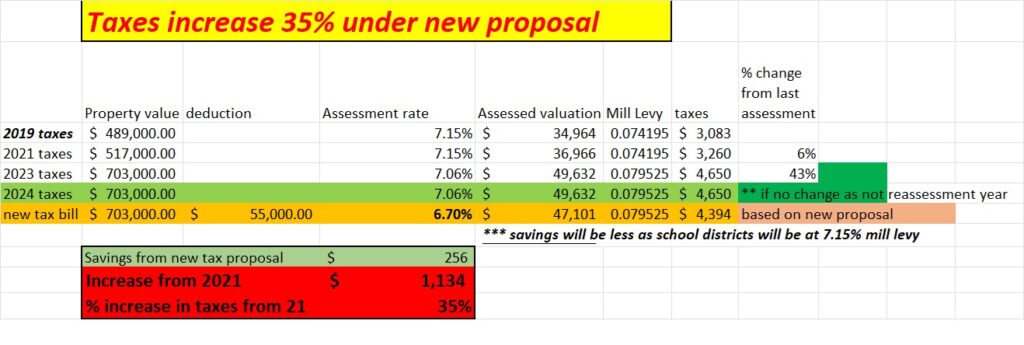

In the waning hours of the legislative session, a grand tax bill reduction was introduced to supposedly offset the 40-50% increases in the last tax cycle. The headlines are everywhere “Bipartisan bill would bring long-term property tax relief for Colorado homeowners”. What is in the new initiative, and will it actually save you money (see calculation above). Did this bill fully pass and what does this mean for your taxes in the future?

In the waning hours of the legislative session, a grand tax bill reduction was introduced to supposedly offset the 40-50% increases in the last tax cycle. The headlines are everywhere “Bipartisan bill would bring long-term property tax relief for Colorado homeowners”. What is in the new initiative, and will it actually save you money (see calculation above). Did this bill fully pass and what does this mean for your taxes in the future?

What are the details of Senate Bill 24-233

- Property tax revenue limit. Beginning with the 2025 property tax year, section 2 of the bill establishes a limit on specified property tax revenue for local governments (limit). This limit does not apply to local governments that are home rule local governments, school districts, have not received voter approval to exceed the statutory 5.5% property tax revenue limitation, or have not received voter approval to collect, retain, and spend revenue without regard to the limitations in section 20 of article X of the state constitution.

- Commercial Property:

- For property tax year 2024, the valuation is 27.9% of the amount equal to the actual value of the property minus the lesser of $30,000 or the amount that causes the valuation for assessment of the property to be $1,000 (alternate amount);

- For property tax year 2025, the valuation is 27% of the actual value of the property;

- For property tax year 2026, the valuation is 26% of the actual value of the property; and

- For property tax years commencing on or after January 1,2027, the valuation is 25% of the actual value of the property.

- Residential property: For multi-family residential real property, the bill reduces SB24-233-2 the valuation from 6.8% of the actual value of the property to 6.7% of the amount equal to the actual value of the property minus the lesser of $55,000 or the alternate amount; and

- For all other residential real property, the bill reduces the valuation from an estimated 7.06% of the actual value of the property to 6.7% of the amount equal to the actual value of the property minus the lesser of $55,000 or the alternate amount.

A couple notes on this bill that sound good on paper but…

- The property tax revenue limit is compounding and has a ton of exceptions (school districts exempted, home rule exempted, etc…). Note, the target rate of inflation by the federal reserve is 2%, yet this allows governments to grow at almost 300% that rate each year. Assuming values remain flat for the next 3 or 4 years due to high interest rates, they then spike 20% in one cycle, under the compounding formula they would have to exceed 22% in year 4 before they kicked in. In essence, this provision is useless.

- You are not going to get much savings from the new bill. After enormous increases in taxes, this bill is more hype than savings. Based on the analysis below the average homeowner will save under 200/mo (once you factor in that school’s will keep their mill levy at 7.15%). This is well over a 35% increase.

Property tax bill ultimately passed but not law

I was actually surprised this bill passed in the wee hours of the session but there is a contingency that if either of the property tax ballot initiatives pass in November this bill would be void.

Summary

The new tax bill is extremely disappointing because it does nothing to limit huge growth in government spending and does very little to actually save taxpayers. The way the bill is written, the growth cap of 5.5% a year compounding is laughable. Why don’t they change it to actual inflation in any given year is the max growth not compounding until eternity. Furthermore, the tax savings from a lowered mill levy do nothing to negate the huge run up in prices and over 35% increase in property taxes that are already being paid. The tax savings amount to less than an 8% saving (after factoring in the school levy staying the same it is closer to 4-5%!).

Please don’t buy the media hype and headlines that this recent tax bill moved the needle much on what you will pay in property taxes. This recent proposal does nothing to solve the long-term issues of property taxes rising 300% the pace of inflation.

There is hope on the horizon. Initiative 50 looks to still be on the ballot in November (as of this writing) to cap the rate of increases to 4% over the previous year (not compounding). Here are the details on initiative 50. As you can imagine this initiatives facing strong resistance from local governments and the legislature. Also, although the tax bill ultimately passed, look for it to only become law if initiative 50 does not pass. You can bet that legislatures will hold up this law as a “great alternative” to any of the ballot initiatives to save money on taxes.

Additional reading/resources:

- https://www.denver7.com/news/politics/bipartisan-bill-would-bring-long-term-property-tax-relief-for-colorado-homeowners

- https://leg.colorado.gov/sites/default/files/documents/2024A/bills/2024a_233_01.pdf

- https://coloradohardmoney.com/real-colorado-property-tax-reduction-on-the-ballot-in-2024/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal from this blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender