The most recent data in Crested Butte tells an interesting story. Single family homes continued to increase in value while town home median prices have decreased 13%. What is happening in Crested Butte and other mountain towns causing property declines? Why are single family homes outperforming condos? Is the recent data in Crested Butte a blip or is the onset of a downward trend in real estate prices?

What was in the data on Crested Butte?

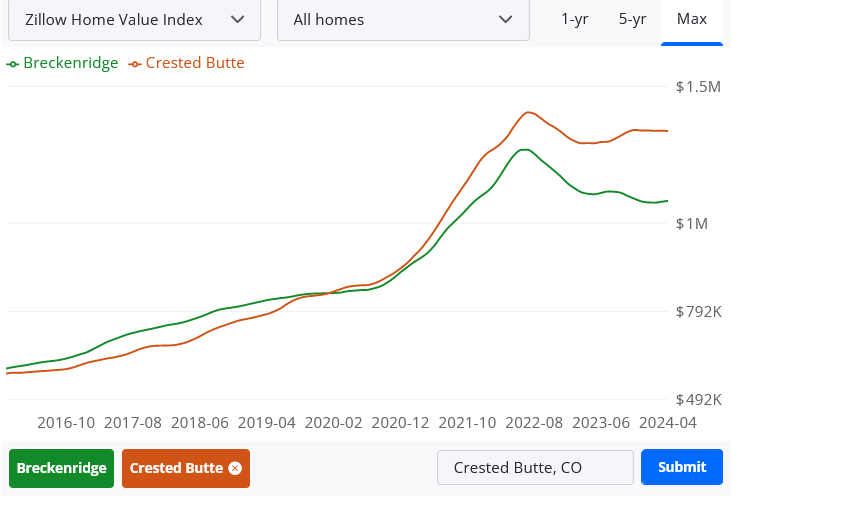

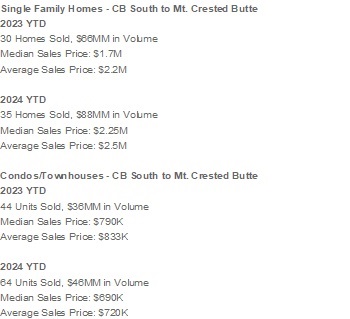

If you look at the chart below, single family homes continued to increase in price through July while condo and townhomes have seen prices about 13% lower.

Take the numbers with a grain of salt as the volumes are small as there were only 35 homes sold so far in 2024 and 64 condo units sold. Also note in 2023 during the same period there were only 44 so there likely was a development or something that came online at lower price points.

Long and short, although it is surprising to see a 13% drop, it is important to put it in perspective and not get overly worried at this point. It is also important to see if the same trends are holding true in a larger market like Breckenridge.

Is Breckenridge also declining?

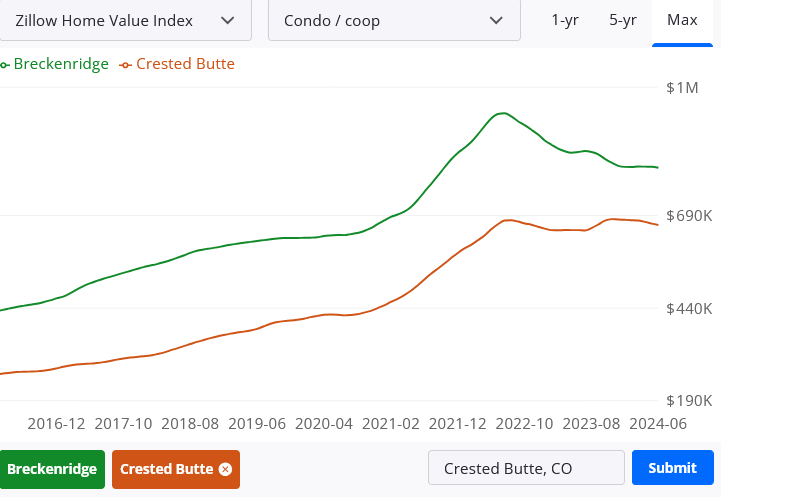

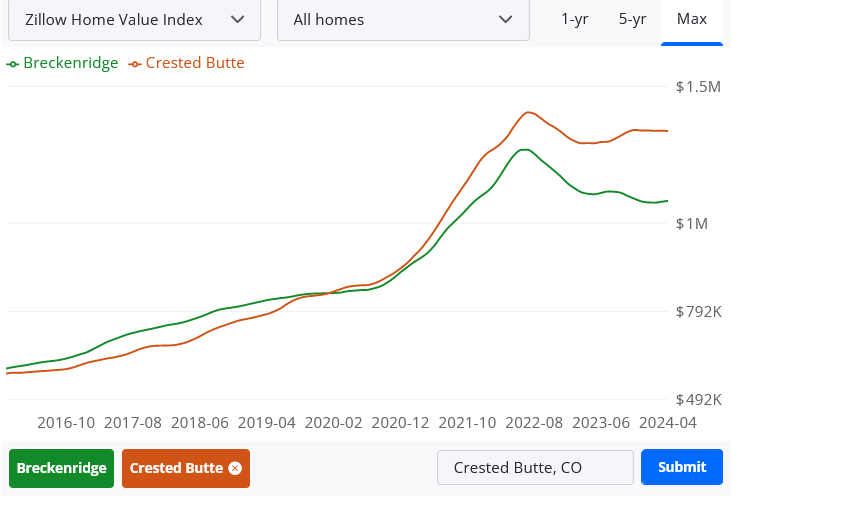

To put all the data in perspective, I looked at the peak in both Breckenridge and Crested Butte. Both markets peaked around July of 2022 and have declined since then (see charts below). From the peak condos are off around 15% in Breckenridge while only 2% overall in Crested Butte so the huge drop shown in current data was a bit of a blip in Crested Butte, but the trends are heading down.

| Jul-22 | Jul-24 | % change | |

| Breckenridge | $ 966,279 | $ 819,225 | 15% |

| Crested Butte | $ 676,232 | $ 664,744 | 2% |

Single family homes outperforming condos but also off peak

Single family homes are doing better than condos, but they are also a little off their peak about 10%, but if you look at the chart they are still up substantially from pre covid. The only real risk is to those that bought properties from around 6/21 to 7/21, all of that appreciation has basically evaporated with the reset in prices.

What happens to ski real estate prices the remainder of 24 into 25?

I don’t see a cliff drop in prices in most Colorado ski towns. Currently the stock market and basically every other asset is appreciating, which has led to huge jumps in ski real estate. We are definitely at the tail end of the appreciation cycle which means that ski real estate will have impacts later this year or early next year. I see prices in 2025 dropping 10-15% in most ski mountain towns. Even towns like Steamboat and Vail who have continued to appreciate in 2024 will see a small drop in prices in the 10-15% range.

No cliff drops or 08 repeat in the ski towns

Fortunately I don’t see an 08 repeat in the various Colorado ski towns. Most of the properties over the last 5 years or so were bought in cash which will insulate the amount of downward pressure on the market. Furthermore, there is still very little if any inventory in the various ski towns and it is impossible to do much if any large scale development due to land constraints.

Summary

Although the recent numbers coming out of Crested Butte look alarming, they need to be taken with a grain of salt. Crested Butte, like many Colorado ski markets, has limited inventory and in turn sales so the numbers can look startling in any one month.

Although there is not an impending real estate crash in ski real estate, we will see a reset in prices as the stock market resets next year. This should lead to declines in price on condos in the 10-15% range and single family homes in the 5-10% range. Every Colorado ski town will likely experience some declines even towns like Aspen, Vail, Telluride and Steamboat as high net worth buyers pull back as the economy softens.

Fortunately I don’t see a cliff drop like 2008 as the federal reserve has plenty of room to drop rates to avoid a huge economic downturn. Unfortunately, some property owners will be less fortunate than others as if you bought in most ski towns between about June of 21 to July of 22 you could be looking at a much larger reset in prices from the peak in the 15-25% range.

On a positive note, ski real estate will outperform other markets like Denver in the short term and is still a great long term investment as there is no way to materially increase the supply of houses/condos due to land constraints, land prices, and building restrictions.

Additional Reading/Resources:

https://coloradohardmoney.com/what-is-the-best-colorado-ski-town-to-buy-real-estate-in/

We are a Colorado Private/ Hard Money Lender funding in cash!

If you were forwarded this message, please subscribe to our newsletter

I need your help! Do not worry, I’m not asking you to wire money to your long-lost cousin that is going to give you a million dollars if you just send them your bank account! I do need your help though, please like and share our articles on linked in, twitter, facebook, and other social media and forward to your friends/associates I would greatly appreciate it.

Glen Weinberg personally writes these weekly real estate blogs based on his real estate experience as a lender and property owner. He is the owner of Fairview Commercial Lending. Glen has been published as an expert in hard money lending, real estate valuation, financing, and various other real estate topics in Bloomberg, Businessweek ,the Colorado Real Estate Journal, National Association of Realtors Magazine, The Real Deal real estate news, the CO Biz Magazine, The Denver Post, The Scotsman mortgage broker guide, Mortgage Professional America and various other national publications.

Glen resides in Colorado, lends in Colorado, owns property in Colorado, and services loans in Colorado which provides a unique real estate prospective of what is actually happening on the ground both in Denver and throughout Colorado. My goal of this real estate blog is to provide an honest assessment of what I see happening in Colorado real estate and how it will impact real estate owners, buyers, realtors, mortgage professionals, etc…

Fairview is the recognized leader in Colorado Hard Money and Colorado private lending focusing on residential investment properties and commercial properties both in Denver and throughout the state. We are the Colorado experts having closed thousands of loans throughout the Front range, Western slope, resort communities, and everywhere in between. We also live, work, and play in the mountains throughout Colorado and understand the intricacies of each market.

When you call you will speak directly to the decision makers and get an honest answer quickly. We are recognized in the industry as the leader in Colorado hard money lending with no upfront fees or any other games. Learn more about Hard Money Lending through our free Hard Money Guide. To get started on a loan all we need is our simple one page application (no upfront fees or other games)

Tags: Denver hard money, Denver Colorado hard money lender, Colorado hard money, Colorado private lender, Denver private lender, Colorado ski lender, Colorado real estate trends, Colorado real estate prices, Private real estate loans, Hard money loans, Private real estate mortgage, Hard money mortgage lender, Hard money mortgage lender, residential hard money loans, commercial hard money loans, private mortgage lender Hard Money Lender, Private lender