Property taxes on short-term rental properties in Colorado would more than triple under a bill drafted by state lawmakers that comes as communities from Durango to Denver grapple with surging numbers of vacation rentals. What is in the new proposal? How will this impact property owners throughout Colorado? Did this initiative pass in the legislature? Where does legislation go from here?

Property taxes on short-term rental properties in Colorado would more than triple under a bill drafted by state lawmakers that comes as communities from Durango to Denver grapple with surging numbers of vacation rentals. What is in the new proposal? How will this impact property owners throughout Colorado? Did this initiative pass in the legislature? Where does legislation go from here?

What is in the proposal to tax nightly rentals as commercial properties.

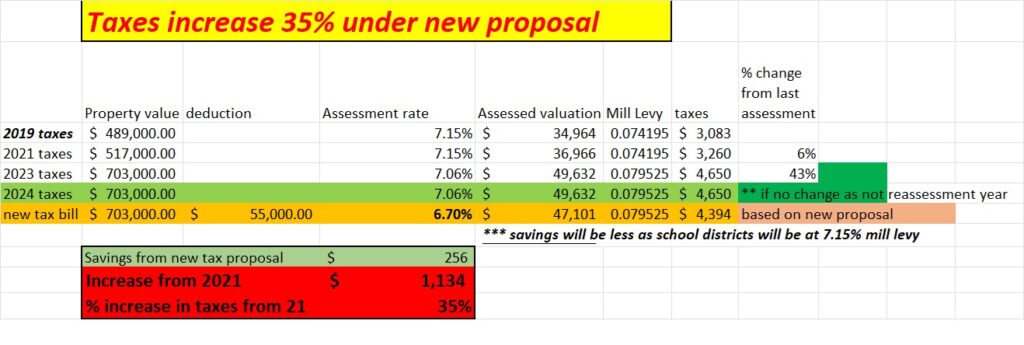

The proposal would tax vacation homes like hotels and motels, which are subject to a higher assessment, on the days they are being rented and deliver the extra revenue to public schools, fire departments, libraries and other districts that rely on property taxes. State Sen. Chris Hansen, a Denver Democrat who sits on the powerful Joint Budget Committee and is leading the push for the legislation, said the idea is to boost revenue for local communities.

“There’s a really strong need for us to stabilize our property tax system and increase our local share,” said Hansen, referring to the rising education funding burden on the state budget. “If this is something we don’t get ahead of, it’s going to spiral out of control for the state”.

Here are some highlights of the bill as it is written today

- Properties rented nightly rental more than 30 days a year are subject to commercial property tax rates for the days they are rented.

- The commercial property tax rate is 29% while the residential rate is 6.9%

The practical matter of the bill; some items needed to be worked out

How the bill is currently rented will be challenging for assessors to track and calculate when a property is taxed at residential vs commercial. Assessors do not track nightly rentals as many are not licensed, take Steamboat for example, only properties not in the mountain area need to be licensed. This equates to about 200 licensed properties in Steamboat out of about 3k total nightly rentals. Tracking and enforcing the nightly rental tax is going to be a nightmare for assessors.

Did taxing nightly rentals as commercial properties pass the legislature?

After strong lobbying from VRBO, AIRBNB and others the legislature radically changed the bill so it commits to only “studying” the nightly rental issue in various communities and the modified bill failed to pass. As a result, the proposed bill will have no impact on how nightly rentals are taxed today as residential properties.

This is just the beginning of taxation of nightly rentals

Even though this particular bill failed, the tide has changed on nightly rentals. Voters in Avon, Crested Butte, Leadville, and Ouray will consider ballot questions that increase taxes on short-term rentals. Councils and commissioners in several other communities have stalled or capped the flow of permits for vacation homes.

As we have seen with many housing bills this legislative session that failed last session, they come back to life and transform a bit but ultimately pass. I would not put the taxation of nightly rentals to bed just yet as it is more than likely going to reappear in an upcoming session.

What will the taxes and caps on nightly rentals do to real estate values?

Although the statewide bill taxing nightly rentals as commercial properties has failed, nightly rentals are still facing large jump in taxes from local jurisdictions through licensing fees and fees for each night a property is rented.

If you were buying a property with the intent of renting it heavily, higher taxes and prospective moratoriums are huge. Furthermore, some owners that rely on nightly rental for their mortgage payments or retirement will feel these changes the most.

Fortunately to the entire real estate market, the changes to nightly rentals will have no impact on values. Many of the newcomers to the mountains are not buying for investment purposes but for personal use. Furthermore, most purchasing in areas with lots of nightly rentals (Steamboat, Vail, Aspen, etc…) are wither using very little leverage or buying in cash. I’ve seen statistics throughout the mountains, depending on the location that between 40% and 70% of the transactions are cash transactions. People buying with little, or no leverage have the ability to not rent the property.

In Breckenridge, Vail, Aspen, Steamboat, Crested Butte, etc.., and other ski towns there is zero available inventory and considerable pent-up demand which will lead to minimal impact on real estate prices in the core areas. Note in areas like Silverthorne, there will likely be impact on prices.

Summary:

Long and short nightly rentals are in the cross hairs as their impacts are felt by more locals. As a result, radical changes are coming down the pipe from the statehouse and local governments. Even though the biggest bill on nightly rental taxation failed this session I’ll bet it will be back in another form in the next session.

The biggest themes are increased taxes, capping the number of nightly rentals, and prohibiting nightly rentals in certain property types and locations. Although I can’t say with certainty which bill/measure will pass, with this much momentum there will ultimately be huge impacts on property owners soon.

Additional Reading/Resources:

- https://www.vaildaily.com/news/bill-hiking-taxes-for-short-term-rentals-to-be-gutted-after-resistance-from-airbnb-vrbo/

- https://coloradosun.com/2021/10/14/short-term-rentals-tax-bill-colorado

- https://www.the-journal.com/articles/property-taxes-would-more-than-triple-for-colorado-short-term-rental-owners-under-proposal/

- https://coloradohardmoney.com/live-like-a-local-pay-hotel-property-taxes-on-nightly-rentals/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal from this blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender