Over the last 5 years Vail resorts stock has lost – 23% substantially below the S&P which means Vail has underperformed the market by almost 40%. Why the sudden drop in Vail resorts stock? What does this drop mean for Colorado ski real estate? Is the ski party coming to an end? Are Colorado ski towns also showing a decline in revenue?

What was in the data on Vail resorts that caused shares to plummet?

Vail Resorts’ shares are not very volatile than the market average and over the last year have had only 3 moves greater than 5%. Moves this big are very rare for Vail Resorts and that indicates to us that this news had a significant impact on the market’s perception of the business.

Vail Resorts is down 20.2% since the beginning of the year, and at $168.15 per share it is trading 34.8% below its 52-week high of $258.04 from June 2023. Investors who bought $1,000 worth of Vail Resorts’s shares 5 years ago would now be looking at an investment worth $710.29.

Has there been a fundamental change in Vail’s business model?

Skier visitation from lift ticket guests was down 17% compared with the prior year period, but total net revenue for the company increased 3.6% to nearly $1.3 billion for the three-month period that ended April 30.

The decrease in lift ticket revenue the company saw over the final two months of its season was part of an overall decrease in visitation across Vail Resorts and North America, Lynch pointed out on the call with investors, saying Vail Resorts properties saw an 8% decrease in skier visits in 2023-24.

The National Ski Areas Association’s preliminary skier visit numbers for 2023-24, released in May, estimate a 7.6% decrease nationwide to 60.4 million, down from 65.4 million in 2022-23. That number was an outlier on the chart, occurring during a massive snow year when many places across the West saw snowfall totals well above average and some parts of the country broke records.

“I think it is important for us to highlight that the U.S. ski industry decline of 8%, our decline in visits of 8% which is consistent with that, does reduce the pool of guests to transition into a pass, and we do believe that it is having an impact, and it will have an impact through the rest of the selling cycle,” Lynch said.

Big changes in the ski industry with lift ticket sales

Vail resorts data is showing two unique and differing trends that will have long term impacts.

- Daily Lift ticket sales are down: this would be expected as they increased daily prices in order to force people into the pass product so this is what I would have predicted.

- Overall ski industry decline: Nationwide the decline in visitation of 8% is not surprising as Covid had bumped up the number of people considerably higher than past trends, the interesting part is what happens 3-5 years from now. Will the number stabilize, or will they continue falling?

None of the data talks about expenses for Vail

I think the market is underpricing the huge increases in expenses for Vail including lift upgrades, labor costs, etc… Furthermore, there is a much more acrimonious relationship between the company of Vail and the communities that they operate in. For example, the town of Vail sued Vail resorts on a project and won; Park city also blocked the construction of new lifts. All of these items will increase the costs for Vail resorts.

How does Vail resorts compare to Alterra?

It is hard to see how much of the items above are just impacting Vail or other resorts as well. Unfortunately Alterra, the parent company of the Ikon pass, is privately held so we don’t have a good comparison to see how much is industry wide versus just Vail.

Although lift ticket sales down, ski spending is still increasing

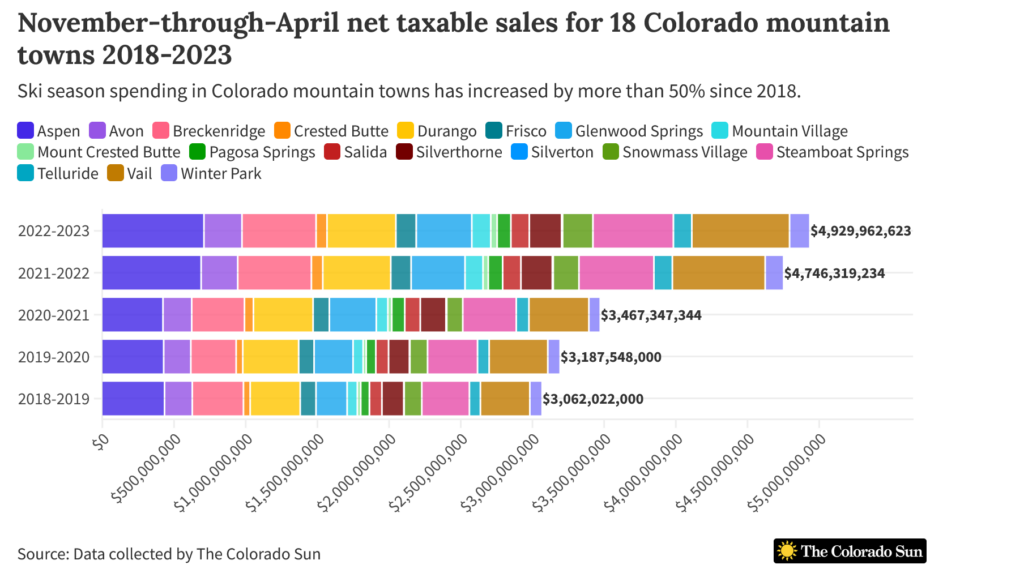

Even with a huge decline in visitation, spending in Colorado ski towns hit record highs in 2023-24. The Colorado Sun tracks net taxable sales in 18 small and large municipalities next to ski areas in Colorado and total spending from November through March reached $4.5 billion, up from $4.4 billion in the record-setting 2022-23 season and up 50% from the pre-pandemic 2018-19 season. From the chart below, the increases appear to be pretty uniform amongst Colorado ski mountains with Vail resort properties trending similar to areas like Steamboat and others.

How can visitation decline but ski town sales tax revenues continue to increase?

I thought it was interesting to see the amount of money spend in ski towns continue to increase while the umber of visitors has declined. There are three possible explanations.

- Less skiing but similar mountain visitation: I think as the cost of skiing has continued to increase, more people are deciding not to ski while they visit. For example, parents would put kids in ski school and decide to go out to lunch or spa or some other cheaper activity.

- Higher price points leads to more spending: Although visitation is down, prices on everything in ski towns has gone up from lodging to food leading to considerably more spending from each visitor.

- Increase in non ski visitation: Although ski visitation is down, I don’t think overall visitation to ski towns is down. Since Covid the visitation during non ski times has exploded including what used to be the mud seasons. Furthermore the summer season is huge for ski towns now.

What does this all mean for Colorado ski real estate?

5-10 years ago, a huge drop in skier visitation by Vail resorts would definitely give me heartburn. Since Covid the various ski towns have continued to evolve to attract visitors interested in a mountain lifestyle. This demand for the Colorado mountain lifestyle will continue to be desirable which should ultimately lead to a healthy real estate market in the various Colorado ski towns.

Summary

Although the headlines on Vail resorts performance are startling, this does not mean that ski towns owned by Vail and/or Alterra will experience the same decrease. Colorado ski towns continue to be desirable places to visit and invest, which is a drastic departure from 10 years ago. Colorado ski towns continue to increase their sales tax revenue due to more affluent visitors and also non ski visitors in off times like the mud season and summer. These factors should continue to keep Colorado ski real estate much healthier than Vails stock price.

Additional Reading/Resources

- https://coloradosun.com/2024/06/17/colorado-ski-areas-visits-spending/

- https://www.steamboatpilot.com/news/vail-resorts-stock-hits-4-year-low-after-announcing-that-next-seasons-pass-sales-are-down/

- https://coloradohardmoney.com/what-is-the-best-colorado-ski-town-to-buy-real-estate-in/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender