by Glen Weinberg | Sep 16, 2024 | Colorado Hard Money, Colorado hard money lender, Colorado property tax appeal, Colorado property taxes, Colorado real estate market trends, Colorado real estate prices, Colorado real estate trends, Colorado Real Estate values, Colorado taxes

Will Colorado property owners actually see real property tax relief? Property owners are fed up with the run away increases in Colorado property taxes and yet the legislature has done very little. The governor and legislature blinked from the threat at the ballot...

by Glen Weinberg | Aug 4, 2024 | 2024 Colorado property taxes, Colorado Hard Money, Colorado hard money lender, Colorado hard money loans, Colorado initiative 50 property taxes, Colorado property tax appeal, Colorado property taxes, Colorado Real Estate values

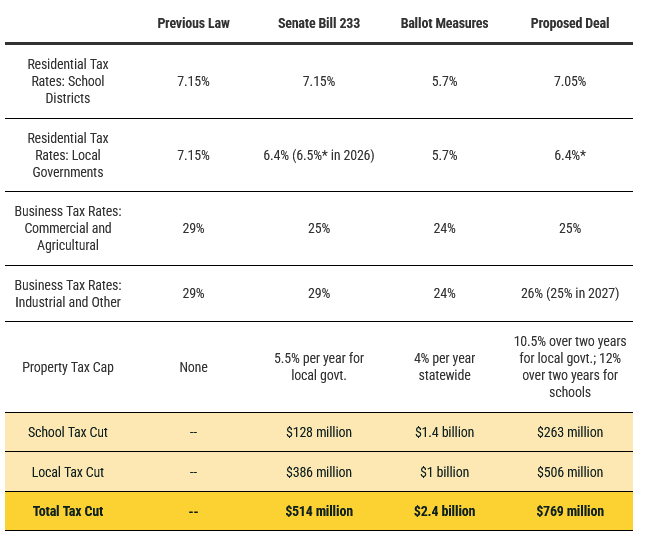

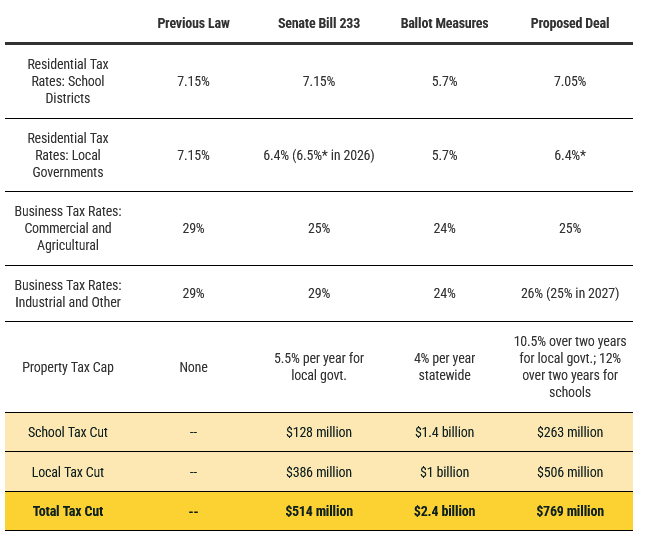

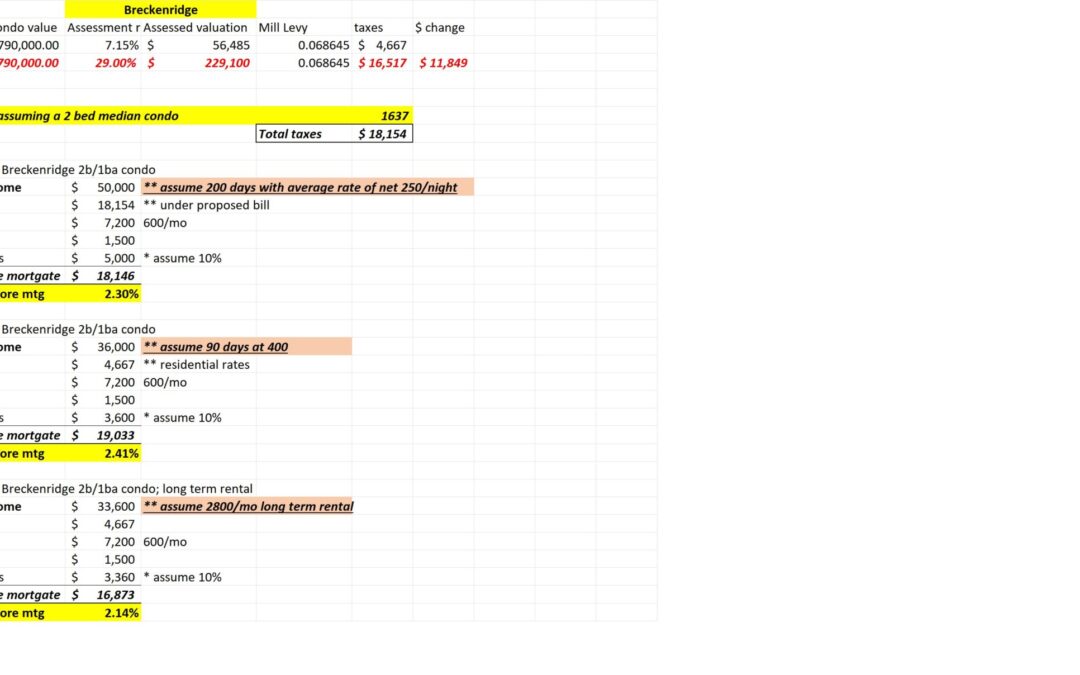

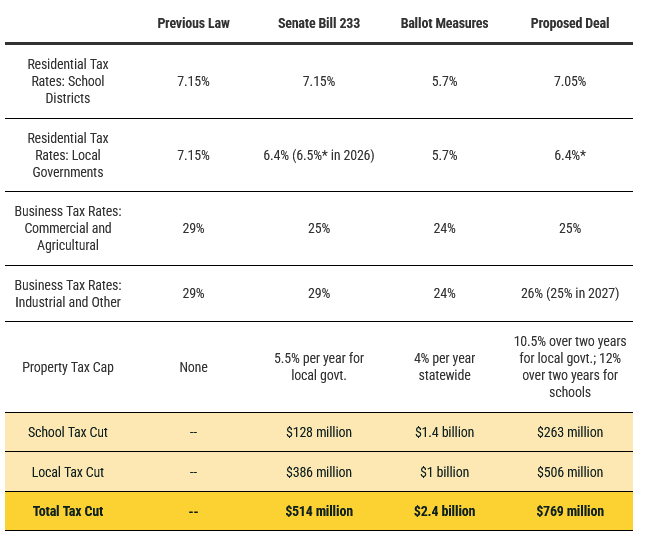

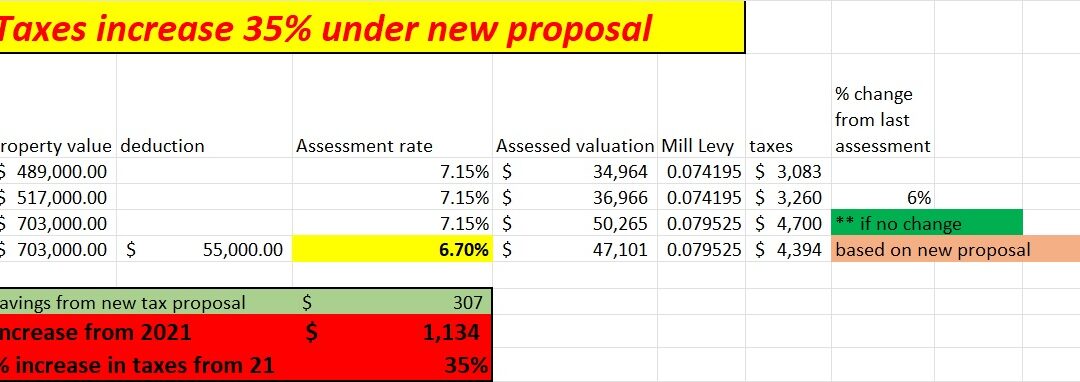

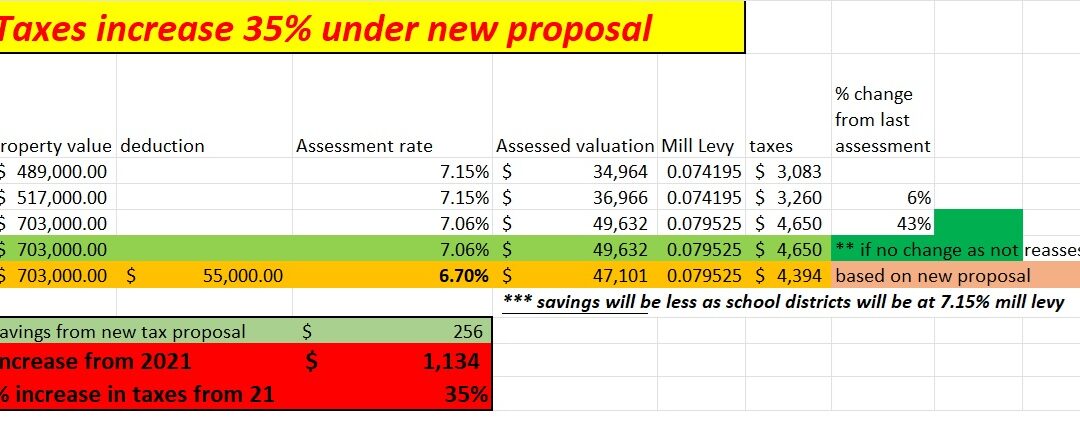

With little real progress on property tax relief by the legislature (above is the legislative fix), there is an initiative now on the November ballot to radically alter how property taxes work in Colorado. The new initiative would cap property taxes with a...

by Glen Weinberg | Jun 3, 2024 | 2023 Colorado real estate predictions, 2023 Denver real estate predictions, 2024 Colorado housing legislation, 2024 Colorado property taxes, are taxes going up or down in Colorado, CO hard money, Colorado Affordable housing proposals, Colorado Election results, Colorado Hard Money, Colorado hard money lender, Colorado hard money loans, Colorado property tax appeal, Colorado property tax deferral, Colorado property taxes, Colorado Real Estate values, Colorado residential property values

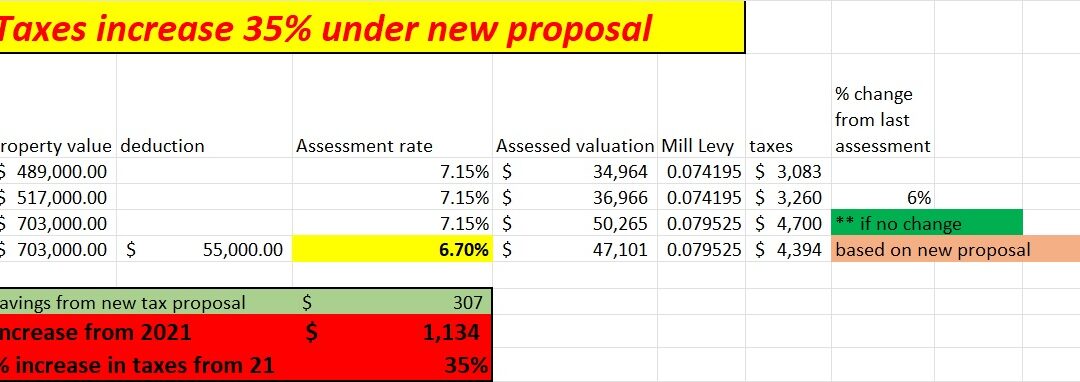

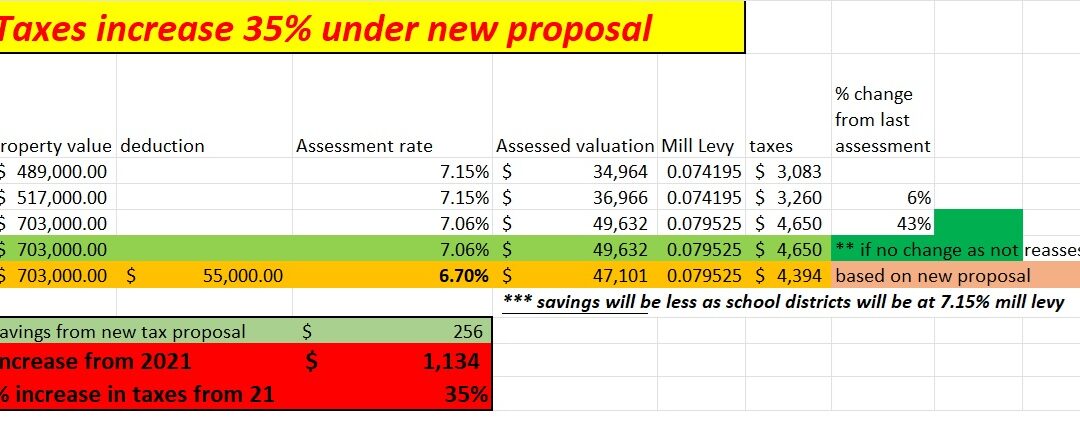

In the waning hours of the legislative session, a grand tax bill reduction was introduced to supposedly offset the 40-50% increases in the last tax cycle. The headlines are everywhere “Bipartisan bill would bring long-term property tax relief for Colorado homeowners”....

by Glen Weinberg | May 20, 2024 | 2024 Colorado property taxes, 2024 Colorado real estate predictions, are taxes going up or down in Colorado, Aspen hard money, Best colorado ski town, Best real estate investments in Colorado, Breckenridge hard money, Breckenridge real estate, Colorado nightly rental legislation, Colorado Private Lending, Colorado property tax appeal, Colorado property taxes, Colorado Real Estate values

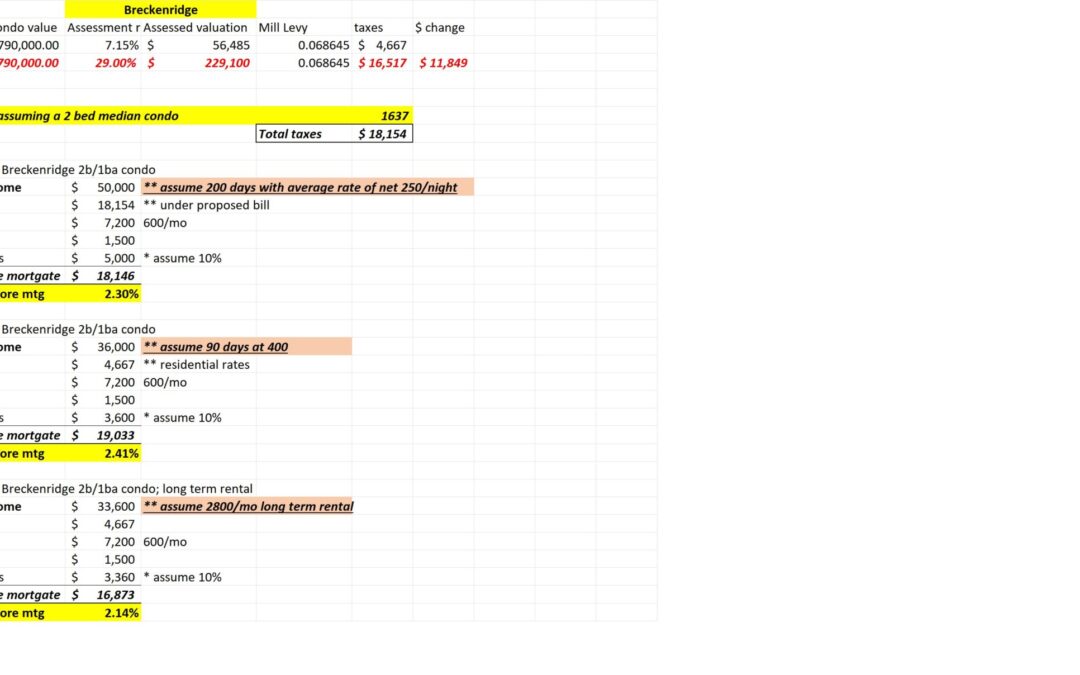

Property taxes on short-term rental properties in Colorado would more than triple under a bill drafted by state lawmakers that comes as communities from Durango to Denver grapple with surging numbers of vacation rentals. What is in the new proposal? How will this...

by Glen Weinberg | Feb 26, 2024 | Colorado Hard Money, Colorado Private Lending, Colorado property tax appeal, Colorado property taxes, Denver Hard Money, Denver hard money Lenders, Denver Private Lenders, Denver Private Lending, Denver private real estate loans, Denver real estate predictions, Denver real estate taxes, Denver real estate values, Lakewood Colorado vacant building tax

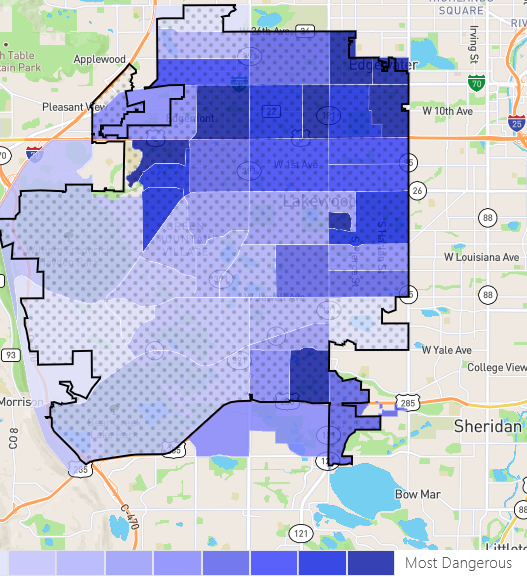

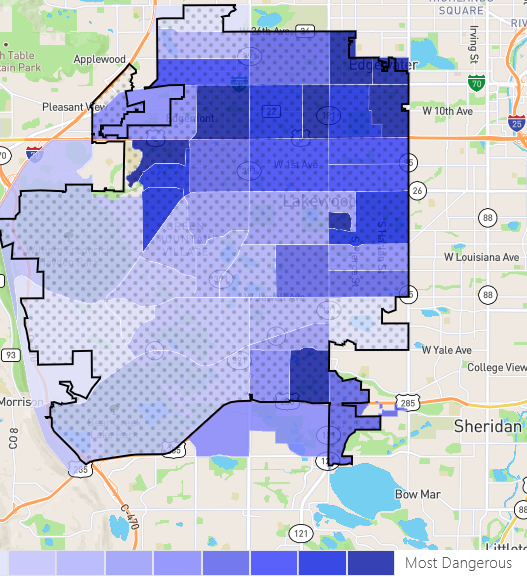

New vacant building tax immediately implemented Lakewood, CO just implemented the first vacant building tax I have seen in Colorado. It seems a bit counterintuitive to put more taxes on a property owner that is already struggling with vacancy. Why did Lakewood...

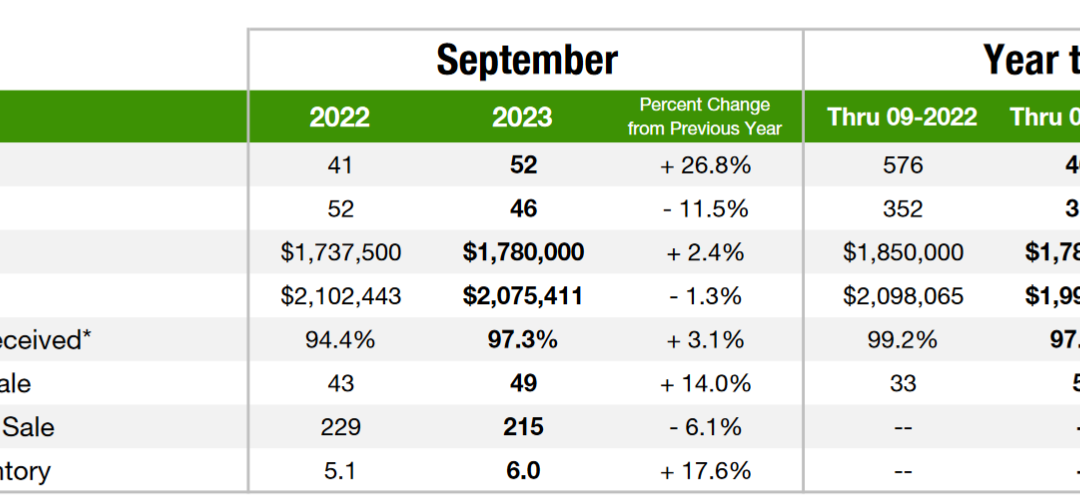

by Glen Weinberg | Dec 4, 2023 | 2023 Colorado property taxes, 2023 Colorado real estate predictions, 2023 Denver real estate predictions, Best colorado ski town, Colorado Hard Money, Colorado hard money lender, Colorado hard money loans, Colorado property tax appeal, Colorado property taxes, Colorado Proposition HH, Colorado real estate market trends, Colorado Real Estate values, Colorado Realtor, Colorado Short Term Rental lending, Colorado Ski real estate, Denver Hard Money, Denver hard money Lenders, Denver Private Lenders, Denver Private Lending, Denver private real estate loans, Denver real estate predictions, Denver real estate taxes, HH eliminates Tabor, initiative 31 income tax reduction

Although HH, the Colorado tax reduction initiative was ultimately defeated, there was one profound item in the legislation that will have far reaching impacts. One of the biggest changes in the proposal is that second homeowners (non-primary residents) are now paying...