What happens now for Colorado property tax relief?

Leading up to election day, millions was spent to try to convince voters to give up Tabor for small tax relief. Voters saw through the games and complexity and in the end the bill failed miserably with over 60% voting against the proposal. After the stunning defeat, Governor Polis called a special session under threat of a new property tax relief bill on the ballot next year. What are the 4 possibilities on the table and will they pass?

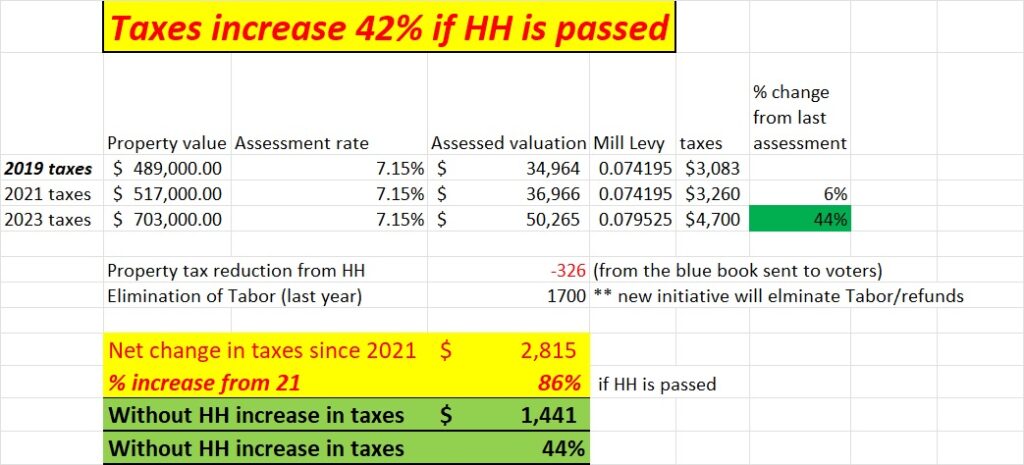

Before going into where we go next, it is important to highlight what was in proposition HH that got defeated for a hint of the future and also the new property tax bill on the ballot for next year.

What was in proposition HH that got defeated?

First, this bill is huge, with so many changes that have very little to do with the simple problem of property taxes. Below I will outline the changes in residential rates and commercial rates while at the same time highlighting how these items will be paid for as the cap for revenue collection/spending is lifted which ultimately will eliminate the taxpayer bill of rights (TABOR) caps over time (more on this topic below). Ultimately as taxpayers we are paying more for the small property tax reduction than we are saving due to increases in taxes due to Tabor elimination. The new tax bill merely increases taxes under the cover of property tax relief.

For residential properties

- The residential assessment rate would be reduced to 6.7% from 6.765% in 2023, for taxes owed in 2024, and to 6.7% from 6.976% for taxes owed in 2025. The 6.7% rate would remain unchanged through the 2032 tax year, for taxes owed in 2033.

- In addition to the assessment rate cuts, residential property owners would get to exempt the first $50,000 of their home’s value from taxation for the 2023 tax year, a $10,000 increase made through an amendment adopted Monday. Residential property owners would then get to exempt $40,000 of their homes’ values from taxation for the 2024 tax year. The break would persist until the 2032 tax year, except for people’s second or subsequent single-family homes, like rental or vacation properties, which would stop being subject to that benefit in the 2025 tax year.

Commercial Properties

- For commercial properties, the assessment rate would be reduced to 27.85% through 2026, down from 29%. The state would be required to evaluate economic conditions to determine if the rate reduction should continue. If the rate reductions persist, the commercial assessment rate would be reduced to 27.65% in 2027, 26.9% in 2029 and 25.9% starting in 2031.

- For agricultural properties and properties used for renewable energy, the assessment rate would be reduced to 26.4% from 29% through the 2032 tax year. For properties that fall under both classifications, such as those used for agrivoltaics, the rate would be cut to 21.9%.

The above is the simple part of the bill. The bill also makes substantial changes to the Taxpayers bill of rights(Tabor) allowing the state to keep substantially more money. To account for the cuts, the legislature is planning to spend $200 million to repay local governments, including schools, for the revenue they would have collected. Additionally, the plan calls for using about $250 million of the $2.7 billion Colorado is projected to collect in the current fiscal year, which ends June 30, above Taxpayer’s Bill or Rights cap on government growth and spending, to further account for local districts’ revenue reduction.

Additionally, property tax reduction is contingent on an increase the TABOR cap, which is calculated by annual growth in population and inflation, by an extra 1%. (Any money collected over the cap has to be refunded.)

The threat of another property tax bill will drive the conversation.

The new tax bill, initiative 50

AS a result of everything above, Colorado taxpayers are fed up with huge jump in property taxes and have put a new tax initiative on the 2024 ballot. Here is the summary of Colorado Initiative 50:

- IF THE TOTAL OF STATEWIDE PROPERTY TAX REVENUE IS PROJECTED TO GO UP MORE THAN 4% OVER THE PRECEDING YEAR, VOTER APPROVAL IS NEEDED FOR GOVERNMENT TO RETAIN THE ADDITIONAL REVENUE

- FOR VOTER APPROVAL OF A PROPERTY TAX REVENUE INCREASE , ANY REFERRED MEASURE MUST BE A STAND – ALONE SUBJECT . THE BALLOT TITLE SHALL READ : “SHALL PROPERTY TAX REVENUE BE INCREASED BY [ TOTAL PROJECTED INCREASE OVER THE PRECEDING YEAR] ALLOWING GOVERNMENT TO RETAIN AND SPEND PROPERTY TAX REVENUE ABOVE THE 4% ANNUAL LIMIT ON PROPERTY TAX INCREASES FOR [ DATES X TO X]?”

What happens in the special legislative session?

Tax bills are set to skyrocket between 40-50% if nothing is done. As a result a special legislative session was called by Governor Polis. There are a number of options in this legislative session.

- Use some sections of HH for property tax relief: The legislature could use some aspects of HH giving some dollar amount of exemption to primary residents to offset the higher bills

- Temporary reduction in assessed rates: I’ve heard another proposal to temporarily reduce the assessed rate on a statewide basis.

- Radical tax plan: Although unlikely to see anything radical out of the special legislative session, we have seen the changing tides to classify residential properties differently. On possible proposal that I have heard is to move nightly rentals to commercial classification to offset revenue losses from owner occupied properties. HH hinted at this with non owner occupied property owners paying more and there is already a current bill circulating on this topic so would not be surprising to see something similar in this legislative session.

- Nothing as the legislature can’t agree on a plan: There is a good possibility that nothing actually happens in the special legislative session as I’ve already seen hints of radically different priorities. For example there is talk of making tabor refunds flat which has nothing to do with property tax relief and ultimately sunk proposition HH.

At the end of the day, the legislature is in a bind as they have pledged that local governments would be spared from any cuts, yet taxpayers cannot absorb the huge increases in property taxes so something has to give.

Summary

The no vote on proposition HH was a resounding defeat for the governor and the legislature which has led to a special legislative session. As of this writing, it is a mystery as to what the actual plan is to solve huge property tax jumps. The special legislative session is under the gun based on the new tax initiative next year that will cap tax increase at 4%. This new initiative is simple and easy for anyone to understand and likely to pass if real property tax reduction is not quickly implemented. It will be interesting to see how this all shakes out in the next few weeks as the deadline is 12/10 in order for assessors to have time to update bills, etc… before the new year.

Additional reading/resources:

- https://www.denverpost.com/2023/11/09/jared-polis-colorado-special-session-property-taxes/

- https://www.denverpost.com/2023/11/07/prop-hh-results-property-tax-tabor-colorado/

- https://coloradohardmoney.com/live-like-a-local-pay-hotel-property-taxes-on-nightly-rentals/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender