Get ready for sticker shock as you open the mail and get your tax bill. As values soften throughout the state, why are your property taxes going up? How can assessed values continue to increase even though property values are softening? Why will your taxes likely stay high through at least 2026! What did the legislature do to help taxpayers? Can/should you protest your property taxes after you receive your bill?

Why are taxes going up now even though values have declined

Colorado taxes are backwards looking meaning they took the values back in 2021 and 2022 to determine the market value for tax purposes. Taxes are paid in arrears which means that your tax bill in 2024 is for the 2023 tax year when properties got revalued.

What did the legislature do about the huge jumps in Colorado property taxes?

After talking about it for years, the Colorado legislature has basically made some minor changes to try to help taxpayers but at the end of the day taxes are still going up by double digits for almost every taxpayer. As expected, the legislature has also convened a “blue ribbon” committee to help address the property tax issues. I wouldn’t hold your breath the legislature is going to do much to assist as they are on the hunt for money to fund their various projects and they have a huge incentive to keep as much money as possible.

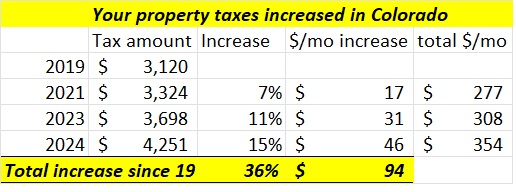

How much are your taxes going up?

It will depend on the county you are in along with the increase in your assessed value. This will be reflected in the property tax bills that are going out now. It is counterintuitive that property taxes are increasing when values are falling or at best flat in most markets, but assessments in Colorado are in “arrears” meaning they are backwards looking and only occur in odd years.

After months of stressing about soaring property valuations, mill levy rates by local taxing districts and projected revenue windfalls, property owners can finally assess the damage for themselves. Property bills were posted on the websites of Colorado counties on Jan. 24, the same date the paper bills were mailed.

A glance by the Aspen Daily News of select properties in the Roaring Fork Valley portion of Eagle County showed tax bills skyrocketed everywhere from 36% for a home in the working-class neighborhood of Sopris Village to 82% for a home on Riverside Drive in Basalt.

Below are more details on how taxes work in Colorado and what you can do about it regarding an appeal.

- When/how are the property values determined for Colorado property taxes?

- Why is this year such a big jump for Colorado property taxes?

- What can you do about the huge jump in Colorado property taxes?

- Are further Colorado property tax increases on the way?

- Can/should you protest your Colorado property taxes?

How are Colorado property tax values determined and when are they determined?

In Colorado every county is the same, each odd numbered year is a revaluation year ( 2023 is a revaluation year). During the revaluation period the tax assessor looks at comparables 18 months prior, so for 2023 they would be using 21 and 22comparables (to be exact you can use a comparable up to 6/22)

Why is this year such a big jump for Colorado property taxes?

Most areas in Colorado continued picking up steam (aka value) as the pandemic unfolded. In many areas values increased > 15% a year during these two years with some mountain communities almost doubling during the last two years. These increases were reflected in the sales that ultimately are used in the 2023 revaluation cycle

Is assessed value market value for Colorado property tax calculations?

Remember, property tax value is not market value. Property tax value is derived from prior sales (last summer and earlier). The market was in a much different place then than it is now. The statute in Colorado does not care about current market value. The increase you are seeing this year was for “prior” real estate appreciation that is now just flowing through to your property value which ultimately determines your property taxes.

Are further increases to your Colorado property taxes on the way?

Increases will be determined based on increases in value. Depending on the real estate market, 2025 could provide a very small amount of relief. Remember the next revaluation cycle will be in 2025 based on sales up to 2024 so unless there is a major correction soon in Colorado real estate, I doubt we will get much if any relief.

Note, counties are fast to raise property values, but very slow to drop them unless you appeal. Look for your taxes to remain about where they for the foreseeable future.

Should you protest your Colorado property taxes

Unfortunately, you are out of luck, appeals had to be done last summer and the next revaluation is not until the summer of 2025 when you will have another opportunity to appeal based on 23 and 24 sales. I would not get your hopes up of huge savings as it doesn’t look like the bottom is going to fall out of the real estate market in the next 6 months so substantially lower sales will not be factored into the next revaluation cycle that will occur in 2025 (based on sales up to June 24).

Summary

Long and short, Colorado is a bit unique in that even though real estate prices are falling/softening there will still be huge jumps in taxes as the prior increases have not fully factored in. The high taxes look to stick around at least until 2026 as values have not softened much and do not look like they will in the next 6 months.

Also note, do not take your frustration of higher taxes out on the assessor as they are just following the law, if you don’t like the higher taxes, the legislature, governor, and ballot box is where you should focus your efforts. Remember one of the key reasons for the huge jump in taxes is the elimination of the Gallagher amendment that balanced commercial with residential assessments which led to huge jumps in residential property taxes. I’ve spoken about this for years and finally taxpayers are starting to wake up and see that we have a huge problem.

It is crazy that property taxes are increasing 45-85% in one year. This money is a windfall to local governments and enables the state to spend more on other projects as they do not need to backfill the coffers of local governments for education funding. This is why our state legislature did basically nothing to slow the huge jumps in property taxes.

There is a little hope on the horizon, there is a ballot proposal in November to basically cap property tax increases to 4%/year. I think it has a good shot of passing. Unfortunately it will “lock” in today’s higher tax rates but will keep them from jumping like they have over the last 8 years or so.

Additional Reading/Resources:

- https://www.aspendailynews.com/news/the-tax-man-cometh-effects-of-soaring-property-values-in-the-valley-become-apparent/article_698dbba4-be90-11ee-b7da-ab04d70b05fa.html

- https://coloradohardmoney.com/real-colorado-property-tax-reduction-on-the-ballot-in-2024/

- https://coloradohardmoney.com/colorado-property-taxes-increase-35/

- https://car-co.stats.showingtime.com/docs/lmu/2020-06/x/DenverCounty?src=page

- https://www.steamboatpilot.com/news/property-taxes-101-owners-should-prepare-for-big-increases-on-may-notice/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between.

When you call you will speak directly to the decision makers and get an honest answer quickly. They are recognized in the industry as the leader in hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Hard Money Lender, Private lender, Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender