When looking at the chart above it is clear that Breckenridge is substantially underperforming other ski towns in Colorado. Why has Breckenridge peaked and fallen while other ski towns hit a blip and powered higher? What does this mean for ski real estate in general? Will other ski towns follow the same pattern? Are the nightly rental regulations driving the changes in Breckenridge? Was I right on my best Colorado ski investment picks last year?

What is in the data on Breckenridge real estate?

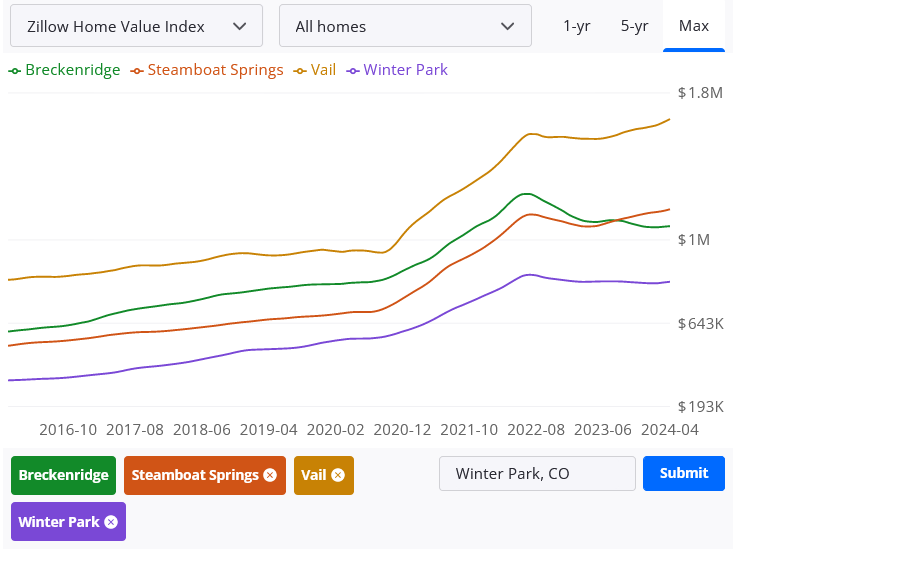

After a steep run up in prices, Breckenridge peaked in the summer of 2022 at 1.35m This was a similar peak for every ski town. The difference is what happened after the summer of 2022. Fast forward to 2024 and Steamboat and Vail have pulled higher while Winter Park has essentially stayed about flat from the peak. Note I used data from Zillow as it is the widest data set and captures almost all transactions even those not in the MLS.

Why did Breckenridge fall from the peak and not rebound like other ski towns?

I’ve been lending in the Colorado mountains for over 25 years and I’ve seen many different cycles. Here are some of the primary theories as to why Breckenridge has not rebounded more than others. Why is Breckenridge falling more than other comparable front range ski areas. Here are 4 theories and I will talk about each one in depth below:

- Nightly rental regulations

- The rise of the 4-day work week

- Crowded, buyers are looking for alternatives

- Higher correlation to Denver than other ski towns

Are nightly rental regulations causing Breckenridge house prices to fall?

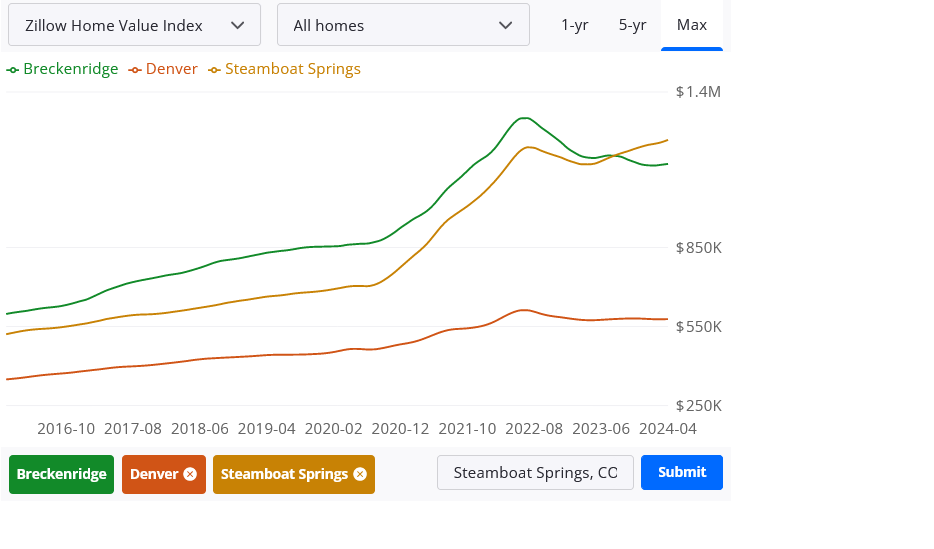

I would disagree with this argument that nightly rental rules in Breckenridge are causing the large declines in real estate prices. First, Steamboat and Vail have also implemented nightly rental regulations. In Steamboat, no new permits are allowed in “red zones” which is similar to what has occurred in Breckenridge, yet Breckenridge real estate prices have recently fallen while Steamboat’s have increased.

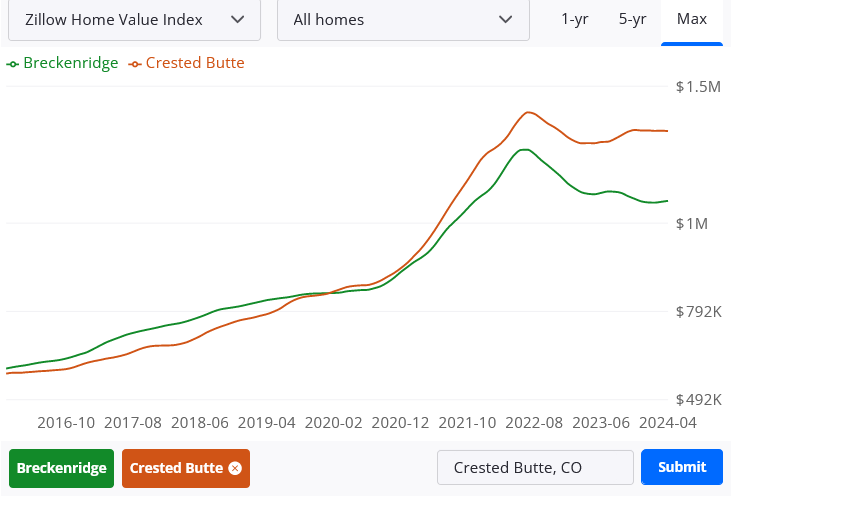

Look at this chart of Crested Butte, Crested Butte has some of the strictest nightly rental rules in their downtown core and yet look at the divergence in pricing. Crested Butte fell and then rebounded a bit and is not far off the peak. If nightly rentals regulations were the primary driver, we would see Crested Butte decline similar to Breckenridge. On a side note, I do think the nightly rental regulations are having a much bigger impact on pricing in places like Silverthorne in Summit County and some of the non-core mountain areas.

Is the rise of the 4-day work week impacting Breckenridge real estate prices?

I think the rise in the 4-day work week where Friday is off or remote is contributing to the decline in Breckenridge real estate prices. Pre Covid, most people worked 5 days a week so that required them to buy a vacation property within a few hours radius of Denver which Breckenridge fit perfectly. As the 4-day work week has become the norm, this has opened more alternatives like Steamboat and Vail that are just a little farther but escape the crowds a bit more from the front range. This could be one of the drivers of the disparity in pricing among the ski areas.

Summit County has gotten more crowded, and buyers are seeking alternatives.

Breckenridge is unique as it is a day drive from Denver bringing lots of traffic along with the normal destination tourists. As the Denver metro (including suburbs) has grown, the visitation in Breckenridge has also grown (along with the traffic on i70) which is pushing buyers to look for alternatives. This coincides with the 4-day work week above which encourages different ski options.

Breckenridge has higher correlation to Denver than other ski resorts

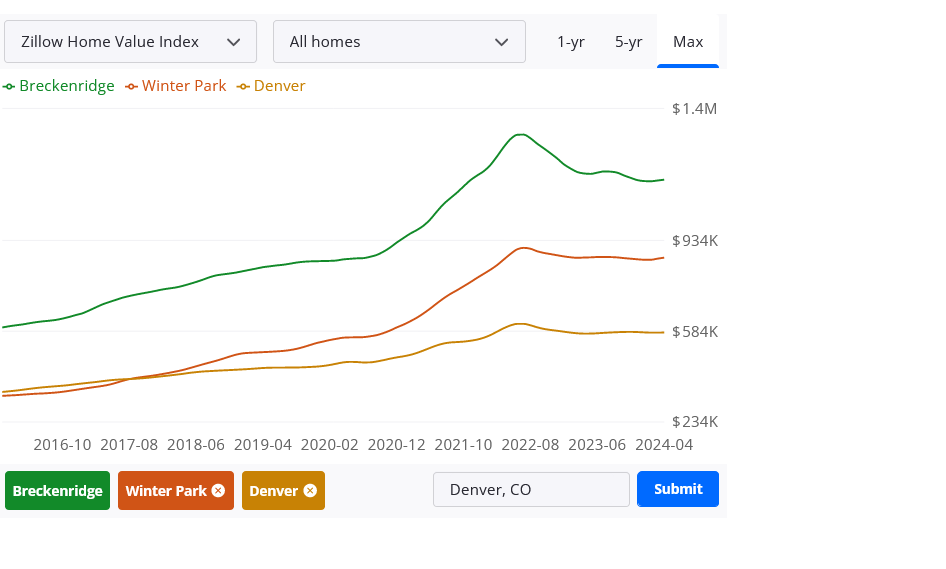

This is one of the primary reasons for the disparity in pricing amongst ski towns. Due to its proximity to Denver, Breckenridge has a large correlation to Denver along with Winter Park. Look at the graph, Winter Park is almost identical to Denver while Breckenridge is following a similar trend with a peak and then a drop off.

Essentially as Denver’s real estate has plateaued/declined the same is happening in Breckenridge and in Winter Park as opposed to Vail or Steamboat which attract wider national buying as opposed to having a huge direct relationship with the Denver metro area. We saw this in the last cycle as well. This is the biggest driver of the fall in real estate prices.

Is Breckenridge still a good place to buy real estate?

Yes, in the town of Breckenridge is still a good real estate investment due to limited supply and basically no way to build more. Overall ski towns like Breckenridge will hold up better than other markets in a downturn. Although I wouldn’t hesitate to buy a property in Breckenridge,

Does this mean that Steamboat and Vail will not fall like Breckenridge?

I always like to remind investors that the past is not necessarily an indicator of future success. Although Breckenridge and Winter Park have high correlations to Denver and emulate the front range markets, other ski resorts are not immune to macroeconomic drivers in the economy. Historically markets like Steamboat and Vail lag the front range by about 18 months, this is what we saw during the 2008 crisis. I suspect that Steamboat and Vail will ultimately see a minor reset in prices as well, but it could be another year before we see it. On the flip side, I don’t see a ton more upside in either market as prices are pretty lofty now.

Summary

Although the market thought that ski real estate would continue going up to the moon, the recent data is a cautious reminder that even Colorado ski town real estate is not immune to macroeconomic pressures. Breckenridge is the first to see a decline due to the higher correlation to Denver along with the transition to the 4 day work week which opened up other options like Steamboat and Vail.

Fortunately the bottom will not fall out on pricing as there is limited inventory and still a desirable area but there will be a reset as we are now seeing. Now is the time to remember that not everything goes up and be more selective on purchasing. On a positive note, the reset in Breckenridge is healthy as prices were appreciating at 30% + a year during Covid which was not sustainable. Furthermore I picked this outcome a year ago in my best CO ski investments

Additional Reading/Resources:

- https://coloradohardmoney.com/what-colorado-ski-town-is-outperforming-others-which-colorado-ski-town-is-the-best-investment/

- https://www.zillow.com/home-values/14934/breckenridge-co/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Written by Glen Weinberg, Owner Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal from this blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender