The original Colorado short term rental bill is still moving through the legislature but now there is a competing bill to also classify short term rentals as commercial properties but with a big twist from the first bill. The new bill proposes to try to tax “corporate” owners that have more than one nightly rental as commercial property. What is in the new bill? How will it actually be implemented? Should you worry if it becomes law?

The original Colorado short term rental bill is still moving through the legislature but now there is a competing bill to also classify short term rentals as commercial properties but with a big twist from the first bill. The new bill proposes to try to tax “corporate” owners that have more than one nightly rental as commercial property. What is in the new bill? How will it actually be implemented? Should you worry if it becomes law?

What is in the new bill to define short term rentals as commercial properties in Colorado:

“The bill defines a short-term rental unit as a building that is

designed for use predominantly as a place of residency by a person, a

family, or families, is leased or available to be leased for short-term stays,

and includes the land upon which the building is located. A commercial

short-term rental unit is defined as a short-term rental unit that is not the

owner’s primary or secondary residence.”

What is in the original Colorado short term rental bill?

This new bill is radically different from the original bill progressing through the legislature. Under the original bill.

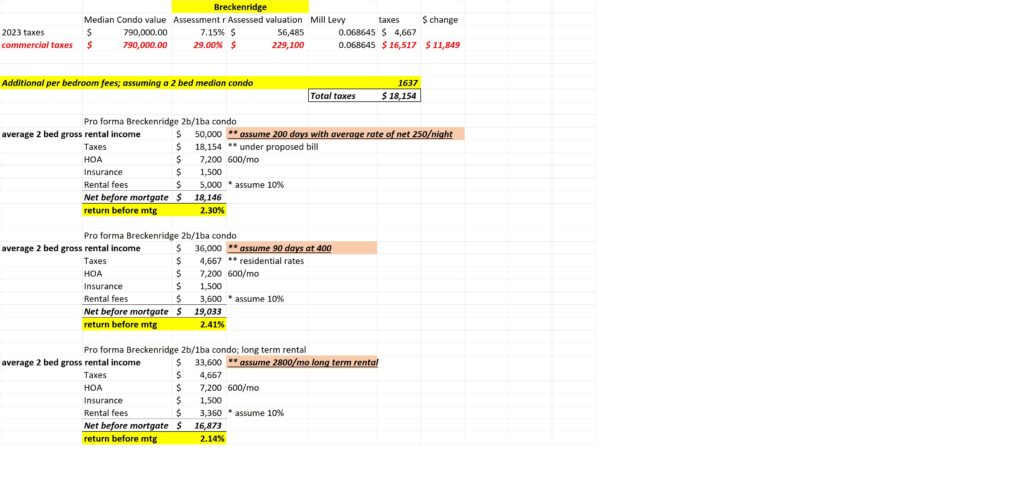

- Properties rented nightly for more than 90 days a year are subject to commercial property tax rates for the days they are rented.

- The commercial property tax rate is 29% while the residential rate is approximately 7%

Major gaps in new legislative proposal to classify STRs as commercial

It never ceases to amaze me that our legislators don’t have a clue as to how real estate actually works in real life. There are a few glaring issues that will make this law a joke if it actually gets implemented. Personally I wouldn’t worry too much about this law as very few if any will actually be impacted the way it is currently written.

- How do you define multiple properties: The law doesn’t clarify whether someone must own multiple properties in Colorado to trigger the higher tax rate, or whether they can own two homes in, say, Florida and a third in Colorado and skirt the higher taxes.

- Very easy to subvert multiple properties: the way the law is written now it would not be hard to subvert the law. For example, assume a married couple, each one could have their own second home that they use as a short term rental. Furthermore, you could set up unique trusts or LLCs that only hold one property so as to not trigger commercial property taxes.

Original short term rental bill also has an enforcement problem

Under the original bill nightly rentals are classified as commercial only if they are rented for more than 90 days. Cities currently have a problem even defining which properties are currently nightly rentals and yet who is going to track the actual days a property is rented. Does the legislature think that assessors or other government agencies really have the time or capability to track this? It will be next to impossible to actually enforce this provision of 90 days.

How will the taxes and caps on nightly rentals in Colorado impact real estate values?

If you were buying a property with the intent of renting it heavily, commercial property tax rates could throw a wrench in your plans. Furthermore, some owners that rely on nightly rental for their mortgage payments or retirement will feel these changes the most.

There will be substantial impacts on prices if the proposed legislation to tax nightly rentals as commercial properties becomes law if they are used for more than 90 days. It is hard to predict exactly the impact, but I suspect you could see values in some ski towns drop 20% or so especially on condos as the rental numbers are substantially impacted. Places like Copper Mountain and Keystone that shot up in value recently as they were excluded from Summit Counties rental caps will be impacted considerably more than other areas.

Summary of new Colorado short term rental laws:

Regardless of how the two prospective short term rental bills play out, short term rentals will continue to be a hot button issue as this is a top priority for the governor of Colorado. Unfortunately neither bill is cleanly written and enforcement will be very difficult if not impossible so the true impact on the market will be questionable.

The new bill to classify properties that are not the first or second homes as commercial will have basically no impact as the loopholes around second homes or setting up separate entities will make it extremely easy to avoid commercial tax rates. On the flip side if the legislature can actually figure out an enforcement method for the 90-day cap with the original legislation then the impact will be much greater.

Currently there are a ton of moving parts with short term rental taxation in the legislature, but it is fair to say that we are just at the beginning of this journey regardless of what happens to these bills. Short term rentals will continue to be a hot button legislative priority that could radically alter the current economics of renting short term and in turn have substantial impacts on values. Right now we will just have to wait and see how it all ends up. I’ll provide an update once I see additional information.

Additional Reading/Resources:

- https://leg.colorado.gov/sites/default/files/documents/2024A/bills/2024a_1299_01.pdf

- https://coloradohardmoney.com/bill-to-quadruple-taxes-on-short-term-rental-passes-out-of-committee/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal from this blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate.

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender