Nobody is talking about the impending storm coming for Colorado property owners. Even with fixed rate mortgages, payments are set to skyrocket next year. What will cause everyone’s payments to jump in 2024 on top of large increases already for 2023 (hint, look at the chart above)? Servicing millions in loans we are already seeing huge changes with payments jumping in some cases by 30%! What is happening in Colorado and why is this coming to a head next year?

Mortgage payments already increasing in 2023

As a lender, we are servicing millions throughout Colorado and have recently noticed a huge trend that is causing payments to increase substantially. Included in most payments are escrows for taxes and insurance. Taxes in 2023 did not increase as they are paid in arrears so 23 tax bills are for 22 taxes but insurance has jumped substantially.

We recently had a borrower whose property insurance more than doubled from the prior year. They where paying 1400 and the renewal was at 3100. This increased their mortgage payment by $142/month so that there was enough in the escrow account to cover the increased insurance costs.

Why is property insurance increasing so much in Colorado?

I wrote a prior blog about huge jumps in Colorado property insurance costs due to new legislation where the state is getting into the insurance business and there are now minimum rebuild requirements. These bills are substantially increasing insurance costs.

Along with new legislation, there have been considerable recent losses from large hail along with fires in the front range. Furthermore, rebuild costs have gone up due to material prices, labor, etc… More expensive losses coupled with the legislation above are leading to huge jumps in property insurance on both residential and commercial properties throughout Colorado. If I look at our portfolio we are seeing around 30-40% increases in insurance premiums on renewals. This is basically across the board and we haven’t seen a single decrease in premiums on any of our Colorado loans.

Brace for huge jumps in 2024

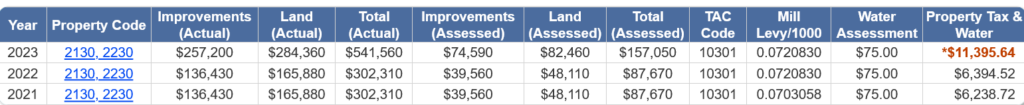

The chart above shows the tax increases on a commercial property in Grand Junction, the estimated taxes add up to a 78% increase from 2022. Assuming this were escrowed this would lead to a payment increase of 416/month. Regardless of proposition HH taxes are going up in most areas around 50%. If you are in the mountains, the amount is even worse. As my taxes are set to almost double.

The impacts of the new increases will be felt starting in January when the new tax bills are released, and lenders adjust escrows for the new amounts.

Renters not immune from the increases

Unfortunately the higher tax and insurance amounts are not reserved for just property owners as the expenses will be passed through to tenants.

Commercial Properties: On the commercial side, most leases are NNN (net of taxes, insurance, and maintenance) meaning these expenses are passed through directly to the tenant. For example, if taxes increase 5k, the tenant would be responsible for the increase. This will also occur with the recent insurance bills. The increases raise the effective lease rate for the property due to the much higher expenses. Here is an example on a commercial property

Residential properties: Apartments and single-family homeowners will also pass the expenses through to tenants via higher rents. With property taxes and insurance increasing so much, there is no way that property owners will be able to absorb all of these expenses without substantially raising rents.

Huge impacts on affordable housing

As property taxes rise, affordable housing becomes even less attainable. For example, in Denver property values went up 40% plus in many areas which means property taxes also went up. Those taxes are passed through to renters in once affordable neighborhoods.

On top of already high prices with high mortgage rates, higher taxes also make it harder to qualify for a mortgage. The huge spike in taxes and insurance is impacting anyone looking to buy a home. This will be most impactful on the lower priced homes as on a percentage of payment the impact is greater. Remember taxes and insurance are factored into the total payment for a house. As both expenses rise substantially many will not have the excess income to cover the increases and stay within the debt-to-income guidelines.

Higher taxes result in less buying power for borrowers, increasing demand for less expensive homes. This will in turn keep prices high on starter homes, further pushing up rents.

Summary

Remember the root cause of the huge jump in property taxes is due to the elimination of the Gallagher amendment that balanced residential and commercial property taxes. Before it was passed, I highlighted the issue and I’ve been talking about the impending “time bomb” of higher property taxes for years.

2024 is when we see the “bomb” go off with property taxes set to increase from 40%+ in most metro locations to 100+ in some mountain areas. On top of the jumps in property taxes, insurance bills are also increasing substantially due to higher rebuild costs, increased losses, and new legislation.

Property owners along with renters are ill prepared for the huge jump in expenses. Lower priced properties will be hit the hardest as the mortgage/escrows are typically a much higher percentage of their income. At some point in 2024 this will lead to an increase in properties for sale due to the much higher expenses.

On a side note, do not count on the new proposition HH to help much as the average property owner might save 5-10% at best which would still leave a 30%+ increase. Furthermore, proposition HH recovers any property tax savings through Tabor refunds so in the end property owners will be considerably worse off.

Additional Reading/Resources

- https://coloradohardmoney.com/2-new-bills-signed-into-law-that-will-cause-colorado-property-insurance-to-skyrocket/

- https://coloradohardmoney.com/tax-bills-double-in-co-mountain-towns-new-legislation-doesnt-help-you-can-reduce-your-taxes/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates 😊 I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender