Colorado ski resorts continue holding strong in the face of higher interest rates. Why are interest rates not the best metric for Colorado ski real estate? What two factors are driving the difference in ski town fortunes? Will these trends continue heading into 2025? What does the spring selling season hold for the various Colorado ski towns?

What are the two metrics to watch to predict Colorado ski real estate prices?

Before going into what two factors to watch, I want to emphasize one metric to not watch. The key focus in the media for the last several years has been interest rates; this is the wrong metric to watch for Colorado ski towns. The two factors to watch are Denver real estate prices and the stock market if you want to predict what Colorado ski real estate will do.

Will high rates impact purchases in Colorado ski towns?

There is no doubt interest rates are rising/staying constant on treasuries and in turn mortgage rates are remaining high. The federal reserve has telegraphed a loosening policy sometimes next year, but it doesn’t appear that mortgage rates are going to plummet. How will the high rates impact Colorado ski real estate? Long and short, interest rates should have a limited impact due to the number of cash purchases. In most major ski resorts in Colorado the number of cash purchases are between around 40% and 70%. This is a huge percentage of purchases that are not interest rate sensitive as they have no mortgage. Here is a past article on this topic: Best Colorado ski town investments. With such a large percentage of properties being bought with cash, a move upward in rates is unlikely to be the catalyst for a slowdown in ski real estate.

What ski real estate will fall based on Denver?

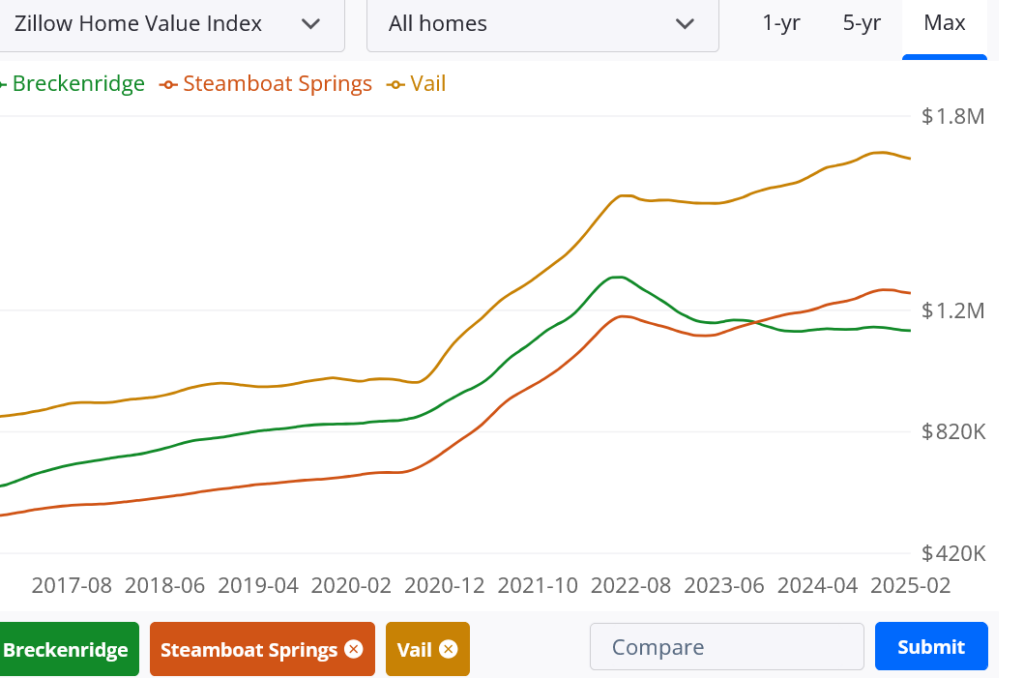

Denver real estate prices seem to be holding up okay in face of higher interest rates. Based on the recent Summit County data and others I have looked at so far, I’m not seeing any sign of big drops in real estate prices. We will need to wait to see what happens in Denver to see how markets like Breckenridge and Winter Park will perform as they have a very high correlation to the Denver metro market.

Steamboat and others continue to outperform

We have seen historically that resorts like Steamboat and Vail have a much lower correlation to Denver than other resorts closer to the front range. The same is true for Crested Butte, Aspen, and Telluride. Since Steamboat and Vail show they have very little correlation to Denver then what is the driver of appreciation in these ski towns?

What is the better metric to predict ski real estate prices in Vail/Steamboat/Aspen/Telluride?

If mortgage rates and the performance of Denver do not slow down ski real estate in towns like Steamboat and Vail, what will?

Resort real estate is highly correlated to stock market performance. With the huge quantity of cash transactions, much of these funds were from gains on equities. Furthermore, the demographics of various ski towns throughout Colorado are heavily invested in the stock market due to their net worth. As we can see last year, the stock market did great. In turn ski real estate in places like Steamboat and Vail continued to appreciate. The recent gyrations in the Stock market should be a warning for ski real estate. As high net worth buyers get nervous, we will see a decline in purchases in many of the higher priced ski markets.

Will there be a correction in Colorado ski real estate?

With a high correlation between the stock market and ski real estate, will there also be a correction in ski real estate. Fortunately, although there is a correlation between the stock market and ski real estate it is not a one-for-one correlation. For example, a 20% drop in the market might lead to a flattening or possibly a loss of 2-5% in ski real estate. Currently the stock market is starting to wobble, which means as the spring selling season approaches, we will likely see some pullback in prices.

On the other hand, Breckenridge/Summit county will follow closely to Denver real estate prices as opposed to just the stock market.

Note all bets are off for later in 2025 as I am already seeing a slowdown in closing volumes and some increasing inventory especially in condos which will lead to lower prices. This is due to the stock market gyrations and Denver real estate softening. Fortunately, I’m still not seeing any indication of a 2008 type reset.

Summary

Long and short, Colorado ski real estate looks to continue holding up better than other markets even with the gyrations in the stock market and softening in Denver. One of the big positives in every ski town is it is not possible to develop a ton to drastically increase inventory and build prices are extremely high coupled with so many cash purchases which will limit the downside risk, but it would be worthwhile to watch the Denver real estate market and the stock market to see where we head in 2025 as the party will not continue indefinitely and there will be some heartburn later this year especially in condos.

Additional Reading/Resources

- https://coloradohardmoney.com/category/summit-county-hard-money-lender/

- https://coloradohardmoney.com/category/summit-county-hard-money-lender/

- https://www.fairviewlending.com/will-mortgage-rates-stay-higher-forever/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help as my goal in writing these articles is to provide the best information/insight on Colorado Real Estate that you cannot get anywhere else! Please like and share my articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender, Hard Money Lender, Private lender, private real estate lender, residential hard money lender, commercial hard money lender, No doc real estate lender