will have to defend these homes in case of fires.

Unfortunately we are just as the beginning of the costs increases in the property insurance market in Colorado. California is a roadmap for what is to come in Colorado. Look for more carriers to pull out and rates to continue rising by double digits until the state and/or local governments take concrete steps to address the risks like hail and fire by mandating changes.

Additional Reading/Resources

- https://coloradofairplan.com/faqs/

- https://www.durangoherald.com/articles/colorados-wildfire-risk-is-so-high-some-homeowners-cant-get-insured-the-state-may-create-last-res/

- https://coloradosun.com/2022/12/30/colorado-property-insurance-wildfire-risk/

- https://coloradohardmoney.com/category/colorado-property-insurance/

- https://coloradohardmoney.com/why-are-insurance-costs-increasing-in-colorado/

- https://www.steamboatpilot.com/opinion/writers-on-the-range-its-a-perfect-storm-for-fire-insurance/

- California’s Last-Resort Insurer FAIR Needs a Bailout. Expect More. – Bloomberg

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender